VIG Partners

LPACs: Conflicts and complexity

The combination of a maturing Asian private equity landscape and a fast-emerging continuation fund opportunity is placing greater emphasis on the role of the LP advisory committee

Korea's VIG seeks $1.1b for Fund V

South Korean mid-market private equity firm VIG Partners has launched its fifth fund with a target of USD 1.1bn, seeking to replicate the even split between domestic and foreign capital achieved in the previous vintage.

Asia deal financing: A selective market

Regional buyout activity is weak but leveraged loans are available for the right kind of target – in Japan, Korea, Australia, and beyond – and with a suitably customised structure

Deal focus: VIG secures rare airline turnaround opportunity

VIG Partners stepped into the breach when Eastar Jet’s previous white knight bailed. It agreed to recapitalise the airline on obtaining assurances that key licenses and routes remain in place

VIG acquires Korea's Eastar Jet

Korea’s VIG Partners has acquired 100% of local low-cost airline Eastar Jet for USD 117m, citing plans to introduce new aircraft to the fleet as part of a “quick turnaround.”

One size does not fit all in Asia value creation – AVCJ Forum

Replacing portfolio company CEOs is not part of buyout firms’ value creation playbook in emerging markets, the AVCJ Private Equity & Venture Forum heard.

Korea: A good time to be different?

Macroeconomic uncertainty and liquidity risk are pushing Korean private equity firms to think beyond buyouts, double down on operational capabilities, and consider all their exit options

Alternative fuels: Burning questions

From the landfill to the inside of atoms, the alternative fuels angle on energy transition gives investors a range of risk profiles to consider. Developed economies are the primary playgrounds

VIG buys Korean healthy beverage brand

VIG Partners has agreed to acquire a majority stake in Teazen, a South Korean producer of tea-based health drinks, for approximately USD 70m.

Korea's VIG makes first full exit from Fund III

VIG Partners has agreed to exit its 51% stake in eyewear brand Star Vision through a buyback by the South Korean company’s founder and current minority shareholder.

VIG makes partial exit from Korea funeral services business

Korea’s VIG Partners has sold a 10% stake in funeral services provider Preed Life to Mastern Partners, a local PE platform, for KRW50 billion ($43.2 million).

VIG buys Korea waste-to-energy business

Korean private equity firm VIG Partners has acquired a controlling stake in waste-to-energy (WTE) facility operator BioEnergyFarmAsan for about $100 million.

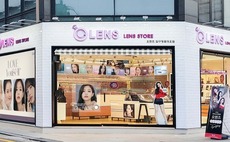

Korea's VIG buys The Skin Factory

Korean mid-market private equity firm VIG Partners has acquired 100% of The Skin Factory, operator of domestic home and personal care products brand Kundal.

Korea retail: Digital or dead?

Coupang’s bumper IPO has underlined the appeal of a Korean e-commerce industry characterized by chaebols playing catch-up and PE and VC investors looking to profit at the margins

Portfolio: VIG Partners and Joun Life/Preed Life

By merging Joun Life with Preed Life, VIG Partners’ groundbreaking venture into Korean funeral services is reimagining an industry beyond its core ceremonies

Asia exits: Liquidity lags

Private equity exits – outside of the public markets – are gradually emerging from a COVID-19 hibernation. But sellers must be mindful of timing, structure, and which buyers they are targeting

VIG makes second Korea funeral services acquisition

Korea’s VIG Partners has made the second investment from its fourth fund – which closed at $810 million in January – with an agreement to acquire Preedlife, the country’s leading funeral services provider.

Coronavirus in Asia: Ongoing analysis

Coronavirus concerns among GPs not solely focused on China vary based on their direct or indirect exposure to China, but gauging private equity responses to the crisis is like chasing a moving target

Fund focus: Korea's midcap buyout space comes into focus

VIG Partners believes its recent $810 million fundraise validates the firm's middle-market strategy and spur the emergence of new domestic GPs in this area

VIG reaches $810m final close on fourth Korean fund

VIG Partners has closed its fourth Korea-focused fund at $810 million, with approximately half the commitments coming from international investors. This compares to 30% for Fund III, which closed at $600 million in 2017.

PE & QSR: Ambition on a bun

Many private equity investors think they can make a fast buck from fast dining, but rolling out a Western-style brand in Asia requires discipline on valuation and competence in execution

VIG acquires Korean education business

VIG Partners has agreed to pay KRW165 billion ($137 million) for a controlling stake in D.Share, an online-offline English language education provider in Korea.

VIG secures 3.2x return on Korea's HiParking

VIG Partners has agreed to sell Korean parking management business HiParking to Humax, a consumer electronics manufacturer, for KRW170 billion ($141 million).