China VCs back local automotive chip developer

SiEngine Technology, a China-based developer of chips for smart cars, has raised CNY 500m (USD 73m) in an extended Series A round featuring several local VC firms.

Teda Venture Capital, Haier Capital, SPDB International Investment, Wuhan Innovation Investment Group, and Tongxi Capital came in as new investors. Existing backers Shanghai Guosheng Group, Yuexiu Industrial Investment Fund Management, and Vision Knight Capital Partners re-upped.

SiEngine confirmed in a recent statement that the deal was completed at the end of last year. That extended a string of three investments over the course of 2022, including a Series A of CNY 1bn in June led by Sequoia Capital China and a strategic round from state-owned automaker FAW Group in March.

SiEngine was established in 2018 by EcarX, a smart mobility solutions provider backed by Geely Auto Group and the China unit of global central processing units designer Arm. EcarX listed in the US last December through a USD 3.82bn merger with a special purpose acquisition company (SPAC).

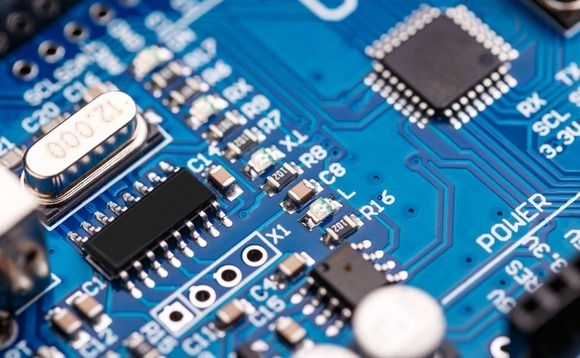

Operations focus on high-end automotive system-on-chips (SoC) – integrated circuits that bring together all or most components of a computer or other electronic system. The aim is to service all three major automotive chip application fields: smart cockpit multimedia SoC, advanced driver assistance systems (ADAS), and in-vehicle central computing chips.

In June 2021, SiEngine rolled out the first domestically produced car-grade seven-nanometre smart cockpit chip. It entered mass production at the end of last year. Several new car models equipped with the chip will be available for sale from the middle of 2023.

The start-up has been registered in Hubei Wuhan Economic and Technological Development Zone since inception. This attracted investment from Wuhan Innovation, state-backed fund, in the latest round.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.