Buyback

KKR exits Malaysia's Weststar Aviation after 10-year hold

KKR has exited Weststar Aviation Services (WAS), which primarily provides helicopter transportation services to the offshore oil and gas industry, after a holding period of nearly 10 years.

GPs exit Australian quantity surveyor to management

The management team of Australia-based quantity surveyor BMT Tax Depreciation has assumed control of the business, ending a seven-year holding period for private equity backers CHAMP Ventures and Yorkway Equity Partners.

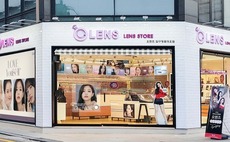

Korea's VIG makes first full exit from Fund III

VIG Partners has agreed to exit its 51% stake in eyewear brand Star Vision through a buyback by the South Korean company’s founder and current minority shareholder.

Kyobo Life arbitration favors GPs, but resolution still elusive

A private equity consortium's right to enforce a put option against the chairman of Korea's Kyobo Life Insurance has been upheld following arbitration, though the ruling stopped short of endorsing a price for the transaction.

Bharti Airtel to buy back stake in DTH business from Warburg Pincus

Warburg Pincus has agreed to exit its stake in Bharti Telemedia, the direct-to-home (DTH) satellite television services arm of Indian telecom services provider Bharti Airtel, through a share buyback worth INR31.3 billion ($429.5 million) in cash and shares....

AVCJ Awards 2020: Exit of the Year - Large Cap: Velocity Frequent Flyer

Building a core competence in data analytics and a broader array of loyalty options underpinned Affinity Equity Partners’ 3.6x return on Velocity Frequent Flyer

Japan energy solutions buyback continues J-Star's exit run

J-Star, a Japanese lower middle-market GP, has announced its third liquidity event in the space of a week with the exit energy savings solutions provider ESCO via a buyout by company management.

GPs sell Wall Street English China business back to founder

Baring Private Equity Asia and CITIC Capital have sold the China-based assets of English language training provider Wall Street English (WSE) back to the original founder after COVID-19 called into question the business model.

French GP exits Singapore's JustCo with 8x return

France-based GP Tikehau Capital has exited its stake in Singapore workspace provider JustCo, achieving a net profit of S$27.7 million ($20.5 million) and an 8x return multiple.

Affinity sells frequent flier stake back to Virgin Australia

Affinity Equity Partners has more than doubled its money on Virgin Australia’s frequent flyer business, having agreed to sell back a 35% stake to the parent company for A$700 million ($480 million).

India exits: Milking unicorns

Partial exits from Oyo by Sequoia Capital India and Lightspeed India Partners underline the importance of securing liquidity from a technology unicorn while it is still on the rise

Sequoia, Lightspeed make partial exits from India's Oyo

Sequoia Capital India and Lightspeed India Partners have made a partial exit from India-based online hospitality platform Oyo through a $2 billion round comprising primary and secondary shares. The round brings the company’s valuation to around $10 billion....

Kyobo Life: The mother of all puts

Put options amount to threats seldom acted upon. By demanding that the chairman of Korea’s third-largest life insurer buy back their shares, a group of investors has taken Asian PE into uncharted territory

Proventeus exits Philippines franchise of Kenny Rogers Roasters

Proventeus Capital, a Southeast Asia-focused middle-market buyout firm, has exited the Philippines franchise of casual dining chain Kenny Rogers Roasters to the company’s founders, receiving PHP1.79 billion ($34 million).

TRG agrees sale of Korean fried chicken business BHC

The Rohatyn Group (TRG) has agreed to exit BHC Group, a South Korean fried chicken restaurant franchisor, by selling the business back to its founder.

GMR reaches settlement with investors in airport business

Private equity investors in India’s GMR Airports (GAL) will receive INR35.6 billion ($481.3 million) in cash plus additional equity in compensation after the company failed to deliver a liquidity event within an agreed timeframe.

CHAMP exits Australian forex broker Pepperstone

CHAMP Private Equity has exited Australian foreign exchange broker Pepperstone following a buyout by its founders, senior management and Fiona Lock, a managing director at the PE firm.

TR gets 3.4x return on Flipkart, opens India office

TR Capital secured a 3.4x net return on its investment in Indian e-commerce giant Flipkart, having sold its stake in conjunction with Walmart’s acquisition of the business. The secondaries specialist announced the exit to coincide with the opening of...

SCPE exits India power business via buyback

Standard Chartered Private Equity (SCPE) has sold its stake in Sterlite Power, the power grid subsidiary of Sterlite Technologies, an India-listed transmission solutions provider for the telecom and power industries, via a buyback.

AVCJ Awards 2017: Exit of the Year - Mid Cap: Riraku

Over the course of four years, Advantage Partners doubled Japanese massage chain operator Riraku’s store count and tripled EBITDA. A 12x money multiple on exit was its reward

Noah to buy back Sequoia's stake in asset management unit

Chinese wealth management firm Noah Holdings has agreed to repurchase Sequoia Capital China’s stake in its asset management unit – Gopher Asset Management - following difficulty in winning approval for the investment.

Deal focus: Advantage kneads 12x return

Advantage Partners has sold Japanese massage chain Riraku back to one of the company's co-founders at a valuation of $300 million, having successfully executed its expansion strategy

Advantage exits Japan massage chain in $300m sale

Advantage Partners has sold its majority stake in Japanese massage chain operator Riraku at a valuation of approximately $300 million, securing a 12x money multiple.

IDFC exits Seaways via share buyback

India’s Seaways Shipping & Logistics has bought back the entire 24% holding of private equity backer IDFC Alternatives following a decision to defer a previously planned domestic IPO.