China's Oricell secures $45m Series B extension

Qatar Investment Authority (QIA) and RTW Investments, a US-based healthcare investor, have led a Series B extension of USD 45m for Oricell Therapeutics, a China-based drug developer working on CAR-T cell therapies.

Several existing investors took part, including Qiming Venture Partners and C&D Emerging Industry Equity Investment. Qiming and Quan Capital led the first tranche of the Series B – worth USD 125m – which closed in July 2022. That followed a red chip restructuring that redomiciled the company outside of China, potentially facilitating an offshore IPO.

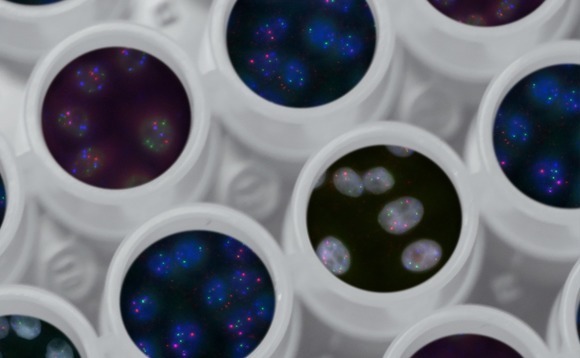

Founded in 2015, OriCell's model is based on four platforms focusing on antibody discovery, cell culture, and CAR T technology. The goal is to remove the efficacy and cost bottlenecks in CAR T-cell therapy, which involves extracting immune cells from a patient, modifying them, and then returning them to the host to attack tumours.

The company has 20 pipeline treatments, including CAR T, universal CAR T, and antibody-based products. It holds global intellectual property rights for each one. Ori-C101, its first internally developed CAR T product, which targets advanced liver cancer, was granted investigational new drug (IND) status by China's National Medical Products Administration (NMPA) last year.

OriCell is also working on OriCAR-017, China's first CAR T therapy for relapsed and refractory multiple myeloma (RRMM). It has received orphan drug designation by the US Food & Drug Administration.

The antibody drug pipeline is all pre-IND stage apart from Ori-Bs-001, which was licensed to Hong Kong-listed Anteggene for USD 142m, including upfront and milestone payments. The treatment, an immune checkpoint inhibitor that prevents cancer cells from evading immune systems, is beginning clinical trials in Australia, China, and the US.

The new capital will primarily support core product clinical development in the US, according to a statement.

"RTW continues to focus on advanced tumour cellular immunotherapeutics. As a long-term investor in the primary and secondary markets, we have been closely following OriCell and have been duly impressed by its milestone achievements over the past year," said Roderick Wong, a managing partner and CIO at RTW.

OriCell received CNY 80m (USD 11.3m) from Qiming in 2019 and then a CNY 200m Series A led by Shanghai Pudong Innotec Capital in 2021, AVCJ Research's records show. Other investors – across various rounds – include Shanghai STVC Group, Yijing Capital, Osen Assets, Jianyi Capital, a fund-of-funds linked to the Suzhou city government, and Boquan Equity Investment Management.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.