MBK Partners

Mubadala supports buyout of Korea's Osstem Implant

Mubadala Investment has invested in Osstem Implant, a Korean manufacturer of dental implants that was taken private by MBK Partners and UCK Partners (formerly Unison Capital Korea) earlier this year.

MBK launches sixth North Asia fund, targets $7b

North Asia-focused buyout firm MBK Partners has set a target of USD 7bn for its sixth flagship fund, according to three sources familiar with the situation.

MBK buys Japan aged care business

MBK Partners has acquired Unimat Retirement Community (URC), a Japan-based company that primarily provides in-home and residential nursing care services.

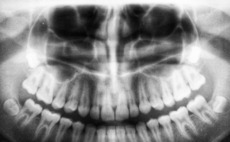

MBK, Unison Korea pursue dental implant buyout

MBK Partners and Unison Capital Korea have launched a tender offer for Osstem Implant, a Korea-based manufacturer of dental implants, that values the company at approximately KRW 2.85trn (USD 2.3bn).

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Korea's MegaStudy pulls plug on 35% stake sale to MBK

MegaStudy Education, a listed Korean education provider with a market capitalisation of nearly KRW 900bn (USD 660m) has decided against selling a stake to North Asia-focused private equity firm MBK Partners.

Korea's Kakao abandons plans for mobility unit stake sale

South Korean internet giant Kakao has abandoned plans to partially divest Kakao Mobility, its transportation division.

Korea's Kakao considers partial divestment of mobility spin-out

South Korean internet giant Kakao has indicated it may sell around 10% of Kakao Mobility, its transportation division, which has several private equity backers.

MBK to buy control of Korea e-commerce solutions provider

MBK Partners has agreed to buy a controlling stake in KoreaCenter, a Korea-based e-commerce services provider, for KRW 491.7bn (USD 429.8m) across several equity and debt transactions.

North Asia buyout player MBK sells GP stake to Dyal

North Asia-focused buyout firm MBK Partners has sold a 12% GP stake to Dyal Capital Partners, a unit of US-based alternative investment firm Blue Owl that buys interests in third-party managers.

MBK sells Japan's Accordia Golf to Fortress

MBK Partners has agreed to sell Japan-based golf course operator Accordia Golf, which it acquired in 2017 via a tender offer, to Fortress Investment Group.

MBK agrees $1b China theme park deal

MBK Partners has agreed to buy five ocean theme parks in China – four operational and one under construction – from Hong Kong-listed Haichang Ocean Park Holdings for RMB6.53 billion ($1.01 billion).

Partners Group backs continuation vehicle for Korean restaurant brand

MBK Partners has signed up Partners Group as the anchor investor in an approximately $500 million single-asset continuation fund for its majority stake in Korean fried chicken franchisor BHC.

China healthcare big data player pursues US listing

Chinese healthcare big data company LinkDoc Technology, which counts New Enterprise Associates (NEA), China Broadband Capital, and Temasek Holdings among its investors, has filed for an IPO in the US.

MBK exits China's Apex International

MBK Partners has agreed to sell Apex International, China’s second-largest air freight forwarder, to Swiss logistics giant Kuehne + Nagel.

MBK targets $639m acquisition of Japan aged care business

MBK Partners has joined the list of private equity firms pursuing deals in Japan’s aged care and healthcare space, having launched a tender offer for Tsukui Holdings Corporation at a valuation of JPY66.9 billion ($639 million).

OTPP backs Korean fried chicken chain at $1.6b valuation

Ontario Teachers’ Pension Plan (OTPP) has invested in Korean fried chicken restaurant franchisor BHC Group at an enterprise valuation of KRW1.8 trillion ($1.6 billion), facilitating a full exit for Elevation Equity Partners.

MBK credit fund to join PE fund on CAR investor roster

MBK Partners has agreed to subscribe to $175 million in convertible bonds issued by China Auto Rental (CAR). It follows a large commitment and a take-private offer by MBK last month.

MBK makes $1.1b take-private offer for China Auto Rental

MBK Partners has followed up its purchase of a significant minority stake in car rental business China Auto Rental (CAR) with a take-private offer that values the company at HK$8.56 billion ($1.1 billion).

MBK invests $228m in China Auto Rental

MBK Partners has agreed to invest HK$1.8 billion ($228.3 million) in Hong Kong-listed China Auto Rental (CAR), taking a 20.9% stake.

MBK-owned Accordia Golf to buy courses from Singapore trust

Japan’s Accordia Golf, which was acquired by MBK Partners in 2017, has agreed a S$804.1 million ($577 million) privatization of a Singapore-listed trust it established six years ago as the holding entity for 88 golf courses.

MBK closes Fund V at $6.5b hard cap

MBK Partners has closed its fifth North Asia-focused fund at the hard cap of $6.5 billion. It is the joint third-largest PE vehicle raised for deployment across the region and MBK has become the seventh manager to cross the $6 billion threshold.

MBK wins US pension support for Asia fund

MBK Partners has picked up commitments from New York State Common Retirement Fund (NYSCRF), New York State Teachers’ Retirement System (NYSTRS), and Los Angeles County Employees Retirement Association (LACERA) for its fifth North Asia fund.