South Asia

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Beauty brand Mamaearth raises $204m in India IPO

India’s Honasa Consumer, the private equity-backed parent of mother-and-baby brand Mamaearth, raised about USD 204m in a domestic IPO, facilitating several partial exits.

Norwest backs India hospital, HealthQuad marks 3x exit

Norwest Venture Partners has invested INR 4.5bn (USD 54m) in Indian hospital operator Regency Healthcare, facilitating an exit for HealthQuad, which generated a 3x return.

OTPP invests $80m in India's Xpressbees

Teachers’ Venture Growth (TVG), the late-stage growth investment arm of Ontario Teachers' Pension Plan (OTPP), has invested USD 80m in Indian logistics start-up Xpressbees.

Alta Capital commits $200m to India's Cappella Educore

India’s Alta Capital, a real assets and early-stage property tech investor, has committed USD 200m to an expansion effort by Cappella Educore, a chain of K-12 schools and student housing.

Deal focus: True North to end 13-year journey with Fincare

Indian private equity firm True North took advantage of regulatory reforms to convert Fincare SFB from a non-bank into a bank. A merger with listed peer AU SFB will finally deliver an exit

Q&A: BPEA EQT's Jean Eric Salata

Jean Eric Salata, head of BPEA EQT and chair of EQT Asia, on the benefits of diversification, why Asia’s limited reliance on leverage could lead to better relative performance, and being creative with liquidity

India's Euler Motors gets $14m Series C extension

India’s Euler Motors, a logistics-focused electric three-wheeler maker, has lifted its Series C round to about USD 83m with a USD 14m tranche featuring cleantech investor Green Frontier Capital.

Everstone exits India's Servion Global Solutions to EMK Capital

Everstone Capital has sold Indian customer experience management provider Servion Global Solutions to UK private equity investor EMK Capital for an undisclosed sum.

Kedaara targets up to $1.5b for fourth India fund

Kedaara Capital is looking to raise up to USD 1.5bn for its fourth India middle-market fund, having edged past the USD 1bn mark in the previous vintage.

Ares raises $2.4b for sixth Asia special situations fund

Ares Management has closed its sixth Asia special situation fund on USD 2.4bn, including a sidecar vehicle, citing strong economic trends in India and Australia.

MassMutual Ventures leads Series A for India's Sugarfit

Sugarfit, an India-based health technology start-up that helps people manage type-two diabetes with a view to reversing the condition, has raised USD 11m in Series A funding.

Deal focus: Affirma generates 8x return with India's TBO

Affirma Capital makes good on a partial exit from Indian travel agent software provider TBO.com as General Atlantic comes in to help rekindle plans for a domestic IPO

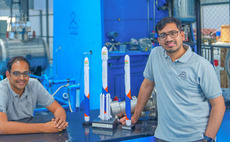

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

PE-backed Fincare Bank to merge with listed Indian lender

India’s Fincare Small Finance Bank (Fincare SFB), which is backed by the likes of TA Associates, True North, LeapFrog Investments, and Tata Opportunities Fund, has agreed to merge with listed lender Au Small Finance Bank (Au SFB). The combined entity...

Flourish Ventures secures $350m in new funding

Flourish Ventures, a US-based emerging markets financial technology investor with a strong Asia focus, has secured USD 350m for future deployments from its sole LP, eBay founder Pierre Omidyar.

Husk Power raises $43m for Asia, Africa mini-grid strategy

India, US, and Nigeria-based renewable energy developer Husk Power has raised USD 43m in Series D funding from global VC investors for a South Asia and sub-Saharan Africa mini-grid rollout.

Deal focus: Bolt.Earth looks to close India's EV infrastructure gap

Bolt.Earth turned its electric vehicle operating system into the foundation stone for India’s largest charging network aimed at two- and three-wheelers overlooked by mainstream operators

General Atlantic backs India travel platform, Affirma exits

General Atlantic has acquired a minority stake in TBO.com, an India-based business-to-agent travel portal that serves a global customer base, for an undisclosed sum. The deal facilitates a partial exit for Affirma Capital.

Faering invests $30m in India's Vastu, Multiples exits

Faering Capital has invested USD 30m in India’s Vastu Housing Finance, facilitating an exit for Multiples Alternate Asset Management.

PayPal backs Quona, Sweef impact funds

PayPal has confirmed LP commitments of undisclosed size to funds managed by financial inclusion-focused Quona Capital and women-led businesses specialist Sweef Capital.

Quadria hits $500m first close on third healthcare fund

Singapore-based healthcare specialist Quadria Capital has reached a first close of USD 500m on its third flagship fund. The target is USD 800m.

Q&A: BII's Holger Rothenbusch

Holger Rothenbusch, head of infrastructure and climate at British International Investment, unpacks the opportunities and challenges of a significant new credit programme for developing Asia