Mobility: Gravitational shift

The automotive industry’s VC overtures might be in retrograde, but traditional carmakers are finding new ways to make a mark in mobility innovation. This creates new dynamics for financial investors

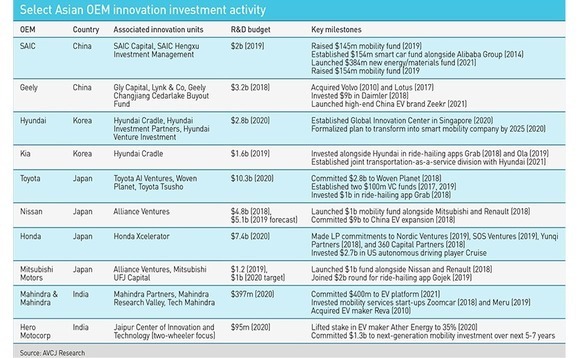

Corporate venture capital, often seen as relatively fickle, is sturdiest in the automotive space. Traditional original equipment manufacturers (OEMs) are facing an existential crisis as new data-driven models of mobility emerge, which makes them less prone to fall into the directionless innovation agendas or reversible PR campaigns that define much of corporate VC landscape. Or so the theory goes.

There's nothing inherently wrong with the logic here, except that it fails to acknowledge the naturally counterintuitive psychology in powerful industries being marginalized after more than a century of dominance. For the past two years, market watchers have been tracking – at least anecdotally – an erosion in corporate VC activity among OEMs, partially because of pandemic-related macro stresses but principally because of human nature.

Much of this boils down to confusion about the nature of the competitive threat facing OEMs: Are they in trouble because the world has changed or because high-tech experimentation in recent years has distracted them from sticking to their traditional strengths?

"There is a muscle memory in automotive," explains Huu Hoi Tran, a China-based vice president and head of automotive at Capgemini Invent, a consulting firm.

"You start to change a little bit, and there is hype about being agile in areas like data, autonomous driving, and vertical take-off mobility. That goes well for 6-12 months, but then it's clear that you are not really innovative in those ways. The changes have been small compared to the ambition, and you still lack implementation speed. We started to see this mindset last year. A lot of traditional OEMs said they had to do a comprehensive transformation, but they decided to focus on a few areas like connectivity and electrification."

Dissolved alliance

Perhaps the highest-profile example of the perceived retreat is Alliance Ventures, a $1 billion joint venture launched by the broader alliance between Japan's Nissan Motor and Mitsubishi Motors and France's Renault. The firm, which has offices in China and Japan, appears to have been in a state of gradual disintegration almost since its launch in 2018. Mitsubishi confirmed last year it would no longer invest money in the project, and Nissan followed shortly thereafter.

Even more visible are cracks in Alliance's leadership. Carlos Ghosn, chairman and CEO of the parent, is the big-name departure, having been arrested in 2018 on corruption charges before jumping bail in Japan and fleeing to Lebanon. But it extends deeper. Francois Dossa, a vice president in charge of innovation projects and chairman of Alliance Ventures, left to fill a similar role at Renault, while Christian Noske, a founding managing director of the VC unit, has moved on to Germany's Target Global.

"Right now, it's a time when most OEMs are stepping back a little bit, reducing their activities in this space, and consolidating activities," says Noske, who also helped set up BMW i Ventures in 2011, leaving the firm in 2018.

"That's partly driven by some misconceptions and some failures. The misconceptions are around exclusivity and what it actually means to have a minority investment in a fast-growing company. Failures are part of the life of a VC, but in the automotive space, it's harder to digest. There have been a lot of management changes in the last 12-24 months."

For financial investors, these themes are of most interest in how they prompt OEMs to evolve their approach to the VC space targeting mobility. Changes here include a reduced emphasis on pure VC in favor of more joint R&D projects in pre-competitive technologies, commercial agreements with existing digital operators, M&A targeting the shift to software, creative strategic LP agreements, and support for spinout investment units that are kept at arm's length from the parent company.

Hong Kong's Gly Capital, which launched its debut fund with a target of $300 million last month, is a case in point. The mobility-focused firm is largely the brainchild of Eric Li, founder and chairman of Chinese auto giant Geely, which contributed $30 million as an anchor LP. The name Gly is an intentional reference to Geely heritage, but the VC claims to be completely independent.

A strict focus on returns is enshrined in the limited partnership agreement and maintained by a performance-aligned team with only one voice representing Geely on a five-strong investment committee (IC). Any IC members connected to a transaction under consideration must recuse themselves from voting. John Walker, vice chairman of Macquarie Capital Asia, is the non-voting chairman.

There is one IC member from Korea's SK Holdings, which also put $30 million into the new fund. Gly formed a relationship with SK while performing due diligence on Israeli automotive data platform Otonomo, an Alliance Ventures-backed company. SK went on to invest in Otonomo. Gly held its fire.

The plan is to write checks in a range of $20-30 million for companies where the combined SK and Geely ecosystem – which includes Geely-owned Volvo – can offer strategic growth support. With $60 million from the OEMs in the bank, a second close of $150 million is expected in June, mostly from family offices. A final close is targeted within the year, with a cap set at $500 million.

"Our value-add to LPs is that we have a unique ability to source investments, and more importantly, evaluate them with an ecosystem that has five research centers and 20,000 engineers," says Gly CEO Harry Krkalo. "We meet a company to seek opportunities for financial return. In exchange, we bring them the opportunity to potentially commercialize their business."

A brand apart

Toyota Motor has recently demonstrated an alternate path. The Japanese carmaker is already well versed in top-down balance sheet investment – it pumped $1 billion into Singapore-based ride-hailing app Grab – as well as traditional corporate VC and LP activity. Its Toyota AI Ventures unit has mobilized $200 million across two single-LP vintages, and recent fund commitments around Asia include Sparx Group. Notably, the latest venture in this vein is all in-house but with carefully segregated branding.

Woven Planet, the company's 100%-owned data R&D division, started life in 2018 as Toyota Research Institute-Advanced Development. It relaunched in January this year with a new name and a new software-focused VC subsidiary, Woven Capital, seeded with $800 million for global growth-stage mobility start-ups. Woven Capital made its first investment last month in US autonomous delivery specialist Nuro.

The plan is to establish a brand that is strongly connected to an OEM in a strategic sense with more than just a veneer of financial, returns-focused credibility. To this end, Woven Capital was incorporated in Delaware as a limited partnership, and Woven Planet, rather than Toyota itself, is the sole LP. The VC claims that it is focused on advancing Woven Planet's niche safety-focused agenda and does not invest on behalf of the parent company.

"We have to make a good investment first and foremost, but we're always doing that with one eye on the potential strategic benefit to us down the road," says George Kellerman, managing director at Woven Capital, adding that a strategic relationship with Nuro remains to be negotiated.

"We don't require any kind of strategic collaboration or commercial agreement to invest, but we're thinking about it. In some ways, we're investing in getting a seat at the table. In order to incentivize companies to work with us, we're putting capital at risk to invest in them – we're not just their vendor or vendee."

Mobility as it relates to smart cities is a core part of this mandate. Indeed, the firm is advancing a project called Woven City at a former Toyota factory site where all the vehicles will be connected, autonomous, and shared. The idea is to explore concepts where automotive technology intersects with areas such as healthcare, agriculture, and education.

Blurred lines

Perhaps without coincidence, the smart city sub-sector is particularly conducive to erasing the lines between financial and strategic investment. The B2B models, long sales cycles, and infrastructural nature of mobility plays in this space make it a difficult proposition for financial investors lacking OEM expertise. This has been the experience of Idinvest Partners - now part of Eurazeo - which has about 25 corporate partners across its two smart city funds, including Peugeot, Michelin, and Total.

Idinvest takes a hybrid financial-strategic approach to smart cities, whereby investment decisions are made independently but with objectives closely aligned with LPs' operational interests. Naturally, this facilitates some interesting exposures for OEMs such as NEoT, an electric vehicle (EV) services joint venture between Mitsubishi, French power utility EDF, and Forsee Power, a smart battery maker. Idinvest invested Forsee in 2011 and exited last year to a Pantheon-led consortium.

"The silos that OEMs have comfortably operated in are disappearing with the advent of digital, and there's a lot of convergence," says Julien Mialaret, who leads early and growth-stage investments in Asia for Idinvest.

"Automotive companies are moving into energy storage and vehicle-to-grid, while energy companies are moving into mobility. The functions of a city are being blurred, and a lot of the most valuable companies we invest in tend to be at those intersections. It's mostly the entrepreneurs who are identifying those intersections, not the incumbents."

Volta Charging, another Idinvest investment, illustrates this point. The US-based start-up helps commercialize notoriously difficult-to-monetize EV charging stations by deploying billboard-style advertisements, effectively combining tactics of the property, mobility, and energy sectors into a uniquely smart city model. The company went public last February through a merger with a special purpose acquisition vehicle (SPAC) at a valuation of $2 billion.

It's worth mentioning that the growing popularity of SPACs for just such a deal has diminished some of the angst about OEM sluggishness to facilitate exits through strategic M&A. The standout transaction is Grab, which agreed a $30.4 billion SPAC listing last week. This too will set up an exit for Idinvest, as well as for the likes of SoftBank Vision Fund, Tiger Global Management, Hillhouse Capital, and GGV Capital. In addition to Toyota, Grab's OEM backers include Honda and Hyundai.

Expectations for an uptick in strategic buyouts by OEMs has dwindled in step with appetite for traditional corporate VC, however. This is perhaps especially true for smart city and services-oriented companies such as Grab. Equipment-related and car-integrated technologies that are more intuitive to traditional OEMs will see strategic M&A, albeit most likely from tier-one suppliers and technology companies.

Interestingly, autonomous driving appears to be an exception. The highest-profile transaction here is General Motors' acquisition of US-based Cruise in a 2016 deal said to be worth more than $1 billion. Cruise received $2.7 billion from Honda earlier this year - $750 million in equity and $2 billion in additional financing over 12 years to bankroll buildout of the autonomous program – before going on to acquire a competitor called Voyager.

Other OEM darlings in this space include Argo AI, which has received $7 billion from Ford Motor and Volkswagen, and Motional, a $4 billion joint venture between Hyundai and Irish auto parts maker Aptiv. Indeed, Woven Capital-backed Nuro is often seen as one of the few sizeable independent players left.

"We are cognizant of the fact that someday, down the road, any of our investments might be acquisition targets," says Woven Capital's Kellerman, who also holds the title of head of acquisitions at Woven Planet. "Part of the reason we invest is to get an early look, see the management, and understand the business. Is this really an area that we want to be in? If it is, we can always change gears and look at it more from an acquisition lens."

Competing interests

Investors are advised to be aware of how this interest varies by segment. Whether OEMs are tinkering in coopetition with their peers (ride-hailing), seeking more competitive joint ventures with technology providers (EV), or absorbing entire companies (autonomous driving), they are exerting significant influence on the investment dynamics of a start-up ecosystem that is ostensibly replacing them.

Furthermore, investors tracking specific mobility start-ups will have to consider the motivations of OEMs also in the chase. Has the start-up distanced or attached itself too much with regard to OEMs? What are the implications of the OEM relationship, not only regarding a potential exit but also in terms of skills integration and connecting with relevant supply chain players? Are partnering OEMs giving the start-up as much as they take from it?

"Investors always have to look at the end market. If a start-up is selling technology that is integrated into the vehicle, you should be able to understand how it will serve the end customer. Start-ups don't necessarily need to have an OEM relationship, but they should have a clear strategy where to play along the value chain," says Andrey Berdichevskiy, director of Deloitte's future of mobility solutions Center in Singapore.

"If it's a direct-to-consumer start-up, the question is whether it will compete against the OEMs. I would strongly advise looking into the teams to see what kind of talent is being brought to the table. There are entrepreneurs out there who think they can sell cars like smart phones, but they're going to fail."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.