News

B Capital closes US-Asia healthcare fund on $500m

US and Asia-focused VC firm B Capital has closed its first dedicated sector fund, collecting USD 500m for investments in healthcare.

Investcorp opens Japan office

Investcorp has opened a Tokyo office to serve as a staging post for direct private equity and real estate investments Japan.

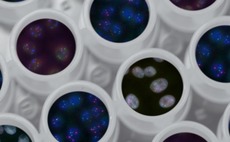

China vaccine developer Immorna raises $100m

Immorna, a China-based biotech start-up focused on RNA-based therapeutics and vaccines, has raised about USD 100m across two Series A extensions.

China VCs back local automotive chip developer

SiEngine Technology, a China-based developer of chips for smart cars, has raised CNY 500m (USD 73m) in an extended Series A round featuring several local VC firms.

Northstar leads pre-Series C for Singapore's Una Brands

Northstar Group had led a USD 30m pre-Series C round for Una Brands, a Singapore-based brand agglomeration platform that operates across Asia.

Goodwin adds investment funds partner in Singapore

Goodwin Proctor has recruited Matthew Nortcliff as a partner in its investment funds practice in Singapore, adding headcount to an office that opened towards the end of last year.

China chatbot developer raises funding to ride ChatGPT wave

Emotibot, a China-based chatbot developer, has raised a Series D extension of undisclosed size from GP Capital, KYMCO Capital, Jiangsu Cultural Investment, and Junci Investment.

India's Nexus Venture closes Fund VII on $700m

Nexus Venture Partners has reached a final close on its seventh India venture capital fund with USD 700m in commitments, taking the firm’s total assets under management past the USD 2bn mark.

Japan enterprise blockchain supplier LayerX raises $40m

Japan’s LayerX, an enterprise technology supplier that incorporates blockchain into functions such as expense management, has raised JPY 5.5bn (USD 40m) from a mostly local VC syndicate.

New Zealand electronic waste start-up gets $37m

New Zealand’s Mint Innovation, a precious metals refiner that salvages electronic waste, has raised NZD 60m (USD 37m) in Series C funding featuring Australian PE firm Liverpool Partners.

China's Oricell secures $45m Series B extension

Qatar Investment Authority (QIA) and RTW Investments, a US-based healthcare investor, have led a Series B extension of USD 45m for Oricell Therapeutics, a China-based drug developer working on CAR-T cell therapies.

China edtech player Nowcoder raises $50m

Beijing-based Nowcoder Technology, a Chinese campus recruitment platform also known as Niuke, has raised USD 50m in Series B funding from Sequoia Capital China, Shunwei Capital, 5Y Capital, Tiger Global Management, and Pegasus Capital.

Japan's Astroscale raises $76m Series G

Japan’s Astroscale, a start-up specialising in on-orbit space debris removal, has raised USD 76m in Series G funding featuring Mitsubishi Corporation.

Singapore's Grayscale hits first close on debut VC fund

Grayscale Ventures, a Singapore-based VC firm set up last month by South Asia-focused investors at Japan’s Strive, has achieved a first close of about USD 10m on its debut fund.

Regulator raises the qualification bar for Chinese GPs

China has introduced minimum paid-up capital requirements for local private equity firms that could force smaller, less sophisticated players out of the market.

Cenova leads $40m Series B for China's Eluminex

China-based healthcare investor Cenova Capital has led a USD 40m Series B round for Eluminex Biosciences, which is developing drugs and regenerative tissue used to treat eye disease and other vision-threatening medical conditions.

Fan Bao cooperating with investigation - China Renaissance

Fan Bao, group chairman of China Renaissance, is “cooperating in an investigation being carried out by certain authorities” in China, the firm has announced.

Allegro agrees take-private of Australian law firm

Allegro Funds has agreed to acquire Slater & Gordon, a Melbourne-headquartered law firm that trades on the Australian Securities Exchange, at a price that equates to a market capitalisation of around AUD 77.6m (USD 52.3m).

Advent backs China pest control company

Advent international has invested an undisclosed sum in China’s LBS Group, a regionally active pest control and hygiene company.

DCP backs China expansion by Canadian vitamins brand

DCP Capital has agreed to invest approximately USD 175m to support the China expansion of Jamieson Wellness, a listed Canadian producer of health and wellness products.

Fengyuan leads Series A for China battery components maker

Fengyuang Capital has led a CNY 150m (USD 22m) Series A round for Haodyne Technology, a China-based battery materials supplier.

Kotak fund invests $129m in India's Biocon

Kotak Mahindra Advisors (KIA), the alternative assets arm of Kotak Mahindra Group, has committed INR 10.7bn (USD 129.4m) to Indian pharmaceuticals manufacturer Biocon to support the latter’s acquisition of a biosimilar business from global healthcare...

Potentia makes improved buyout offer for Australia's Nitro

Potentia Capital has submitted a new bid for Nitro Software that values the listed Australian business at approximately AUD 532.3m and eclipses a competing offer from a strategic investor.

Anchorage agrees carve-out from New Zealand's Green Cross Health

Anchorage Capital Partners has agreed to buy New Zealand-based Green Cross Health’s community healthcare business – which provides in-home nursing, personal care, rehabilitation, social support, and household assistance services – for an enterprise value...