Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

The company is being acquired alongside industry peer Tapas Media, which is based solely in the US. The Tapas deal is worth $510 million. Both deals are intended to help Kakao expand its original content business in North America and other English-speaking regions, adding to a dominant market presence in Japan with comic platform Piccoma.

SoftBank and Kakao led a $63.2 million Series A for Radish as recently as August 2020. Mirae Asset Venture Investment, Mirae Asset Capital, Partners Investment, and Daekyo Investment also contributed. The company previously received $3 million in seed funding in 2017 from SoftBank's Next Media Innovation Fund, Sherpa Capital, Lowercase Capital, Greylock Partners, Bertelsmann Digital Media Investments, and talent agency UTA.

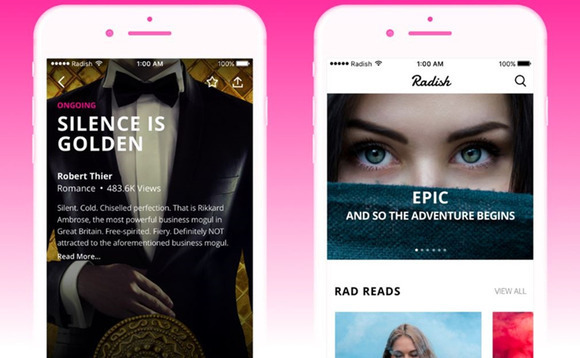

Radish specializes in fiction across a range of genres that are deliverable in episodes as short as 10 minutes. The hyper-serialized approach is designed to be habit-forming, with a micropayments system that encourages frequent repeat use to access new content that follows cliffhanger endings. The company has produced more than 6,500 episodes for 30 original series with a team of experienced TV writers. Payments can be as low as $0.20 per episode.

Amateur authors can also publish their own original stories via user-submitted content, but Radish also produces Radish Originals, serials in a variety of genres designed specifically for its mobile platform and written by in-house teams. Radish Originals accounts for more than 90% of revenue, with overall sales increasing tenfold in 2020, according to a statement.

"Radish is joining the Kakao Entertainment family, a leader in the story entertainment industry, to take our web novel business to the next level in this ever-evolving industry," said Seungyoon Lee, founder and CEO of Radish, who will retain day-to-day operational control.

Kakao originally invested in Radish via its media marketplace Kakao Page. The full acquisition is being made by Kakao Entertainment, which was formed earlier this year through the merger of Kakao Page and Kakao M, the Korea internet giant's music and entertainment division. Anchor Equity Partners has invested in Kakao Page – then known as Podotree – in 2016 and Kakao M in 2020.

Kakao Entertainment has invested approximately KRW1.5 trillion in web literature, building the largest intellectual property library in Korea with over 8,500 pieces of original content. The company wants to expand its network beyond Korea, Japan, and North America, with platforms set to launch in Taiwan and Thailand next month and in China and India later this year.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.