North Asia

LG Chem to anchor IMM's Korea battery fund

IMM Private Equity’s recently established credit unit has launched a KRW400 billion ($353 million) Korea-focused fund that will invest in components for electric vehicle (EV) batteries and other environmentally friendly industrial materials.

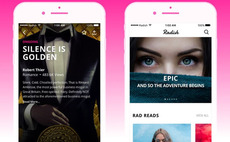

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

Japan's Infinity Ventures joins global alliance

Japan’s Infinity Ventures has teamed up with US and Europe-based E.ventures as well as its Brazilian affiliate Redpoint Eventures to form a global VC under the name Headline.

Korea's IMM makes debut credit investment

IMM Private Equity has made the first investment under its newly launched credit strategy, picking up a 40% stake in SK Lubricants, which is controlled by Korean conglomerate SK Group, for KRW1.09 trillion ($984 million).

Japan's JGC, Global Brain launch $46m VC fund

Japanese engineering conglomerate JGC Group has teamed up with local VC Global Brain to establish a JPY5 billion ($46 million) fund targeting industrial sector technology start-ups.

Bain consortium to buy Japan's Hitachi Metals for $7.5b

Bain Capital has teamed up with two Japanese PE firms – Japan Industrial Partners (JIP) and Japan Industrial Solutions (JIS) – to carve out Hitachi Metals from its corporate parent for as much as JPY816.8 billion ($7.5 billion).

Rising Japan exits staffing services business

Rising Japan Equity, a domestic private equity firm, has agreed to sell Progress, a staffing and contracting services provider, to listed staffing solutions business UT Group for JPY3.09 billion ($28.6 million).

Bain closes Japan fund at $1b

Bain Capital has closed its first dedicated Japan private equity fund with JPY110 billion ($1.01 billion) in commitments.

Japan's J-Star partially exits jobs training service

Japan’s J-Star has exited a 20% stake in Aki-Japan, an employee training service provider for the local construction sector. It leaves the private equity firm with an 80% position.

Mobility: Gravitational shift

The automotive industry’s VC overtures might be in retrograde, but traditional carmakers are finding new ways to make a mark in mobility innovation. This creates new dynamics for financial investors

Japan's Samurai Incubate raises Africa fund

Japanese venture capital firm Samurai Incubate has closed its second Africa-focused fund above target at just over JPY2.02 billion ($18.6 million).

Kakao spins out online fashion unit, buys VC-backed Zigzag

Korean internet company Kakao Corporation has spun out its fashion e-commerce business as an independent entity and merged it with Zigzag, a VC-backed local fashion marketplace.

KKR joins $61m round for Japan's Netstars

KKR has contributed JPY4 billion ($37 million) to a JPY6.6 billion funding round for Netstars, a Japanese QR code payment gateway operator. SIG and Lun Partners, a Hong Kong-based global financial technology investor, also took part.

Deal focus: Partners Group-backed IT play ripens early

Partners Group is set to generate a 5x return on the sale of its 45% stake in GlobalLogic to Hitachi as momentum in corporate digital transformation makes the IT services player a hot commodity

1Q analysis: American dreams

New York makes an unexpected reappearance as the preferred IPO destination for Asian companies; the growth-stage tech investment revival continues; KKR lights up lackluster fundraising environment

Korea retail: Digital or dead?

Coupang’s bumper IPO has underlined the appeal of a Korean e-commerce industry characterized by chaebols playing catch-up and PE and VC investors looking to profit at the margins

Affirma hits first close on Korea fund, backs SK mapping spinout

Affirma Capital has reached a first close of KRW443 billion ($403 million) on its fifth Korea-focused fund, while simultaneously announcing a $181 million investment in SK Telecom’s mobility business.

CVC proposes acquisition of Japan's Toshiba

Toshiba Corporation has confirmed it received a buyout offer from CVC Capital Partners. Based on a reported valuation of $20 billion, it would be the largest acquisition by a private equity firm in Asia.

Japan's YJ Capital, Line Ventures merge, launch $274m fund

Japan’s YJ Capital, recently rebranded as Z Venture Capital (ZVC), has launched a JPY30 billion ($274 million) following a merger with Line Ventures.

L Catterton invests $182m in Japanese healthcare business

L Catterton has invested JPY20 billion ($182 million) in PHC Holdings Corporation, a Japanese healthcare business – formerly known as Panasonic Healthcare – backed by KKR.

Japan payments start-up Paidy closes $120m Series D

Japanese payments start-up Paidy has raised $120 million in Series D funding from JS Capital Management, Soros Capital Management, Tybourne Capital Management, and Wellington Management.

Partners Group, CPPIB exit GlobalLogic to Hitachi

Partners Group and Canada Pension Plain Investment Board (CPPIB) are exiting a combined 90% stake in US-headquartered GlobalLogic to Japan’s Hitachi at an equity valuation of $8.5 billion.

Unison makes two Japan healthcare acquisitions

Japan’s Unison Capital has confirmed two local healthcare deals in the space of a week with pharmacy chain Reliance and outpatient nursing provider N Field.

Applied terminates acquisition of Japan's Kokusai Electric

KKR’s $3.5 billion sale of Japanese semiconductor industry supplier Kokusai Electric to US-listed Applied Materials has fallen through due to regulatory approval issues in China.