Money train: Raising capital out of Asia

Fundraising difficulties at home are prompting some US and European GPs to target Asian capital pools that they previously overlooked. It requires patience and persistence

Integrum Holdings, a US-based private equity firm that invests in technology-enabled services companies, launched its debut fund under the shadow of COVID-19. In-person meetings weren't an option until the latter part of the process – a final close of USD 1.1bn came in May – and a concerted marketing push in Asia was never really on the agenda.

"Given our size and the fact it was a first-time fund, we were a less attractive proposition for investors in Asia. We reached out to everyone we knew in the region, but we didn't spend much time with them when fundraising," said Richard Kunzer, a co-founder of Integrum and previously co-head of investor relations at Europe and North America-focused BC Partners.

Now, though, Kunzer is planning regular trips to Asia, and he is fielding more questions from fellow US middle-market managers that are increasingly interested in raising capital out of the region. Kunzer would visit during and in between fundraises at BC Partners, running seminars as well as conducting one-to-one meetings. He remains an advocate of the high-touch approach.

"You just need to get on a plane and develop those relationships. In certain markets, you won't get a commitment for this fund but the next one or the one after that," Kunzer explained.

"Asia is very relationship-driven, and they like to see people in person – it shows willingness. We are doing it ahead of the next fundraise and we will also think about using a placement agent. That is becoming more important as people look to the region and don't have relationships there."

A challenging fundraising environment globally has forced GPs to consider new sources of capital. Bain & Company observed in July that "2023 may forever be remembered as the year the music stopped," noting private capital fundraising is on track to fall 28% year-on-year by value and 43% by number of funds closed. The supply-demand gap is the widest seen since the global financial crisis.

Bain flagged the need for an uptick in distributions if LPs are to be convinced to put more capital to work, but it also highlighted the need for managers to improve their IR. The fundraising function must be scaled up to deliver, among other things, a more structured approach to selling that includes proper segmentation of LPs and delivering a value proposition in tune with their needs.

Geographies like Asia and the Middle East appear on the agenda because their institutional players are perceived to be in expansion mode – ramping up alternatives allocations that have been relatively meagre by global standards or responding to rapid growth in assets. In contrast, investors in North America and Europe are seen as tapped out – overallocated and underbudgeted.

"Managers are used to scaling their fund size and LPs scaling with them. What we're seeing now, in general terms, is 50% of LPs are coming back at the same size and 50% are coming back at reduced size. Even with a 100% re-up rate, you're at 70% of your previous fund size," said Niklas Amundsson, a Hong Kong-based partner at placement agent Monument Group.

"Some GPs might need 50% on top of what they raise from existing investors, so they must go broader. Many US and European managers haven't spent time marketing in Asia and the Middle East in previous fund cycles. Now they are being forced to do so."

Feeding a need

Monument, like its peers, is receiving more inbound enquiries, primarily from managers that have never been to the region before. Asia might already be represented on the investor roster, but those commitments arose from LPs pursuing GPs and visiting North America, not the other way around.

This tallies with accounts from LPs in the region. One investment manager with an Australian superannuation fund noted he had a meeting in the diary with a North American GP that had never set foot in Australia before, "despite being in our portfolio for 10 years."

A Japan-based LP added that approaches from non-Asian middle-market managers noticeably stepped up last year, although it was selective, seemingly driven by a desire to diversify investor bases rather than by desperation. Japanese LPs have also been selective. A depreciating yen, which makes funds commitments more expensive in US dollar terms, remains a challenge.

"Managers are flying around all the time, including to Japan, and meeting the usual suspects," said Tuck Furuya, CEO of Ark Totan Alternative, a Japan-based placement agent and gatekeeper. "Are they getting the same amount of traction as two years ago? No."

Still, this hasn't dissuaded many from trying, with an eye on raising capital for future funds if not the current vintage. While global fundraising pressures have intensified the focus on Asia, interest has been building for some years, largely in step with a broadening of the region's LP community.

Placement agents have responded to the trend with varying degrees of hype. Finex was established in 2017 and now targets an addressable market of 720 institutional LPs region-wide plus 450 asset managers, 75 gatekeepers, and over 700 family offices, according to a presentation seen by AVCJ. It claims to employ more than 80 people, either directly or through licensed local distribution partners.

Thrive Alternatives was formed in 2021 to serve as an Asian distribution partner for US and European managers and now has 20 people working on the placement side. Thomas Yu, a managing director at the firm, noted that the quality of GPs looking for help is more striking than the rise in inbound enquiries. Some already have IR teams on the ground, but they want to go deeper.

"Asia was never low-hanging fruit because of time zones, because of distance, and because of size and maturity," Yu said. "Now, Asia is more desirable. There are more investors, there is more money. It is a region many managers haven't penetrated, so they want to come here."

Philip Lo, who leads the private equity capital formation group at Littlejohn & Co, a US-based manager with USD 12bn in assets under management (AUM), suggests that non-Asian GPs consider marketing in the region only once they reach USD 2bn-USD 4bn in fund size. Even then, expectations should be kept in check, given most Asian LPs recognise global brand names and not much else.

A manager with at least USD 10bn in AUM across multiple strategies could justify having permanent IR staff in Asia, Lo added. By this standard, GPs have been relatively conservative. For example, it is only in the past 18-24 months that Vista Equity Partners and Clearlake Capital, which have USD 100bn and USD 70bn in AUM, respectively, have put people in the region.

Thoma Bravo, which has USD 130bn in AUM and sourced about one-fifth of the capital for recent funds from Asia, is looking to follow suit, according to a source close to the situation.

On the road

When mapping out roadshows for middle-market managers from outside the region, placement agents carve up Asia into broad territories. Given one week, Vincent Ng, a partner at Atlantic Pacific Capital, tends to go south to north – Kuala Lumpur to Singapore to Hong Kong to Tokyo to Seoul – or north to south. Days in Taipei or Beijing may be swapped in as required.

Australia is either an add-on or a separate trip. Another agent tends to avoid the market unless an investment consultant is pushing the fund to local clients. A third agent highlighted a tendency among North American managers to schedule a one-week trip and then abandon the final couple of days because they don't want to be on the road for so long.

It becomes easier when GPs commit to longer-term plans that take in pre-marketing and marketing. The third agent is currently working with a US private equity firm that reduced Asia marketing for Fund IV from one week to two days, didn't bother coming to Asia at all for Fund V, and is now pre-marketing Fund VI in the region, having gained traction on a visit earlier in the year.

For Ng and Amundsson of Monument, the experience is much the same. "We lay down clear plans saying that between now and 2025 they will be in the region once every six months, going to Korea, Japan, and Taiwan first and to Hong Kong and Southeast Asia next," said Amundsson. "Middle market managers are becoming less opportunistic when thinking about Asia."

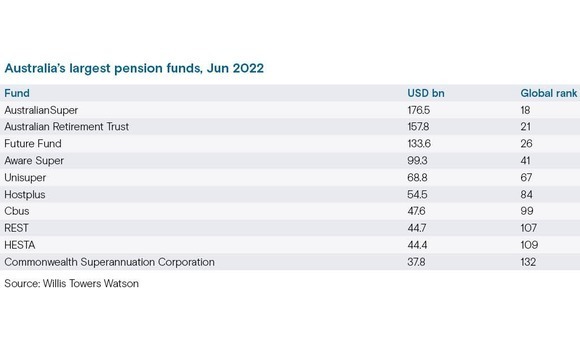

Ultimately, the length of a roadshow depends on where, how, and how soon managers expect their efforts to pay off. Relatively few LPs in Asia write cheques of USD 250m or more – they include Hong Kong Monetary Authority (HKMA), Singapore's GIC, Korea's National Pension Service (NPS), and AustralianSuper – and GPs are drawn to these names and the ecosystems that exist around them.

Kunzer of Integrum likens the approach to elephant hunting. If fundraising in Asia involves demonstrating a commitment to individual markets, then managers will naturally focus on the larger capital bases. This perspective is by no means unusual, but Lo of Littlejohn disagrees with it.

"Given how difficult the current fundraising environment is, I don't think that's the right approach. You must cast your net wide with a good process and see what sticks," he said.

"Even if you don't land a commitment, you've started the dialogue and after a few years, assuming you've kept the relationships warm and you have performed on your strategy, maybe the LPs would do some work on your next fund. This is not a market to take rifle shots to see if you get lucky."

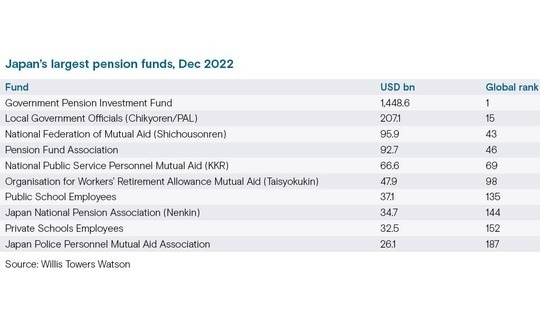

Japan and Australia make for instructive case studies. When Japan's Government Pension Investment Fund (GPIF) announced plans to make allocations to alternatives a decade ago – and Japan Post Bank (JPB) followed suit, yet more aggressively, a few years later – it fanned expectations of a recalibration of programmes by the country's long tail of smaller LPs.

Placement agents identify a dozen groups in Japan that operate in USD 30m-plus territory, but they aren't necessarily accessible. While university endowment Japan Science & Technology Agency is in the process of building out its programme, the likes of the Pension Fund Association and increasingly JPB have mature portfolios that they change up selectively.

"Sometimes GPs come here for five or six years, don't get a ticket, and they ask what's going wrong. It might be timing. When big investors start a programme, they invest heavily for the first couple of years and then it becomes a re-up game. If a manager isn't around when these investors come to market, it is difficult to raise any money from them in the future," said Ark Totan's Furuya.

Tapping the long tail requires elements of blind faith and heavy lifting. Japan's pension funds are serviced by gatekeepers, which means call sheets usually feature the country's four trust banks and a clutch of independent gatekeepers and asset managers, as well as an assortment of insurers.

Tokyo's navigability means many meetings can be crammed into a couple of days, but cultivating relationships takes multiple visits. Furuya described a system where a series of tests – frequency of visits, amount of transparency, willingness to engage in Japanese – are used to assess whether a manager will provide sufficient attention and service over the course of a 10-year fund life.

When it works, it can work well. Amundsson of Monument cites the example of a North American infrastructure manager that spent 10 years chasing USD 5m-USD 10m cheques out of Japan, visiting the country every six months. Nothing happened for the first five years, but then commitments started trickling in. The manager ended up with more than 40 Japanese LPs.

Strategic relevance

Australia and Japan have some similar dynamics. Both are large pools of gatekept institutional capital by Asian standards – Australia has AUD 3.5trn (USD 2.2trn) in pension assets, Japan has USD 1.5trn. Programme maturity is also a prevalent theme. Rest Super and Cbus are named as LPs worth visiting in Australia because they are adding GPs rather than maintaining relatively lean portfolios.

However, co-investment is barely mentioned in Japan. In Australia, it is a top priority. The objective is fee mitigation: regulators focus on management expense ratios rather than net returns, so superannuation funds must bring down the high costs attached to PE if they want to participate in it.

"Quality managers get funded, not just cheap and cheerful ones, but they must consider structures that suit the LP," said Ken License, a managing director at local placement agent Principle Advisory Services, who has seen more middle-market GPs from North America reengaging with the region.

"You can change the quantum of the economics; you can also change how those economics are distributed. For example, some of the fees that might normally be cast as investment management fees could be put into the capitalisation of the deal. But the most obvious solution is co-investment."

AustralianSuper, the country's largest superannuation fund, is by all accounts the most aggressive player, making fund commitments of up to USD 500m but asking for USD 1bn in co-investment on top of that. Others claim to be happy with a 1:1 ratio, emphasizing the virtues of diversification.

Yet capital doesn't necessarily gravitate towards mega funds that might claim the largest co-investment capacity. AustralianSuper is exceptional by virtue of its size and resources. The superannuation fund can leverage its New York presence to compete with other deep-pocketed LPs for co-investment opportunities emanating from these funds.

For the rest, smaller, less proven GPs where there is scope to account for a significant portion of the fund corpus are a natural fit. Moreover, a second investment manager with a superannuation fund said he would rather seek out these GPs than rely on inbound enquiries from managers "who are here because they aren't good enough to get funding locally."

The investment manager added: "As a USD 100m cheque in a USD 20bn fund, I'm a rounding error. If I can commit the same amount and be 20% of the fund for a family office spinout in St. Louis, then there is the prospect of creating a proper partnership. We only have about a dozen names in our portfolio, so commitments are rare. But we will go and see people and knock on a lot of doors."

Most family offices in the region want to know how certain technologies may impact their core business, and this feeds into discussions about potential collaboration, typically co-investments and helping portfolio companies that want to expand into Asia.

"Asian LPs have a plethora of investment opportunities, so it is challenging to differentiate purely on returns. You must come to the table and present a broader offering to investors," said Robert Genovese, a principal and head of IR at Xplorer.

"Traditional Asian businesses are run for cash flow and rather risk averse. As families develop their own portfolios, they look to complement existing cash flows with perceived riskier investments. As our portfolio companies scale and expand overseas, it could be logical for those families to become direct investors and leverage synergies by deploying technologies in their ecosystems."

Pulling power

The basic principles about demonstrating a commitment to a target market apply; it's just that bilateral conversations touch on a different set of LP needs. Xplorer is looking to replicate this approach in the Middle East, with Genovese making three trips to the region this year alone.

Hwee Ang, head of IR East Ventures who has been fundraising in Asia for more than a decade, also sees parallels between the two markets, noting that managers can extract fund commitments by synchronising with economic priorities as well as corporate or family office objectives.

"The Middle East is concerned about issues like food security and moving beyond the oil and gas industry, so they will back GPs that bring relevant companies to them," she said. "Singapore does the same thing. Various managers have leveraged Singapore Inc's strategic agenda by redomiciling companies or setting up local offices that bring employment and contribute to the economy."

The relative merits of Asia versus the Middle East are readily discussed in terms of familiarity with the asset class, average cheque size, geographical and cultural accessibility, number of mega LPs, appetite for co-investment, and geopolitics. The reality is that, as untapped markets, they come with an element of risk, and business development involves considerable time and effort.

"If Asia hits, the numbers can be meaningful, and you get a good spread of investors. But the hit and miss probability is higher than the US or Europe. The books are more idiosyncratic, programmes are more nascent, and there are nuanced country specific and LP specific issues," said Ng of Atlantic Pacific. "And then brand matters. If you're not a global name, the hit-and-miss factor is higher."

It is also unclear to what extent non-Asian managers really need to raise capital out of Asia. The commitment slowdown in North America that began last year is primarily an asset allocation problem, not a global financial crisis-style liquidity drought. Some industry participants already claim to be seeing green shoots, pointing to an upturn in public markets and a resilient US economy.

The second placement agent added that the backlog of recent years has been worked out and fundraising has strengthened as 2023 has progressed, with a lot of commitments from North America. Kunzer of Integrum shares this positive outlook, but he doesn't see it as reason to defocus on Asia. The region's growth and its increasingly sophisticated LP base are too tempting.

"Everyone starts with brand names to get exposure and then they add specialists over time. That's where the Asian market is right now," Kunzer said. "Beyond that, we need to have global LPs. If one market closes, there will be LPs in other parts of the world still investing."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.