Technology

QIA invests $1bn in India's Reliance Retail

Qatar Investment Authority (QIA) has agreed to invest INR 82.8bn (USD 1bn) in the retail unit of Indian conglomerate Reliance Industries.

Indian family offices invest $52m in FirstCry

Three Indian family offices have committed INR 4.35bn (USD 52.7m) to domestic mother-and-baby retailer FirstCry through a secondary transaction that facilitated a partial exit for SoftBank Vision Fund, among others.

WestBridge buys investment platform FundsIndia

WestBridge Capital has acquired a majority stake in FundsIndia, an online investment platform that offers access to mutual funds, public equities, and fixed deposit products, for an undisclosed sum.

Chinese chip developer Sitrus raises $28m

China-based chip developer Sitrus Technology has raised CNY 200m (USD 28m) in a Series C extension from Henglu Assets and Shanxi provincial government investor Photon Strong Chain Fund.

Australia's Airtree leads round for space tech start-up

Australia’s Airtree Ventures has led a AUD 12m (USD 7.7m) Series A round for HEO Robotics, a local space start-up focused on non-Earth imaging.

The innovation game: China GPs play safe

China investors have abandoned their previous high-risk-high-return approach in favour of proven business models and profitability. Hotspots like autonomous driving, biotech, and SaaS are no exception

LP interview: India's Catamaran

Catamaran brings a global, tech-savvy approach to private equity that sets it apart from most Indian family offices. A strong historical focus on digital inclusion is now extending into manufacturing

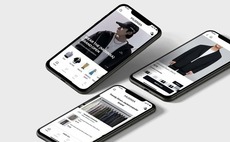

Deal focus: KKR thinks global with Korea's Musinsa

KKR has made its first tech growth investment in Korea with Musinsa, an online marketplace for a carefully curated selection of streetwear brands with export potential

Matrix backs $139m round for China semiconductor start-up Echint

Matrix Partners China has co-led a CNY 1bn (USD 139m) Series B round for Echint, a Chinese chip packaging and testing start-up incubated by VC-backed semiconductor company Eswin.

China's DP Technology raises $97m

China’s DP Technology, touted as a pioneer in the use of artificial intelligence (AI) for scientific research, has raised a CNY 700m (USD 97m) round featuring Loyal Valley Capital.

Forebright raises $502m for third China fund

China-focused Forebright Capital has closed its third fund with USD 502m in commitments. The manager claimed to have spent about a year in the market.

IFM backs Australian property technology player

IFM Investors has committed AUD 50m (USD 32m) to Smart Urban Properties Australia (SUPA), which claims to be the country’s first unified services provider of utilities and communications infrastructure.

Japan's PowerX raises $32m Series B

PowerX, a Japanese start-up developing a “battery tanker” for shipping stored renewable electricity across oceans, has raised a USD 32m Series B round featuring US-based Translink Capital.

China's Runpeng Semiconductor raises $1.7b

Runpeng Semiconductor, a Shenzhen-based subsidiary of Shanghai-listed China Resources Microelectronics, is set to raise CNY 12.6bn (USD 1.7bn) from several state investors.

China Evergrande's EV unit raises $500m

Evergrande New Energy Vehicle (NEV), the electric vehicle (EV) unit of defaulted property developer China Evergrande, has raised USD 500m from Dubai-based carmaker NWTN.

Mirae Asset acquires majority stake in Australia's Stockspot

Mirae Asset Global Investments has invested about USD 17m in a 53% stake in Stockspot, Australia’s largest robo-advisory.

CLP leads $21m Series B for China's Venturous Group

Venturous Group, a Chinese smart city platform, has raised USD 21m in Series B funding led by Hong Kong utility CLP Group. It follows a USD 131m Series A in June 2021.

Singapore's Jungle absorbs healthcare specialist HealthXCapital

Singapore’s Jungle Ventures has ramped up its healthcare investment capacity by combining with local sector specialist HealthXCapital (HXC).

UK VC firm leads $9.4m round for Australia's Pendula

UK-based Octopus Ventures has led a AUD 14.5m (USD 9.4m) round for Australia-based customer retention platform Pendula.

PE-linked SPAC to merge with China ride-hailing business

A special purpose acquisition company (SPAC) led by two Chinese private equity investors has agreed to merge with local ride-hailing business Wanshun Technology Industrial Group in a deal that values the target at approximately USD 300m.

China's ClearVue closes debut blockchain fund on $50m

ClearVue Partners (CVP), a China-focused investor in consumer and technology, has announced a final close of USD 50m on its blockchain technology fund - without adding any capital to the first close 12 months ago.

Singapore metaverse player raises $13m seed round

Singapore-based ZTX, which claims to be Asia’s largest metaverse platform, has raised a USD 13m seed round led by US web3 investor Jump Crypto.

China 3D printing player Boston Micro gets $24m Series D

China and US-based microscale 3D printing company Boston Micro Fabrication has raised USD 24m in Series D funding led by Guotai Junan Securities.

Cathay leads Series C for China's Unisun Energy

Cathay Capital has led a Series C round of undisclosed size for Unisun Energy, a China-based green power service provider for industrial and commercial sites.