Korea retail: Digital or dead?

Coupang’s bumper IPO has underlined the appeal of a Korean e-commerce industry characterized by chaebols playing catch-up and PE and VC investors looking to profit at the margins

IMM Private Equity acquired a majority stake in W Concept, a Korean fashion e-commerce platform, in late 2017 and implemented a five-year business plan. The targets were achieved with more than 18 months to spare. Resolving to pursue an exit, IMM recently agreed to sell W Concept to SSG.com, the online unit of domestic retail giant Shinsegae, for KRW265 billion ($237 million). The private equity firm is on course for a 2.5x multiple and a 30% IRR.

None of this should come as a surprise to those familiar with Korean e-commerce. While IMM might claim the decision was driven by fundamentals, it is selling the right asset in the right industry at the right time to a logical and highly motivated buyer. There is an element of the Coupang effect – Korea's leading e-commerce platform listed in the US last month and now has a market capitalization of $77 billion, seemingly coating the entire industry in gold – but it goes deeper than that.

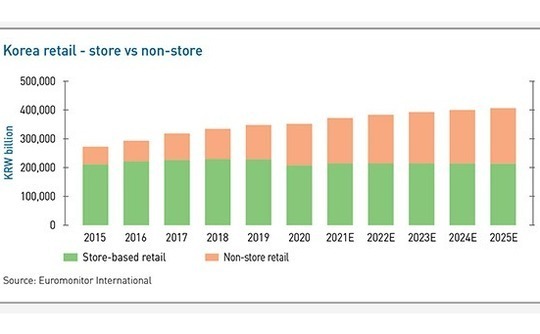

Even before COVID-19, brick-and-mortar retail in the country was flatlining. Store-based sales peaked at KRW227.8 trillion in 2018, fell slightly the following year, and then slumped to KRW206.4 trillion in 2020. Euromonitor International expects a modest recovery followed by more flatlining. In 2017, non-store retail – chiefly e-commerce – was worth KRW91.6 trillion, or 29% of total retail. That became KRW143 trillion and 41% last year, and it is set to reach KRW191.7 trillion and 47% by 2025.

W Concept, therefore, enjoyed some favorable industry tailwinds. At the same time, IMM was careful in picking a suitable, and sustainable, target from a portfolio of then-nascent brands.

"A lot of e-commerce players were burning cash, but we believed there were platforms that could make money," says Jungwon Kim, a managing director at IMM. "W Concept was one of them because it had a high take-rate [visitor to lead conversion rate] and high margins. The business model focuses on premium women's fashion and we got comfortable with that. ISE Commerce [the seller] had taken W Concept as far as it could and wanted someone else to take it to the next level."

SSG views W Concept as a small yet complementary addition to an existing e-commerce portfolio that harnesses the supply chain might of discount retail operator E-mart and – more significantly in this case – the Shinsegae Department Store chain. Investors and advisors expect more M&A activity as the industry consolidates around a handful of key players and the chaebol powerhouses that dominate traditional retail look to join that exclusive group.

"South Korea's e-commerce market is fragmented and highly competitive; there is no evident leader or dominant player like Amazon yet," says one senior banker, noting the significance of the upcoming sale of eBay Korea. Han Kim, a managing director of Altos Ventures, disagrees entirely. Coupang, one of his portfolio companies, "won the war three or four years ago" and everyone else is playing for the minor places. But play they will, aggressively.

B2C on steroids

This dispersion of views is indicative of the speed and level of distortion that e-commerce has inflicted on the Korean market. Similar observations could be made of other markets, but by global standards, Korea is B2C internet services on steroids. Superfast broadband, high mobile penetration, mature online banking channels, dense urban communities, cultural homogeneity – all these have helped forge the world's sixth-largest e-commerce market in the 26th largest country by population.

To put it another way, Korean online food delivery business Woowa Brothers generated gross merchandise value (GMV) of EUR4.6 billion ($4.1 billion) and revenue of EUR301 million in the first nine months of 2019, shortly before global player Delivery Hero announced a $4 billion acquisition. At the time, Delivery Hero was operating in approximately 40 countries across Europe, Asia, the Middle East, and the Americas. Its GMV and revenue were EUR5.2 billion and EUR972 million.

"There are 25 million in the wider Seoul metropolitan area, that's half the population, so you get a herd mentality," says Bernard Moon, co-founder of SparkLabs Global Ventures, which invests in the country. "And whether you are eight feet underground or 60 stories up, you get high-speed internet, which has fed the ubiquity of technology. These factors have contributed to a large base of early adopters. If early adopters in the US are 10% of the population, in Korea it might be 30-40%."

"Historically, the chaebols have been significant players in industry, but they haven't been great innovators, which has allowed new players to come in," says Spyro Korsanos, a managing general partner at Fuse. He points to the way in which Market Kurly – a Fuse portfolio company – has been able to transform the online grocery space by focusing on product quality and timely delivery.

Market Kurly was established in 2015 and saw annual average growth of 3.5x in the first four years as revenue reached KRW429 billion. In 2020, GMV and revenue came to KRW1.2 trillion and KRW953 billion, respectively. Founded in 2010, Coupang took just three years to hit the $1 billion GMV milestone – faster than any other start-up globally – and reportedly surpassed $10 billion in 2019. Revenue reached $11.9 billion in 2020, up from $6.3 billion and $3.8 billion in the two prior years.

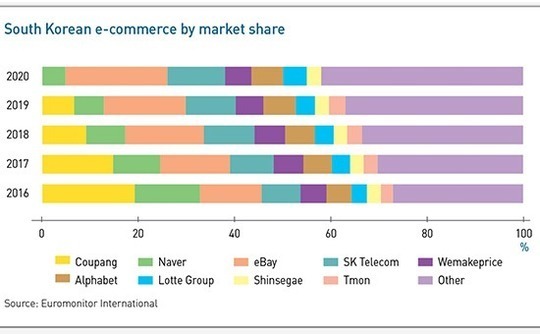

If these represent rapid ascents built on a consumer willingness to engage online and a failure on the part of the traditional incumbents to take advantage of the trend, eBay's forays into Korea seem eerily prescient. It picked up Auction in 2001 and, on adding Gmarket eight years later, had accumulated an estimated market share of 37%.

Admittedly, the business has struggled with the emergence of more rivals. EBay's market share fell from 21.2% in 2016 to 12.8% last year, while over the same period Coupang has risen from zero – based on Euromonitor's numbers – to 19.2% and Naver Corporation from 4.8% to 13.6%. The company still holds a big lead over SK Telecom-owned 11th Street in fourth place, which had 8.1%.

Jason Shin, a managing partner of domestic private equity firm VIG Partners, advised eBay on both acquisitions during his previous career as a banker at Morgan Stanley. They transacted at high single-digit EBITDA multiples. The business is now on the block with a reported KRW5 trillion price tag and Shin expects it to go for "a crazy multiple," as eBay cashes in on its first-mover advantage.

The disrupted

The list of prospective buyers linked to eBay Korea equates to a roll call of the disrupted: Shinsegae and fellow retail giant Lotte Group, SK Telecom, and MBK Partners, owner of supermarket chain Homeplus. Some of these groups "are kind of ‘forced' to be in the process because of their existing portfolios," says the senior banker. He cautions that the asset may not be easy for a private equity firm acting solo, given eBay Korea's declining market share and general industry volatility.

Industry participants suggest that strategic interest in the asset amounts to recognition that organic growth alone is too slow or uncertain. An SSG spokesperson said that GMV increased 36% year-on-year to KRW3.4 trillion in 2020, but Euromonitor recorded a small market share gain of 2.8% to 2.9%. Lotte fell from 3.8% to 3.2%, even as the company outlined plans for Lotte On – the online platform for eight retail subsidiaries – to reach GMV of KRW20 trillion by 2023, nearly double the 2019 figure.

Meanwhile, Naver, Korea's largest internet search provider, is relentless. The company told analysts last month that it was targeting a 30% market share by 2025. GMV reached KRW17 trillion last year. Naver is exploring opportunities in adjacent verticals like food delivery, and it has recruited staff for an internal M&A division, according to a second transaction advisor.

A couple of months prior to the first injection, KKR and Anchor Equity Partners led a $360 million investment for a 46% stake in Tmon, suggesting the company would have the firepower to close what was then a bridgeable gap to Coupang. At the time, questions were being asked of the Coupang model, which involved substantial investment in end-to-end fulfillment infrastructure. It is claimed the company was looking for $500 million in debt funding to stay in business when SoftBank arrived.

There is more clarity on what happened next. Tmon raised new capital as recently as February ahead of a planned IPO, but its market share has declined in recent years, reaching 2.5% in 2020. KKR did not respond to an interview request. Coupang, meanwhile, has gone from strength to strength. It is one of the most graphic examples anywhere of SoftBank using its financial might to help a company power through the uncertain, high cash-burn phase and come out the other side.

The investor's big bet has been handsomely rewarded, at least on paper. Vision Fund I owns an approximately one-third stake in Coupang – an unusually large position for a growth-oriented start-up to give up, which gives credence to the notion that the Korean company took expensive capital at a time when it was needed – worth more than $25 billion.

"People thought that because Coupang was using a lot of cash it might go out of business, but they weren't burning through much working capital. The core business turned profitable a couple of years before the IPO," counters Kim of Altos. The turning point was Coupang demonstrating that its infrastructure investment could lead to efficiencies. "Once they hit that scale it was tough for others to compete. People were getting hooked on Coupang and spending more every year."

Stand and deliver

This evolution was accelerated by Korea's peculiar market dynamics. Population density facilitates word-of-mouth marketing, especially in countries where people are already sold on the concept of buying online, which means relatively high order frequency and low customer acquisition costs. Moreover, it is cheaper and easier to reach concentrated pools of consumers on the fulfillment end.

Coupang has more than 100 fulfillment and logistics centers across 30 cities, enough to ensure that approximately 70% of Koreans live within seven miles of one of these facilities. It also has the country's largest directly employed delivery fleet comprising more than 15,000 full-time drivers. The company promises next day or faster free delivery for nearly 100% of orders, with some users able to place orders as late as midnight and receive the goods before 7 a.m. the following day.

Peter Martisek, a managing director at BlackRock Private Equity Partners, which invested in Coupang in 2014, observes that the focus on end-to-end logistics and delivery capabilities has allowed the company to provide a differentiated service and gain market share. "Given South Korea's geographical features and high population density, a scaled, tech-enabled infrastructure is crucial to build a successful e-commerce platform," he says.

Market Kurly has a similar emphasis, albeit in one vertical. Its cold chain system can take orders for fresh groceries made before 11 p.m. and deliver them by 7 a.m. the next day. This only applies within Seoul – the company relies on third-party delivery outside of the capital – but that is where most of its customers are based. According to Korsanos of Fuse, the combination of infrastructure and product quality represents a sizeable barrier to entry.

"We think a narrower focus, with superior service levels and superior unit economics, rather than dispersing your focus across multiple different types of SKUs [stock keeping units] means Kurly is able to execute better," he says. "If anything, others who might be overspending will correct themselves at a future point in time. When players are seeking to outspend each other, ultimately the most efficient capital players will see the most success."

This begs the question of whether platforms should pursue scale at any cost. There is still evidence of price competition with Tmon recently introducing a "negative commission" system whereby vendors achieving certain volumes will receive payments equivalent to 1% of the goods sold. But others suggest the battle for market share is becoming more nuanced.

"After Coupang proved it could execute on the logistics side, the chaebols tried to drive it into the ground through pricing. Now, they are looking for differentiation in certain areas where they can provide unique items or experiences," says Moon of SparkLabs. "Should they have moved faster? I guess so, but chaebols can't innovate as quickly as companies like Coupang."

In 2018, Shinsegae brought in Affinity Equity Partners and BRV Capital Management as external investors in SSG as part of efforts to reform the chaebol mindset, culture, and operating style. According to a source close to the deal, it was driven by a changing of the guard within Shinsegae as Yong-jin Chung, the social media-loving son of chairwoman Myung-hee Lee, exerts more influence.

There are no plans to emulate Coupang's delivery infrastructure, the source adds. Rather, SSG will seek to leverage its own strengths in areas where Coupang is less strong, as exemplified by the acquisition of W Concept to boost the fashion offering and by a concerted push into online grocery.

Comparisons are often drawn between Coupang and Amazon for their emphasis on broad-based price-driven e-commerce. When Amazon entered the grocery space, most of its sales came in beverages and dry goods. It is much the same story at Coupang Fresh, which was launched in 2018.

Even though SSG has the benefit of E-mart's fresh supply network, over half its order fulfillment capacity is via picking and packing in offline stores. Christy McCaig, a principal at Fuse, observes this approach can be cripplingly expensive. Building an online grocery model from the ground up delivers better unit economics. The SSG spokesperson says pick-and-pack capacity will increase, enabling same-day delivery. Meanwhile, the company continues to work on transferring more of its offline capabilities online.

Beyond the mainstream

The focus on segments where there is less mainstream competition extends into private equity and venture capital consumer strategies. "When people buy fashion items they like to shop around and look at photos and video, and this is harder to do on a general platform," says Kim of IMM. "SSG liked W Concept because of the customer pool, the deep wallets, and high loyalty levels. They want to draw those customers to their platform."

Fashion is a feature of several VC portfolios, usually targeting specific product areas or age groups. SparkLabs has exposure to Balaan, a luxury e-commerce player that sources products from offline boutiques in Europe, and Fleapop, a discount fashion marketplace for women in their teens and 20s that opens for two days every two months. Altos is also pursuing the early 20s market with Zigzag, which is about to raise a follow-on round and Kim tips as a future unicorn.

Content is another prevalent theme, where differentiation is created through engagement instead of in addition to product. SparkLabs has backed Inpock, a social commerce platform where sales are driven by fashion influencers, while Ascendo Ventures is an investor in Canvas, a jewelry business that creates stories around the brands and products it develops. A fast turnaround manufacturing process allows the company to capture prevailing social trends in its designs.

"There are already dominant online retail platforms, and the winners will be those with the most money to spend," says Aaron Shin, founder of Ascendo. "If you use influencers on YouTube and have a merchandising capability to source items or you are focusing on content, that is completely different from traditional e-commerce. You can charge a price premium and your margins are better."

The VC goal is to back entrepreneurs capable of building the next Coupang, but some of these start-ups are likely to be picked off by established players looking for a new edge. Investors across the spectrum are increasingly mindful of how their portfolio companies might fare in a consolidating e-commerce environment – as target, partner or competitor to traditional retailers and online giants.

"Our Holy Grail is expanding a business online by leveraging our offline assets and distribution. We're always thinking about how we can achieve that. Even if we are not directly touched by e-commerce today, we must think about it replacing our offline business at some point," says Shin of VIG, which is about to buy a personal care products company, driven in part by its strong online presence.

"The pandemic has taught people that unless they have the right e-commerce strategy they will be left behind. Some chaebols are old-fashioned in how they do business, but they must change their mindset. It is a do-or-die situation."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.