Weekly digest - November 08 2023

|

AVCJ

EDITOR'S LETTER: AVCJ MOVES TO MERGERMARKET

Tim Burroughs, managing editor of AVCJ, outlines the next steps for the product and its subscribers as we migrate our content and enhance our offering via the next-generation Mergermarket platform. Read it here.

|

|

By the Numbers

AVCJ RESEARCH

SPECIAL SAUCE

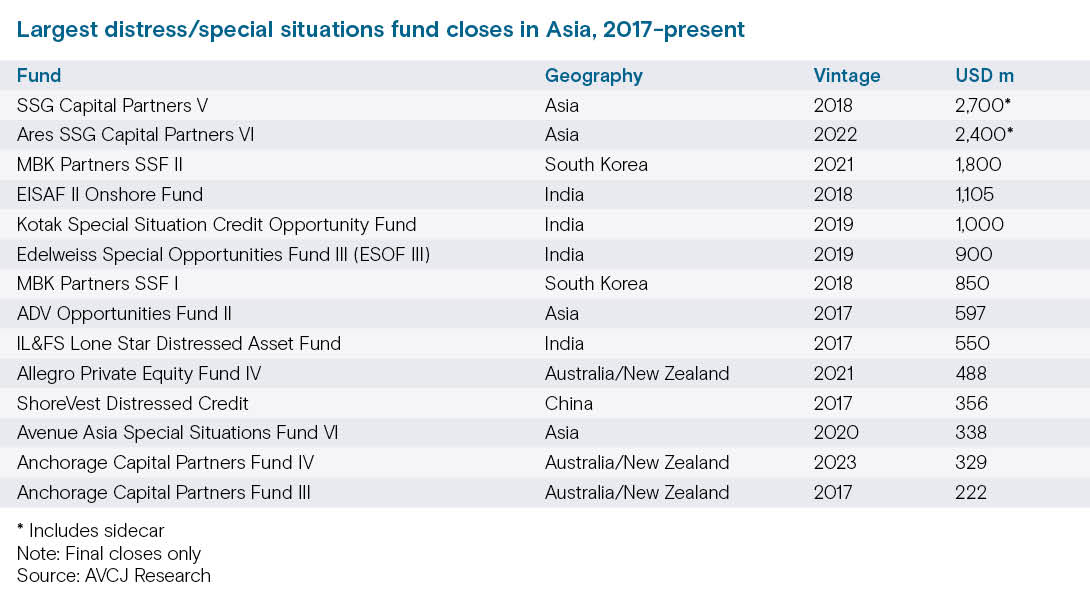

Compiling a list of Asia's largest distress and special situations fundraises of the past six years, two points stand out. First, the region has seen plenty of retreats and reorientations. Second, the definition of special situations has never been clear, which means managers may reclassify themselves as credit without really changing strategy.

The list features two new additions: Ares SSG recently closed its sixth Asia special situations fund on USD 2.4bn and Australia-based Anchorage Capital Partners raised AUD 505m (USD 329m) for its fourth turnaround vehicle. Only three other funds from the last three years feature in the top 15: the latest offerings from Korea-focused MBK Partners, Australia's Allegro Funds, and global player Avenue Capital. As for the retreats and reorientations: India-focused AION Capital Partners is in wind down; Clearwater Capital Partners scaled back its fund sizes and then merged with a global platform; the parent of IL&FS Investment Managers collapsed, so the Lone Star tie-up faded; Shoreline Capital Management stopped raising US dollar-denominated funds but apparently has renminbi capital. There are others – Avenue Capital underwent an Asia reboot – while on the definition side, PAG started labelling its funds private credit rather than special situations. At the same time, industry participants expect special situations activity in the region to increase. This outlook is based in part on a pullback of pandemic-related policy supports, which is normalizing market conditions in sectors already dealing with changing supply chain dynamics and labour challenges. Ares singled out India and Australia as attractive markets due in part to robust corporate earnings growth and a perceived growing opportunity set for financing solutions for sponsor-led acquisitions.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.