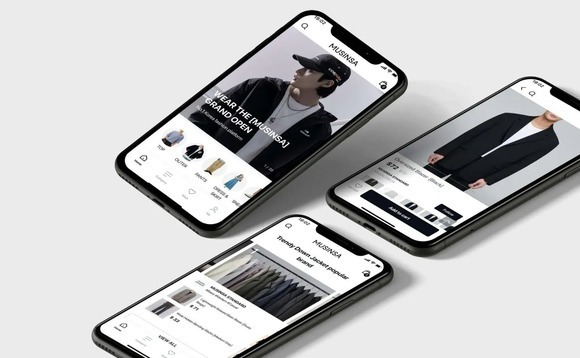

Deal focus: KKR thinks global with Korea's Musinsa

KKR has made its first tech growth investment in Korea with Musinsa, an online marketplace for a carefully curated selection of streetwear brands with export potential

KKR's high hopes for its latest transaction in Korea are betrayed by an enthusiastic pre-investment phase in which deal professionals in at least five countries convened to brainstorm possibilities for growth.

The private equity firm has led a USD 190m Series C round for online fashion platform Musinsa with support from Wellington Management. It marks KKR's first technology growth investment in Korea and part of a plan to build up a portfolio of minority technology positions across the broader region's major markets.

The internationalisation of the diligence process was largely about exploring value creation opportunities: Musinsa is seen as dominant in Korea and ripe to take its brand-incubating streetwear model to global markets where the K-wave cultural vanguard is increasingly marketable. KKR staff across Korea, Japan, Singapore, Hong Kong, and the US were involved.

"We really wanted to find a consumer marketplace that was non-horizontal, and we've found globally that fashion is one of several categories that lends itself to a vertical model," said Victor Chen, a Hong Kong-based principal at KKR, who has joined the Musinsa board.

"No large fashion brand wants to sell on a mass platform like Amazon because it dilutes their brand. They want specialised marketplaces that are more aligned with their image."

Musinsa was founded in 2001 by then-high school student Manho Cho. Originally a sneaker fan forum for simply sharing images of beloved shoes, it experimented with a more diversified pictorial fashion magazine in 2005. By 2009, the community had grown to almost 1m people and a marketplace was launched for an established audience. At the time, Cho was still in design school.

In the meantime, fashion companies Styleshare and 29CM were acquired for a combined USD 265m, bringing more women into a historically men-focused offering. The business is profitable, and Chen said customer adoption is extending from the usually youthful streetwear demographic to include more people in their 30s and 40s.

Musinsa is a pure marketplace in the sense that it maintains hardly any inventory and generates income via marketing and distribution support fees from portfolio brands. The take rate is said to be less than the approximately 40% typically charged by traditional brick-and-mortar department stores but north of the 11%-13% range levied by the likes of eBay.

The platform hosts more than 6,000 local and foreign designer brands, typically fledgling businesses that leverage the Musinsa platform and ecosystem as a kind of accelerator-incubator.

There is also one in-house brand, Musinsa Standard. Last week, Musinsa Standard was confirmed as the official outfitter for the Korean national team's uniforms to be worn during the opening and closing ceremonies at the Olympic Games in Paris next year.

One subsegment of the business is focused on investments in new independent brands, especially those from proven designers. Part of this effort involves investing in sustainable brands and related ventures; Musinsa is an LP in a climate fund managed by Korean VC firm Envisioning Partners.

"It's a very small strategy for them, but it shows they are laser-focused on ESG [environmental, social, and governance] issues," Chen said of the fund commitment. "We think they're among the best in class at this type of governance in Korea."

KKR has plans to help the company expand into Japan, Southeast Asia, and the US. For the latter market, the relatively obscure nature of the marketplace's portfolio brands is expected to be a paradoxical strength. The key to Musinsa's differentiation is the very fact that the brands are underground.

"These brands will be worn by a K-pop star or in a Netflix K-drama, and that's where they gain viral traction," said Elizabeth Qian, a New York-based director at KKR who advised on the potential for a US entry pre-investment. "So, Musinsa provides global consumers of that content the opportunity to access the latest Korean fashion trends."

KKR also saw the brand incubation function as a sign of a relatively resilient business model in this space. This point is perhaps best illustrated by examining one of Musinsa's closest homologues: another Korean shoe platform-cum-streetwear marketplace called Kream that has raised about USD 260m in private funding since 2021.

Most importantly, Kream is a resale platform, which means there are no agreements with brands on the supply side of the business and no designer or factory relationships. To a significant extent, items are listed on the platform because they're collectable or rare, meaning they are prone to trade like stocks rather than traditional merchandise.

"Musinsa focuses on fashion brands on the supply side of their marketplace, whereas some of its peers in the market comprise of sneaker and streetwear resellers," Chen said. "We believe this gives Musinsa a more defensible model through strong network effects."

Private equity obviously sees something in this niche. Streetwear brands are promoted by word-of-mouth far more than storefront displays on expensive real estate. The audiences are young and therefore generally not well-heeled, but they are willing to splash out on fashion. There is significant potential upside in runaway fads.

North Asia is a hotspot, with additional competition represented by the likes of Japan's Soda, operator of sneaker platform Snkr Dunk. Soda raised a USD 336m Series D in 2021 featuring Kream, which is helping the company with a Korean expansion.

Standout deals also include CVC Capital Partners acquiring A Bathing Ape in a deal that valued the Japanese t-shirt brand at USD 460m in 2021. Further afield, The Carlyle Group exited US skateboarding lifestyle brand Supreme in a USD 2.1bn deal in 2020; Carlyle reportedly acquired a 50% stake for USD 500m in 2017.

"Musinsa understands that brands need resources beyond capital to grow. That includes help with content, design, and distribution networks," Chen said, referring to Musinsa's portfolio of emerging brands.

"All the things that private equity firms have helped brands like Supreme and Bathing Ape accomplish – Musinsa is essentially the platform that delivers this type of help and value add for Korean fashion brands."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.