Deal focus: China start-up mines 3D printing's micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

Imcomet is a Netherlands-based healthcare start-up specialising in skin cancer treatment. It uses microfluids and microneedles to clear the fluid surrounding tumours and remove the proteins that enable cancer cells to profligate by tricking immune systems into inaction. This triggers a traditional immune response that can destroy the tumours.

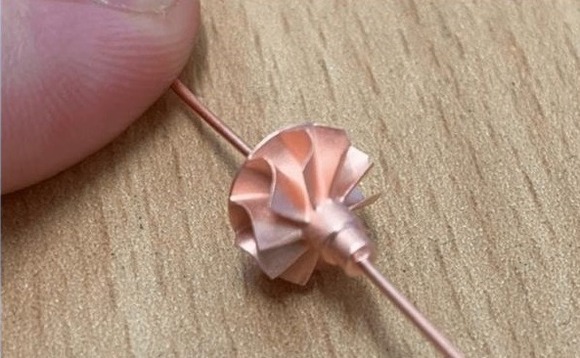

The technology comprises small needles – one injects a fluid designed to replace the tumour microenvironment and its components with healthy tissue and its partner removes the detritus. Each needle occupies a channel 100 micrometres (µm) in diameter and it must be placed no more than 40 µm from its partner. Micrometres, or microns, are one thousandth of a millimetre in length.

Imcomet relies on 3D printing systems developed by Boston Micro Fabrication (BMF) to manufacture the caps and lids that hold these needles in place. China and US-based BMF, which recently closed a USD 43m Series C round led by Shenzhen Capital Group (SCG), claims to be one of few companies globally proficient in microscale 3D printing systems.

"Most of these parts would otherwise be moulded or machined or produced through some other micro manufacturing technique. That's expensive. Standard injection moulding for plastic parts is well understood, but it becomes costly when producing very small parts because there is a need for glass-like surfaces and high tolerances," said John Kawola, CEO of BMF.

The concept of stereolithography – printing in three dimensions using photo-reactive resins and curing parts layer by layer – has been in existence for 30 years. BMF enables this to be done on a much smaller scale through projection micro stereolithography (PμSL), which leverages light and customisable optics, a high-quality movement platform, and controlled processing technology.

With printers capable of delivering products of 2 µm, 10 µm, and 25 µm, the time and cost savings associated with 3D printing now extend into areas that were previously inaccessible.

Manufacturers can receive prototypes for holes, pins, and walls of 10-20 µm within a day; they can generate shapes, geometry, and features beyond the capacity of moulding and machining; and there is no need to invest hundreds of thousands of dollars in tooling required for traditional production. However, BMF's solution doesn't make sense at massive scale.

You wouldn't 3D print 100m parts, the math doesn't work out," said Kawola. "But it does for tens of thousands of parts. If you are manufacturing specialty connectors for aerospace or specialty medical devices, these are high-value applications where the volumes are in the tens of thousands."

BMF was established in Shenzhen in 2016 by Nick Fang, a professor at Massachusetts Institute of Technology, and Xiaoning He, a serial entrepreneur. They were later joined by Chunguang Xia, a 3D printing expert. Early backers included SCG, Green Pine Capital Partners, Haitong Capital Investment, Shenzhen Mobile Internet Alliance Capital Partners, and Zhangjiagang Industrial Capital Investment.

The first customers, signed up in 2018 and 2019, were primarily Chinese universities and research institutes. The company still has a strong following in this segment. Researchers looking to 3D print carbon structures for customisable tissue engineering scaffolds and reservoir rock replicas that mimic a carbonite rock's natural mineralogy are among the case studies profiled on its website.

However, the customer base began to evolve when BMF was relaunched with a global strategy in 2020. Kawola was recruited to lead this effort. There are now 100 employees across Boston, Shenzhen, Chongqing, and Tokyo and approximately 250 customers have 3D printers installed at 300 sites globally. Original equipment manufacturers (OEMs) are the key users.

"Manufacturing is the main driver of our business, certainly in the US and Europe and in some parts of Asia," said Kawola. "A lot of customers are multinationals, with development centres in the US and Europe and manufacturing plants in Asia. Electronic connectors, medical devices, and optronics and photonics are their primary areas of focus."

The new funding will be used to accelerate R&D and product development. There is a general expectation that as 3D printing becomes faster and cheaper, the volume thresholds that limit the scope of BMF's business will rise. But increasing demand for customisation within manufacturing is an equally powerful force.

"The more a product can be customised, the more attractive it is for 3D printing. Just look at the dental industry. 3D printing is increasingly used for dentures, crowns, and clear orthodontic braces, and this makes sense because every part and every patient is different," Kawola said.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.