Growth capital

Altos, Mirae join $85m round for Korea sneaker trading platform

Kream, a Korea-based sneaker reselling business controlled by domestic internet giant Naver, has announced plans to raise KRW 170bn (USD 84m) from Altos Ventures, Mirae Asset, and its parent company.

Warburg Pincus, Malabar commit $60m to India wearables brand

Warburg Pincus and Malabar Investments have injected USD 60m into boAT, an India-based manufacturer of wearables and other electronic devices that was previously on track for an IPO.

65 Equity invests $107m in Singapore's Cityneon

Temasek Holdings-backed 65 Equity Partners has invested SGD 150m (USD 107m) in Singapore’s Cityneon, a company that markets entertainment brands by staging elaborate events, displays, and exhibitions.

Sofina leads $46m round for India agtech player DeHaat

Sofina, a Belgium-headquartered holding company and an active investor in Asia-based start-ups, has led a INR 3.66bn (USD 45.8m) Series E round for Indian agricultural technology platform DeHaat at a valuation of USD 695m.

Deal focus: Food app targets Thailand’s first internet IPO

Thai restaurant delivery app Line Man Wongnai has leveraged the massive messaging service penetration of its parent company to position itself for what is hoped to be a breakthrough IPO

Deal focus: Euler finds favour with India-oriented EVs

Euler Motors is one of several India-based electric vehicle manufacturers attracting significant private capital, but the company believes its customised offering for commercial users is truly differentiated

Q&A: WeRide's Tony Han

Tony Han, founder and CEO of China’s WeRide, on commercialising fully autonomous passenger vehicles, surviving a capital winter, and why universities are vital to the hard-tech revolution

Airwallex raises another $100m, valuation holds steady

Hong Kong-based Airwallex, a cross-border payments provider turned broader financial technology platform, has raised USD 100m in a second extension to its Series E round at a valuation of USD 5.5bn. It comes 11 months after the company secured the same...

India's Motilal Oswal closes latest fund at $552m

The private equity arm of India’s Motilal Oswal Financial Services has closed its fourth flagship growth fund with INR 45bn (USD 552m) in commitments.

Cambodia's Amara Capital backs local hospitality operator

Cambodia’s Amara Capital has agreed to invest an undisclosed sum in local restaurant and hotel group Thalias Hospitality.

Affirma leads $217m investment in Korean digital insurer

Affirma Capital has led a KRW 300bn (USD 217m) funding round – at a valuation of KRW 1trn – for Carrot General Insurance, a South Korea-based digital insurer.

Deal focus: Remote working delivers for Glints

An outsourced talent management service that enables companies to recruit in far-flung markets has become the bulwark of Glints’ business on the back of COVID-19, underpinning a USD 50m Series D

Novo Holdings leads $50m round for India's MedGenome

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a USD 50m investment in MedGenome, an India-based genetic testing business.

Korea's Gentle Monster backs China AR player Nreal

Nreal, a Chinese manufacturer of augmented reality (AR) glasses that resemble normal sunglasses, has received USD15m from South Korean eyewear brand Gentle Monster.

Kedaara buys minority stake in India's Oasis Fertility

Kedaara Capital has invested USD 50m for a significant minority stake in Oasis Fertility, a fertility treatment business with more than 26 centres across India.

China carmaker SAIC raises $148m for mobility unit

Chinese carmaker SAIC Motor has raised CNY 1bn (USD 148m) to support the expansion of its mobile services unit, which last year launched a fleet of robotaxis.

Carlyle backs Japan medical technology player

The Carlyle Group has committed JPY 7bn (USD 52.2m) to CureApp, a Japan-based developer of software for use in the treatment of medical conditions, as part of the company’s Series G round.

Korean carmakers take control of local autonomous driving player

Korean automakers Hyundai Motor and Kia have paid a combined KRW 427.7bn (USD 328.8m) for control of 42dot, a local autonomous driving software developer in which they and several VC investors already held minority stakes.

J-Star invests in Japanese courier business

Japanese lower middle-market private equity firm J-Star has made an investment of undisclosed size in air cargo transportation and courier services provider Score Japan Holdings.

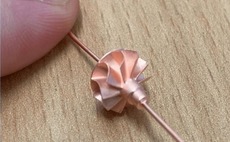

Deal focus: China start-up mines 3D printing’s micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

Matrix leads Series B for China's SpeedBot Robotics

Matrix Partners has led a CNY 300m (USD 44m) Series B round for SpeedBot Robotics, a China-based start-up specialising in vision-guided intelligent robotics.

Korea's Viva Republica raises USD 225m

Viva Republica, operator of the Korean money transfer app Toss, has raised KRW 296bn (USD 225.5m) in series G funding from an investor group that includes Altos Ventures, Goodwater Capital, Greyhound Capital, and Kleiner Perkins.

China's Jaka Robotics raises $150m Series D

Prosperity7 Ventures, a USD 1bn venture capital fund established by Saudi Arabia state oil giant Saudi Aramco, has continued its run of robotics investments in Asia by joining a USD 150m Series D for China’s Jaka Robotics.

Asia logistics: Cost and complexity

Investment opportunities are expected to emerge as companies look to technology as a means of easing inflationary pressure on supply chains. Will Asia’s shallow pool of specialist logistics GPs deepen?