Technology

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.

Japan's LayerX extends Series A to $67.5m

Japanese enterprise billing and invoicing software provider LayerX has raised JPY 2bn (USD 13.2m) from Hong Kong’s Keyrock Capital Management, lifting its Series A round to around USD 67.5m

Deal focus: Riverside flourishes in Australia

The Riverside Company has notched a sizeable exit with the sale of Australia’s Energy Exemplar as the GP expands its local team and launches its fourth Australia fund

Ascendent bids $1.6b for China's Hollysys Automation

Ascendent Capital Partners has joined the battle for Hollysys Automation, a US-listed Chinese provider of industrial automation and rail transportation solutions, by submitting a bid that values the business at USD 1.6bn.

Sinovation-developed LLM platform hits $1b valuation

01.AI, a large language model (LLM) launched less than eight months ago by Chinese venture capital firm Sinovation Ventures, has achieved a USD 1bn-plus valuation, according to Kai-Fu Lee, the firm’s founder.

Five V backs Australia radioactive drug maker

Australia’s Five V Capital has confirmed an investment of undisclosed size in Cyclotek, a radioactive drug maker positioning itself as part of an industry transition toward personalized medicine.

Everstone exits India's Servion Global Solutions to EMK Capital

Everstone Capital has sold Indian customer experience management provider Servion Global Solutions to UK private equity investor EMK Capital for an undisclosed sum.

Japan's Sensyn Robotics raises $15m

Japan’s Sensyn Robotics, which develops drones for various industrial inspection applications, has raised JPY 2.25bn (USD 15m) in growth funding from several local banks and VC investors.

MassMutual Ventures leads Series A for India's Sugarfit

Sugarfit, an India-based health technology start-up that helps people manage type-two diabetes with a view to reversing the condition, has raised USD 11m in Series A funding.

Japanese digital alternatives platform gets pre-Series A

Luca, a Japan-based fundraising platform that aims to give local high net worth investors access to alternatives, has received seed-stage funding from VC investors.

Polaris leads $27m round for Singapore's Engine Biosciences

US healthcare and life sciences growth investor Polaris Partners has led a USD 27m Series A round for Singapore-based cancer medicine developer Engine Biosciences.

Blackstone, Vista buy Australia's Energy Exemplar, Riverside exits

The Blackstone Group and Vista Equity Partners have agreed to acquire Energy Exemplar, an Australia-based simulation software company, setting up a sizeable exit for The Riverside Company.

Deal focus: Affirma generates 8x return with India's TBO

Affirma Capital makes good on a partial exit from Indian travel agent software provider TBO.com as General Atlantic comes in to help rekindle plans for a domestic IPO

Hidden Hill leads $137m round for China's CS Smart

Hidden Hill Capital, a private equity firm backed by warehouse operator turned logistics and infrastructure investment manager GLP, has led a CNY 1bn (USD 137m) Series B round for China-based logistics vehicle manufacturer CS Smart.

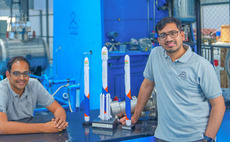

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

KKR commits $400m to Malaysia's OMS Group

KKR has agreed to invest USD 400m in Malaysian telecoms infrastructure and subsea cable services company OMS Group.

Korea Investment Partners raises $60m SE Asia fund

Korea Investment Partners (KIP) has raised USD 60m for a Southeast Asia venture fund from institutional investors in Korea, Hong Kong, and Singapore.

Flourish Ventures secures $350m in new funding

Flourish Ventures, a US-based emerging markets financial technology investor with a strong Asia focus, has secured USD 350m for future deployments from its sole LP, eBay founder Pierre Omidyar.

SparkLabs launches Korea deep tech fund

Early-stage VC investor and accelerator SparkLabs Korea has achieved a first close of USD 15m on a deep tech fund. That target corpus has not been confirmed.

PE-owned Kokusai Electric gains on debut after $720m Japan IPO

KKR-owned Kokusai Electric gained 28% on debut after raising JPY 108.3bn (USD 720m) in Japan’s largest IPO in five years.

Stellantis buys 20% stake in VC-backed Chinese EV maker

LeapMotor, a Chinese electric vehicle (EV) manufacturer that received substantial private funding prior to its Hong Kong IPO in September 2022, has agreed to sell an approximately 20% stake to European automaker Stellantis for HKD 8.5bn (USD 1.1bn).