Asia deal financing: A selective market

Regional buyout activity is weak but leveraged loans are available for the right kind of target – in Japan, Korea, Australia, and beyond – and with a suitably customised structure

IMG Academy, a Florida-based sports education business that evolved from the Nick Bollettieri Tennis Academy, has no apparent Asia nexus. Yet BPEA EQT recognised a potential Asian expansion angle when it teamed up with Nord Anglia Education, an existing portfolio company, to acquire the business for USD 1.25bn earlier this year. It brought a string of Asian banks along for the ride.

The deal is described as the first pure US buyout supported by an Asian bank financing package, and it may remain a one-off. BPEA EQT considered local financing options but reasoned the deal was too small – around USD 400m in senior debt – to be economically viable and the third-party work required to push it through was too onerous, according to a source close to the situation.

Any uncertainty about taking Asian lenders into unfamiliar territory was tempered by the knowledge that the participants were familiar names. All had backed BPEA EQT deals before. "There is direct dialogue with every single lender," the source added. "Asia is a relationship-driven market. Some lenders might not even look at the documentation provided they are comfortable with the credit."

Though an outlier, certain aspects of the IMG deal resonate with investors and advisors active in Asia: a continued appetite for leveraged financing among the region's lenders; a tendency to build larger syndicates of lenders rather than rely heavily on one or two; and a preference among PE firms for conservative leverage upfront (IMG was 4.5x debt-to-EBITDA) with a view to refinancing later.

"Financing terms have tightened around the edges and syndication desks are worried about a further downswing in the market, but the Asian market has stayed relatively liquid," said Manas Chandrashekar, a partner at Kirkland & Ellis.

"Whenever financial sponsors have put an asset up for auction, financing has been available – it just might be a quarter of a turn or a half turn less than the peak, it might take longer to negotiate, and there might be more banks involved."

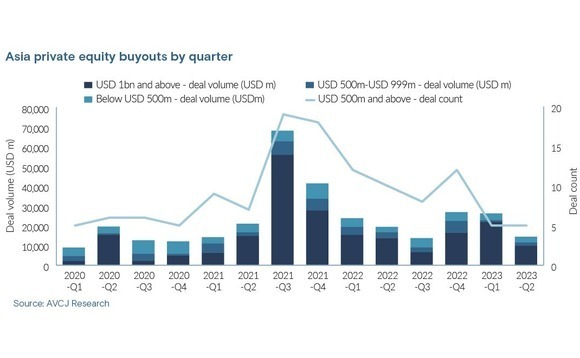

Nevertheless, deal flow remains slow. Asia buyout volume amounted to USD 14.4bn in the second quarter of 2023, less than half the average for the prior eight quarters, according to AVCJ Research.

Cost of capital is another widely cited consideration, alongside macro uncertainty. It is telling, therefore, that the largest buyouts year to date come from the three jurisdictions with the most developed local financing sources: Japan, South Korea, and Australia. Each has seen problem deals, yet they remain resolutely open for business and offer relatively attractive terms.

On a broader Asian level, the combination of cost and a willingness to work with lower leverage multiples is pushing borrowers towards banks rather than private credit funds. Alex Nolet, a partner at Linklaters, is reluctant to engage in trendspotting given financing packages are increasingly bespoke in nature, but he has seen private credit funds lose momentum compared to a year ago.

"As interest rates increased, and capital markets windows became narrower, some deals started to get decoupled, and we went back to seeing more traditional senior-mezzanine structures," he said.

"At the moment, the market is very erratic, but I would say that bank lenders have an advantage deriving mainly from the fact that borrowers are prepared to forgo some of the flexibility they would get from private credit providers, in exchange for significantly better pricing."

Base rate bliss

Japan's perseverance with a low interest rate policy while most other open economies have to some extent tracked the US Federal Reserve's ascent to 5% means buyout players don't necessarily have to re-orient investment theses to a new normal. At the same time, the bank-dominated lending community seems happy with margins in the 200-300 basis-point range.

"Financing is still attractive from our perspective. Interest rates went up around 0.3% but the spread hasn't really changed," noted Atsushi Akaike, a partner and co-head of Japan at CVC Capital Partners. "LBO financing is an important revenue source for the big banks – they want to carry on providing loans at 2%-2.5% upfront fees."

This resilience follows a difficult 2022 in which KKR-owned automotive parts manufacturer Marelli underwent a restructuring that saw creditors forgive JPY 450bn (USD 3.2bn) of a JPY 1.1trn debt pile. Mizuho Financial Group alone was said to have JPY 360bn in exposure. Several managers in the large-cap space claim that Japanese banks have become warier lenders as a result.

Yet Ben Morris, a partner at Ropes & Gray, observed that Japan has demonstrated an ability to move on quickly from periods of difficulty and remain remarkably insulated from external pressures. Terms are tighter but there has been no change in the quantum of leverage available. Other industry participants put it at 4-6x for senior debt with another 2x available in mezzanine financing.

For the right credit, senior debt of up to 8x is feasible, added Clara Shirota, a partner at White & Case. However, she notes two changes. First, the terms of financing have become stricter, for example, with respect to the frequency of financial covenant testing.

Second, leveraged lending in Japan is dominated by three megabanks – Mizuho, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group – to the point that it is hard to get a deal of size done without at least one of them. Marelli has reminded these lenders of the risks of excessive single-asset exposure.

"Previously, for a deal of USD 500m or under, sponsors would want to deal with a sole underwriter and one of the megabanks would take it all," said Shirota. "Now, they would typically try to pull in one of the other megabanks and some of the regional banks as well, either on a pre-syndicated basis or a club deal, in addition to selling down their exposure post-signing."

Mezzanine financing has long been a feature of the Japan market, although one of the investors with a large-cap firm claims to "have a niche in the market" that delivers sizeable portions of attractively priced debt. Commitments from local mezzanine funds are said to top out at USD 200m, but Morris of Ropes & Gray has noted an increase in willing participants.

It is also perhaps the only part of the market in which foreign investors can get a look in. Global credit providers – such as The Blackstone Group and KKR – are presenting themselves as offshore solutions for situations where Japanese lenders pull back or the multi-currency nature of the target's revenue base calls for a multi-currency financing package, according to industry sources.

Beyond the breach

Offshore lenders launched a Korean incursion towards the end of last year when domestic banks went into risk-off mode and ceased lending amid concerns about interest rates. Consequently, one of the deals underway at the time, for dental scanner business Medit, did feature offshore financing, according to two sources familiar with the situation. The bidder ultimately lost out to MBK Partners.

The window was short-lived. Following government reassurances, local lenders re-engaged in the first quarter of 2023. "Financing markets are very much open. The financial system is stable, and people are careful about lending," said Scott Hahn, CEO of Hahn & Company. "Acquisition finance is there for high-quality businesses, though in moderation – usually no more than 50% of a deal."

Hahn & Company is responsible for one of the largest Korean buyouts of the last year. Its USD 1.3bn carve-out of an industrial materials unit from SKC was announced in June 2022 and closed six months later, supported by a bank financing package priced at 7.2% all-in.

They include Homeplus, a grocery retailer acquired by MBK in 2017 that has been challenged by the rise of online platforms, and Hanssem, a listed furniture retailer that has seen significant market volatility since IMM Private Equity took a controlling interest in 2021. In both cases, the GPs injected new equity and renegotiated terms. Two more of the six are currently in sale processes.

"The banks have made so much money from leveraged financing and they see it as part of their core business. They aren't backing off," said Jason Shin, a managing partner at VIG Group. "All we've seen is lending standards become more stringent and in some cases leverage ratios are coming down."

Jackie Kahng, a partner at Ropes & Gray, noted that leverage levels haven't changed much – 6x for senior debt, rising to 7x-8x with mezzanine – while pricing has increased and terms have tightened a little. "For example, we've seen lenders ask for tighter provisions in the amendments section, so it's harder for sponsors to get amendments without the consent of the supermajority of lenders," she said.

In Korea, much like in Japan, mezzanine can be a helpful add-on to an already generous senior debt multiple. Elsewhere in the region, it is increasingly considered a means of bridging the leverage gap following a senior debt retreat from 7x-9x or more 18 months ago to 4x-5x today. Other aspects of senior debt financing packages, such as pricing and covenants, are largely unchanged.

These structures get short shrift from some investors. The source close to BPEA EQT argued that anyone seeking "an extra turn of leverage to justify their return is probably starting off on the wrong foot because there will be no cash available for investment and M&A." It is better to start with lower leverage on day one, ride the growth often offered by Asia-based assets, and then refinance.

Indeed, Baldwin Cheng, a Hong Kong-based partner at White & Case, claims to have seen deals in the manufacturing sector where investors have opted for lower-leverage bank debt because they do not expect much growth in the next couple of years. A revival might be anticipated thereafter, but they "weren't willing to stretch credit right now."

PIKs and toggles

Those looking to stretch must pay a premium for mezzanine from private debt providers – pricing could be 15% all-in, several hundred basis points higher than senior debt – but they get some flexibility in return. This includes payment-in-kind (PIK) toggle mechanisms, that allow borrowers to respond to base rate changes by moving back and forth between different interest payment formats.

If the all-in debt package is 9%, comprising a 4% base rate and a 5% margin, the borrower could opt to reduce the burden in a particular quarter by rolling over a portion of the 5%. Caps are imposed on the number of rollovers, so there's a risk of maxing out before an anticipated base rate alteration.

"A PIK toggle or taking a chunk margin as PIK over the life of the deal is possible if you are willing to bear the price. Asia is a cost-sensitive market, so a lot of sponsors favour the bank debt option which comes with maintenance covenants but is cheaper," said Chandrashekar of Kirkland & Ellis.

This structure has been utilised in the Australian market. Earlier this year, Adamantem Capital acquired restaurant chain operator Retail Zoo for a reported enterprise value of around AUD 350m (USD 238m). There is said to have been a layer of mezzanine sitting behind the AUD 200m bank term loan. Private credit providers are also looking to include PIK toggles in unitranche deals.

"Hypothetically, that's something we are offering to clients to manage interest rate risk in the short to medium term," said one local private credit player. "You can structure it however you want – it's not like the cookie-cutter approach of the broader syndicated market. The ultimate lender must decide whether they are getting an appropriate return for the risk they are introducing."

Australia's high-profile failure is GenesisCare, a cancer care provider that took out a covenant light USD 1.55bn US term loan B (TLB), largely to support global expansion. The company, which counts KKR as a minority investor, filed for bankruptcy protection in the US earlier this year and recently won approval for a restructuring that will see creditors take a haircut.

This hasn't necessarily impacted the quantum of leverage available from local banks in traditional term loan A facilities. Russell Sinclair, head of Australia debt and capital advisory at PwC, puts it at 4x, with another 1.5x-2x available in mezzanine financing. The overall cost, 4.5%-5% on top of a base rate of 4.1%, is comparable to what can be obtained from the unitranche providers.

"Capital is available, and people are exploring solutions to the base rate problem, but few really large deals are getting done. Part of that is investor conviction around whether they want to deploy capital at this stage in the market. They are taking their time and watching how businesses cope with the inflationary environment before deploying a big cheque," said Sinclair.

"There is also concern about getting multi-billion-dollar financings done in Australia because they don't want to go to the US TLB market. We include it as an option, but no one is excited about it."

Local sources of capital, including private debt players investing from pan-Asian funds, can handle up to AUD 1bn per deal. With processes already underway for ticketing business TEG and funeral services provider Invocare, each of which is expected to push the upper limits of that capacity, Australia is likely to be the first Asian market to test US TLB appetite for new deals post-COVID-19.

Digging deeper

TEG might come to be regarded as a bellwether for the overall market, but it is a market leader with a history of private equity ownership being pursued by large global sponsors. This underscores a point made by industry participants region-wide: lenders are very selective as to what they will support, with views on different sectors and assets leading to highly customised solutions.

Accordingly, Peter Graf, a managing director at Ares SSG, a direct lender active in Australia, believes excitement at flattening interest rates is premature. "There are companies having a hard time and it will play out over the next 12-18 months," he said, noting that Areas SSG receives plenty of enquiries from borrowers willing to pay up for solutions that ease pressure on their capital structures.

Private debt providers, with their ability to address structural complexity, may flourish. Rahul Chatterji, a partner at Linklaters, observed that more institutions globally are setting up hybrid capital desks, similar in some ways to strategies that would have been classified as special situations a few years ago. The difference is that they are targeting performing credit, not just distress.

"Debt is often provided at different levels of the capital structure, sometimes coupled with detachable warrants or other synthetic instruments to capture an equity upside. The entire investment is funded from the same ‘book,' with the goal being to optimize the blended returns across the capital structure, not just senior debt," he said.

"This investment strategy is picking up steam in Asia and over the next 12 to 18 months, I expect there will be more data points to demonstrate the trend."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.