Portfolio: VIG Partners and Joun Life/Preed Life

By merging Joun Life with Preed Life, VIG Partners’ groundbreaking venture into Korean funeral services is reimagining an industry beyond its core ceremonies

Korea's VIG Partners entered the local funeral services industry with caution, noting a fragmented landscape and a penchant for financial scandals. It executed the first private equity investment in this space in 2016 with the acquisition of an 84% stake in Joun Life for KRW65 billion ($60 million) after an extended research period, but this was not its first choice.

VIG initially targeted the number one local operator, Preed Life, but the founder was unwilling to sell his controlling stake at the time. Four years later, Preed is ready and currently being merged with Joun to cement its market leadership. This could extend the exit horizon for Joun beyond VIG's usual 3-5-year timeframe, but in many ways the development represents a complete reboot of the investment.

Not only does the combined company now boast 1.5 million pre-paid funeral service subscribers and cumulative advance payments of KRW1.2 trillion, it is redefining itself beyond bereavement. "We're trying to meet the demands of aging people, not just in funeral services but in broader lifecare needs, and we can do that using subscription money," says Byungmoo Park, a managing partner at VIG. "It's a very new idea."

VIG's journey to creating this platform included four years of value-add work with Joun, including the expansion of the asset management and sales channel strategies, the introduction of new management, and a string of bolt-on acquisitions. Roll-ups included two physical funeral homes and two funeral service providers, one of which was carved out from Tong Yang Life Insurance, one of VIG's early portfolio companies which it exited in 2015 to Anbang Insurance Group in a KRW1.13 trillion deal.

The experience with Tong Yang proved valuable in building out Joun due to the similarities between pre-need funeral services and traditional life insurance plans. The key difference here is that if the loss of a family member occurs within the contract period – normally 10-12 years – then clients are required to pay the balance of the service costs in a lump sum. Tong Yang was also tapped in terms of building out management, with Joun's current COO and chief sales officer coming from the company.

In addition, VIG brought in a number of professionals for the combined post-merger entity, which will operate under the name Preed. These include Manki Kim, formerly a managing director at Tong Yang, in the role of CEO, a CFO who had previously worked filled the role at two other VIG portfolio companies, and a CIO with a background in life insurance.

"Preed was focused on increasing its overall subscriber base, whereas Joun, because it was owned by a private equity firm, had products that were more profit-oriented and more beneficial to the company," Kim says. "By introducing this better-packaged product, we believe Preed can increase its profitability."

Joun's revenue climbed from KRW8.7 billion in 2016 to KRW17.9 billion in 2019 and is on track to reach KRW19.9 billion this year despite the impacts of COVID-19. To some extent, this can be explained by a supportive industry backdrop.

Demographic tailwind

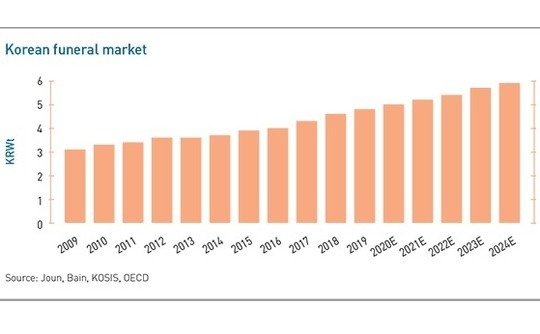

Korea's currently KRW4.8 trillion funeral market is projected to grow stably at 4.3% a year on the back of rising death rates and decreasing family sizes, which translates into less capacity to coordinate traditional ceremonies.

Meanwhile, the average household size has fallen from 4.5 people in 1980 to about 2.4 today. Koreans still abide by the traditional funeral service and have the spending capacity to do so, but they have become much worse equipped to take on these responsibilities in terms of people organizing events.

"As long as the overall population is not declining and we have this increase in the affluent older customer base, the next 10-20 years could be a kind of golden period that we can benefit from," Jason Shin, a managing partner at VIG, said at the time of the Joun acquisition.

Nevertheless, local funeral services players have failed to manage their subscription incomes effectively. Some players in this space are known to take money from customers and put it straight into the bank earning 1% or less interest per year. VIG, by contrast, has helped Joun access international alternatives products managed by BlackRock and Goldman Sachs, among others.

"No funeral services companies have invested well so far. At best, they're just buying government or corporate bonds," Park observes. "But we are trying to expand our investments in alternatives, if it's a stable cashflow investment. Funeral service companies in Korea have not even thought about investing outside the country, but we are. This is a new area that will raise revenue and profitability."

Joun has grown its subscriber base from 70,000 at the time of acquisition to 400,000 in 2019, effectively raising the company from the 10th to fifth in the local rankings. In addition to more astute asset management and expansion through M&A, much of this progress was driven by the transfer of life insurance-style sales practices into the funeral services space.

Historically, Joun had only acquired subscribers through agents who worked exclusively for the company. This lack of diversity echoed the approach of leading players in the funeral services space, including Preed, which traditionally relied on a partnership with household electronics retailer Hi-Mart to drive 60-70% of its sales.

Under VIG, Joun's sales channels have broadened to include general agents, who work across various organizations, home shopping broadcasts and infomercials, as well as offline events such as group presentations. The strategy is now being carried over to Preed.

Joun's core services include a pre-selected coffin, shroud, and transportation to the burial ground, with varying price points based on optional extras. Premium services can include more elaborate food provision services, musician hire, and higher quality coffins and hearses. "More and more high price-level products are being sold and bought by customers," Park says.

Among the new services responding to COVID-19 conditions are a temporary online service, which allows friends and families to express condolences virtually. This may be an area that Preed expands into as well if the pandemic is prolonged, but it is generally not considered a particularly fruitful area of development.

Big urn-ings?

Preed might have more success earning brokerage fees by selling urn depository services. These facilities, known as columbaria, typically sell urn niches in the range $5,000-20,000 for a 30-year lease. Prices vary depending on the position of the niche within the columbarium, proximity to a city or the maintenance extras. Moves into this area will be limited, however, due to local regulations that limit private companies' ability to own and manage columbarium real estate.

Joun's main diversification to date – also set to be rolled out with Preed – is in non-funeral services. The idea is to allow subscribers to use the paid-in fees for quality-of-life expenditures such as vacation travel, family weddings, or the elaborate birthday parties for 60-80-year-olds that are customary in Korea. VIG has engaged a new chief marketing officer with a pharmaceuticals background to explore expanding this concept to lifecare-related services such as regular health check-ups and medical devices.

Non-funeral services still amount to less than 10% of Joun's revenue, but there are plans to build this out significantly in the coming years as the company is fully integrated with Preed. VIG believes that further expansion in this area, which is tantamount to redefining the essence of the funeral services industry, will require much greater scale.

This is the ultimate thinking behind the ongoing merger. Transitioning a fragmented death care category into a professional, operationally diversified industry molded on life insurance will require a high profile, public trust, and deeper market reach.

VIG acquired Preed earlier this year via its fourth fund and structured the deal such that the company is now 100% owned by Joun, a Fund II portfolio company. The size of the transaction was not disclosed, but VIG said that Preed is the first domestic funeral services provider to achieve an asset value of more than KRW1 trillion. Pre-merger, Preed had set goals to reach KRW5 trillion in assets, KRW500 billion in annual sales, and five million customers by 2022.

The combined company has 10 physical funeral homes nationwide – four from Joun and six from Preed – and two more are already under development. The plan is to add one new location to the fleet every year. These businesses are available not only to subscribers but to the general public as well. Market share is now about 22% both in terms of the number of subscribers and income from subscriber payments.

The integration of the two businesses is scheduled to begin in earnest in January and take some time. One of the major priorities will be reimaging the corporate identity, brand identity and logo to capture the new model. Preed's current logo, was developed some 10 years ago and is no longer believed to represent the company. It will be brightened and, with the word Preed added in English script.

The lifecare concept will be emphasized in pamphlets and other marketing materials, as well as office decor and new uniforms. The usual all-black attire has been deemed too austere; service provider suits will feature lighter colors going forward.

"The current image of the funeral services industry is linked with the elderly and death, and in Korea, the image of funeral services providers has been a bit negative," Kim says. "But with the change in brand and the integration of the two companies, the company hopes to show that funeral services provider can be a total lifecare company that's more approachable to younger generations as well."

More difficult will be the IT system and database integrations, which are expected to take all of 2021. Kim notes that Joun has much more detailed information on its customers than Preed, which does not yet have an electronic subscription system. All Preed's customers to date have signed up on paper. Once the Joun method is standardized across the enlarged company, it is expected to strengthen work in areas such as sales, customer relations management, and investment.

"This is the biggest hurdle," Kim explains. "But we believe that once the two databases are merged and you have this rich customer profile and data – not only for the 1.5 million existing subscribers but for all three million that have subscribed and canceled to Joun and Preed – it will be the main strength of the company going forward."

A COVID question

The biggest question mark in all of this is COVID-19, which has dented the effectiveness of some of Joun's most promising innovations in funeral service sales such as group presentations. There has also been a noticeable impact on food services, which are a significant feature in Korean funeral ceremonies. These often involve three days of catered wakes and burial rituals, typically costing $3,000-10,000.

Under recent conditions, people have tended to pay their respects in shorter visits without stopping to eat, but the social gravity of honoring family appears to be keeping operations afloat regardless. Joun recorded a mere 5% year-on-year decrease in new subscriptions for 2020 to date despite curtailed activity in terms of face-to-face sales. Meanwhile, there are plans to offset any reduction in the scope of ceremonies by increasing the frequency of events.

"Previously, Preed only had the normal three-day ceremonies in its funeral homes, which are marketed as premium, large-sized and good-value venues," Kim says. "Now, these may change their business to accept one-day or two-day ceremonies with much fewer visitors. But by increasing the total number of ceremonies held, the company is trying to increase revenue."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.