1Q analysis: American dreams

New York makes an unexpected reappearance as the preferred IPO destination for Asian companies; the growth-stage tech investment revival continues; KKR lights up lackluster fundraising environment

1) Exits: Listing USA

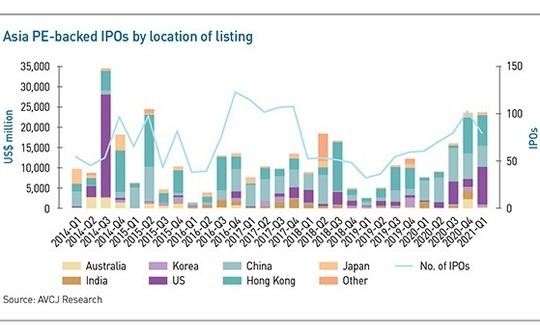

For the first time in nearly seven years – going back to when Alibaba Group went public in 2014 – US bourses have generated the largest share of proceeds from PE-backed IPOs involving Asian companies. There were 10 listings on the New York Stock Exchange and NASDAQ during the first three months of 2020, a record quarterly high, according to AVCJ Research's provisional data. Proceeds came to $9.2 billion, with Hong Kong and the various mainland exchanges relegated to second and third place.

It is a curious development, especially given the uncertainty surrounding Chinese companies trading on US exchanges and the need to comply with US accounting rules. But then the first quarter was extraordinary in several respects. As expected, the PE-backed IPO boom continued, with $23.5 billion raised from 79 offerings, just edging out the prior three months – in proceeds if not in number of listings. It was the largest quarterly total by proceeds since Alibaba listed.

However, this was not purely the China show. In 2020, Chinese companies accounted for more than 80% of overall activity. In the first quarter of 2021, the country's share fell to 69%, even though 16 of the top 20 listings came from China. They were led by short video platform Kuaishou, which raised $5.4 billion in what represents the largest IPO in three years by an Asian company with a financial sponsor.

Second spot went to Coupang, Korea's leading e-commerce platform following its $4.5 billion offering. This was comfortably the largest on record by a PE-backed company out of Korea. And Coupang was chiefly – but now wholly – responsible for US bourses reclaiming the top spot after such a long hiatus.

The 11-year-old start-up has several private equity investors, notably SoftBank, which put in $3 billion and now owns a one-third stake worth about $25 billion. Another, BlackRock, took more than $900 million off the table. A partial exit of this size at IPO is a rarity in Asian private equity. The Carlyle Group did something similar with India's SBI Card last year, but there are few other examples since – you've guessed it – Alibaba. Total IPO realizations for the quarter came to $1.9 billion, the most since 2017.

Of the remaining $4.7 billion raised by Asian companies in the US, Telus International, a Singapore-headquartered business process outsourcing specialist controlled by Baring Private Equity Asia, accounted for about one-fifth. The rest came from Chinese companies, ranging from e-cigarette maker Relx Technology to question-and-answer platform Zhihu.

The IPO postscript is the relative weakness of listings within mainland China. Ever since the introduction of Shanghai's Science & Technology Innovation Board – better known as the Star Market – last year, mainland exchanges have been the most active for PE-backed companies in Asia. But between January and March, the number of offerings fell below 40 for the first time in a year, while proceeds slipped to $5.1 billion, the third straight quarterly decline.

Once again, there is an Alibaba connection. There has been a spate of IPO withdrawals dating back to December 2020, shortly after Ant Group, Alibaba's financial services affiliate, was forced to abandon its Hong Kong and Shanghai dual listing in controversial circumstances. They include the likes of smart sensor maker Hesai Technology, artificial intelligence specialist Yitu Technology, and display developer Royole Corporation, each of which was tipped to raise a sizeable amount.

The primary attraction of the Star Market is its lighter-touch regulation, which speeds up the listing process. But regulators have started challenging the suitability of IPO candidates and the quality of their information disclosure. The higher costs and hassle of compliance are proving a turn-off for some. More significantly, it calls into question China's willingness to embrace reform.

Meanwhile, the broader private equity exit environment appears to be in revival mode. The number of deals was down on the previous quarter, but January-March saw transaction value hit $15.8 billion, up from $10.8 billion. Encouragingly, trade sales increased, in US dollar terms, for a fourth consecutive quarter. The market has yet to return to pre-COVID-19 levels, but it is certainly on the way.

There are representatives from each major Asian market in the top 25 exits from the three-month period. Just as significantly, the buyers are not just local strategic players or PE firms with an on-the-ground presence, although that remains a prevalent theme. Switzerland's Kuehne + Nagel bought a Chinese air freight forwarder, US-based Mondelez International acquired an Australian biscuit maker, and a trio of North American trade buyers picked up Australia and New Zealand software businesses.

The strength of the global-first, English language-based Antipodean enterprise software offerings should not be underestimated. Seequent, Vend, and Ascender sold for a combined valuation of more than $1.8 billion. For Potentia Capital, which secured a 30x return on Ascender, it represents the validation of an entire thesis rooted in B2B technology.

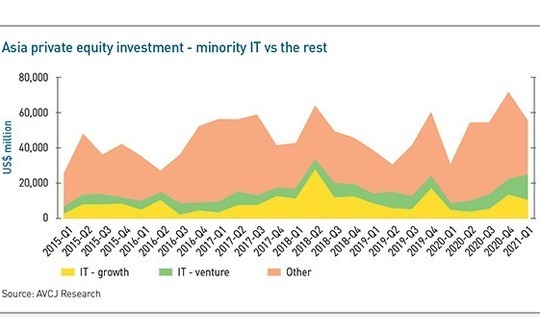

Growth-stage rounds for internet-related companies were the rocket fuel that propelled Asian private equity investment to a record quarterly high in the last three months of 2020, ensuring a robust yearly total despite COVID-19. Three months into 2021, the headline number isn't as large, but the broad theme remains pertinent. Indeed, the IT concentration effect was more pronounced in the first quarter than it was in the fourth.

A total of $55.2 billion was deployed, down from $71.3 billion. Growth capital across all sectors dropped off, but it still accounts for a larger portion of overall deal flow, 66% vs 63%. The phenomenon is exacerbated when technology, including growth and venture strategies, is considered in isolation. The $24.7 billion invested represents a small increase on the previous quarter and the second-largest three-month total on record. Of every $1 committed, $0.45 went into minority IT deals, up from $0.31.

If education was a dominant trend of the 25 deals in the previous quarter, this time around it gives way to groceries and mobility. Chinese community-based retail platform Xingsheng Youxuan secured $3 billion in funding from a string of brand-name investors, while Didi Huoyun, the freight unit of ride-hailing giant Didi, and last-mile delivery player Lalamove raised $1.5 billion apiece.

There was also a flurry of new funding for China's preeminent autonomous driving technology developers, Pony.ai, WeRide, Didi Autonomous Driving, and Momenta. Several of these companies are expanding from robotaxis into trucks, searching for a shortcut to monetization. Moreover, there was a round for truck specialist Plus, which came on the heels of industry peer TuSimple filing for an IPO. Receptive public markets are another reason for money flowing into growth-stage tech deals.

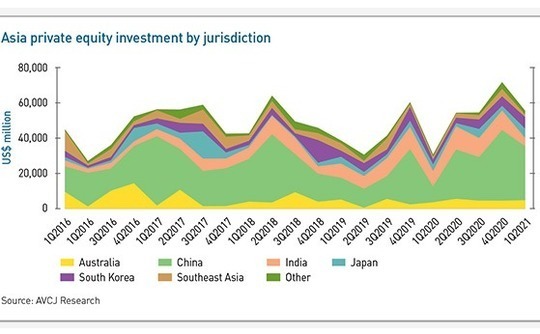

Examining investment on a geographical basis, the most notable drop-offs on the previous quarter were in China, India, and Southeast Asia. India's total fell from $11.1 billion to $4.6 billion – a more than two-year low – with Reliance Industries having already wrapped up the bumper fundraising efforts for its Jio Platforms and Reliance Retail divisions. Similarly, in Southeast Asia, the mega-platforms that suck up a lot of capital were relatively quiet.

The region's more mature markets, Australia, Japan and Korea, all saw more capital committed than in the last three months of 2020, perhaps as buyout investors felt comfortable enough to reengage with targets. There were seven $1 billion-plus deals, compared to 15 in October-December, but four were control transactions, with each of these three countries represented.

In Japan, CVC Capital Partners agreed to pay $1.5 billion or Shiseido's personal care business, its largest investment in the country since before the global financial crisis. Little did the industry know that this was merely the precursor for a much more ambitious $20 billion tilt at Toshiba Corporation.

KKR raised the bulk of its fourth pan-Asian fund in a $10 billion first close that happened around the mid-point of last year. As of September, the running total was $13.1 billion. The final close, which came at the end of the first quarter, was widely expected and the $15 billion figure had been well disseminated. There was little impact on AVCJ Research's headline fundraising data for January-March because the first close had already been counted.

A total of $21.8 billion was committed to Asia-focused managers during the period, down from $23.1 billion in the prior quarter. There were fewer than 90 partial or final closes, a nearly eight-year low. The reality is that fundraising remains difficult unless you are relying heavily on re-ups, have done extensive facetime with target LPs, or have a strong enough brand for investors to back you sight unseen.

KKR falls into the latter category. Of the 290 investors in KKR Asian Fund IV – the largest US dollar vehicle ever raised for the region – 80 hadn't previously backed any of the firm's Asian funds. There was a small window of opportunity prior to the launch in November 2019 and the imposition of travel restrictions in response to COVID-19, otherwise diligence would have been largely virtual.

It made for a very different fundraising process to the last vintage, when KKR collected $9.3 billion in six months. Existing investors account for 83% of the new corpus in US dollar terms, which suggests the first close was packed with known quantities writing very large checks. Filling out the remaining $5 billion was likely more of a slog, much of it spent helping new LPs get comfortable with smaller commitments.

No other private equity funds of significant size achieved final closes during the first three months of 2021, effectively continuing the story of 2020 – although a few are now entering the market in anticipation of conditions easing up.

Nine of the 15 largest were by funds primarily pursuing China venture or growth strategies, a COVID-19 resistant agenda if ever there were one. KKR was followed in the quarterly rankings by Lilly Asia Ventures and Source Code Capital, which raised $1.35 billion and $1 billion for their latest sets of funds. Firstred Capital, a China GP that secured $1 billion for a debut renminbi fund with a mandate to facilitate corporate M&A, completes the top four.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.