Asia logistics: Cost and complexity

Investment opportunities are expected to emerge as companies look to technology as a means of easing inflationary pressure on supply chains. Will Asia’s shallow pool of specialist logistics GPs deepen?

Marc Dragon found little in the way of precedent – within Asia or globally – when he was recruited to launch a logistics-focused early-stage investment firm in 2019. Corporates were responsible for the bulk of activity, making investments directly from their balance sheets or through captive VC structures, but these were often local pilot programs. It was rare to see anything formalised or elevated to global level.

Reefknot Investments, where Dragon serves as managing director, is a joint effort from Temasek Holdings and transport and logistics giant Kuehne + Nagel intended to fill this gap in the market. They were the anchor LPs in a USD 50m debut fund that has made half a dozen investments in start-ups committed to bringing digitisation to supply chains.

"There are sector specialists in areas like B2C and fintech, but few investors are familiar with supply chain and logistics in the traditional sense. And then few supply chain practitioners understand technology," said Dragon. "The challenge for investors is ascertaining what makes a good investment. Often what happens is they back cyclical trends, mistakenly thinking these are structural in nature."

Interest in supply chain technology among Asia's generalist GPs has been rising for several years, largely in synch with corporate demand for solutions that help mitigate costs or risks arising from greater operational complexity. In the past 12 months, these concerns have been exacerbated by supply shortages linked to pandemic-related shutdowns of factories and ports and to the war in Ukraine.

Supply chain resilience emerged as a priority last year, prompting companies to pay up for quick fixes. In recent weeks, though, soaring inflation has ramped up the cost pressure. While investors are not formulating strategies as a direct response to developments of uncertain severity and longevity, some observe that deployment will reflect the broader economic reality.

"If we are entering a period of stagflation, with weak demand on one side and supply shortages on the other, investment dollars will move from the demand side to the supply side," said Kay-Mock Ku, an ASEAN-focused managing partner at Gobi Ventures. "Technology can be applied to the supply side to counter inflationary pressure coming from supply shortages."

Last month, Gobi re-upped in Deliveree, a Southeast Asia mid-mile logistics marketplace it first backed in 2017 when capital was beginning to flood into the last-mile delivery space. If, as Ku suggests, investors look deeper into supply side opportunities, that ability to discern cyclical from structural will be tested.

It is telling that there are still no more than a handful of sector specialists operating in Asia. Moreover, three have similar origin stories: Eastern Bell Capital was co-founded by Zhiming Mei, also co-founder and CEO of warehouse operator turned logistics and infrastructure investment manager GLP; Starlight Capital is an early-stage spinout from Eastern Bell; and Hidden Hill Capital is GLP's private equity arm.

Such concentration – among a group of managers that primarily invest in China – is unusual, but it speaks volumes for the powerful knowledge and networking effects in supply chain and logistics. Domain expertise is invaluable in spotting new trends, while deep industry connections present opportunities to road-test ideas on the way to commercialisation.

One of the other sector specialists, EmergeVest, has a similar ethos. Most of its asset value is tied up in global forwarding business EV Cargo, and experiences accumulated through that buy-and-build process help guide separate VC investments. "It is an early-stage strategy focused on finding ways to participate in the digital transformation of the sector," said Heath Zarin, founder and CEO of EmergeVest.

Under the cosh

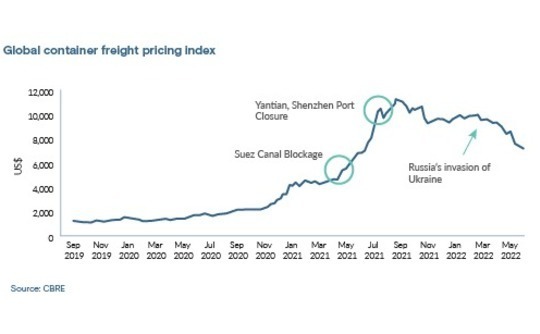

The pressure inflicted on supply chains is neatly captured by the upward trajectory of various datasets. For example, the Suez Canal blockage and the closure of certain Chinese ports in spring and autumn of last year saw the global container freight pricing index rise 150%. Even as it began to drop off earlier this year, inflation was accelerating. The IMF's 2023 projections, set at 3.9% for mature economies and 5.9% for emerging markets in January, were revised upwards to 5.7% and 8.7% in April.

Colour comes through individual anecdotes, not least at the PE portfolio level. "There are cost pressures on materials, which are very real. There are labour shortages, which are very real, and they are amplified into labour cost increases. And then there are transportation cost increases. You are getting hit from all sides," said Kyle Shaw, founder of ShawKwei & Partners, which has industrials exposure.

ShawKwei is also moving quickly to negotiate price increases with customers, which works in segments where companies enjoy pricing power. Shaw added that diversification is another compelling issue: customers in healthcare and automotive that want to locate new product platforms outside of China are willing to fast-track qualification for suppliers in markets like Southeast Asia.

This feeds into the concept of supply chain resilience, characterised by dual sourcing to ease dependency on markets like China amid geopolitical uncertainty and a desire to hold inventory – raw materials and finished goods – in reserve in case of further pandemic-style disruption. "The biggest supply chain cost is not having inventory available and missing out on a sale," said EmergeVest's Zarin.

For warehouse operators like GLP and ESR, there is a greater emphasis on the regional footprint and having more space in certain markets. However, Jeffrey Perlman, head of Southeast Asia and head of Asia real estate at Warburg Pincus, which seeded ESR and remains an investor, observes this doesn't necessarily increase costs as much as one might expect.

In the US, labour and real estate costs are both rising, which is forcing companies to maintain fewer facilities, use space more efficiently, and think about the role technology can play in that. Apart from markets like Australia and Japan, Asia is seeing comparatively less wage inflation, so there is less impetus to review approaches to logistics spending and warehouse vacancy rates are low.

"There isn't as much pressure on companies, whether they handle logistics directly or use third-party logistics providers," said Perlman. "Rent growth is starting to come through but it is easier to bear than in the US. And because they aren't getting hit on the wage side, they aren't thinking too much about what they do inside the warehouse, such as using more technology and fewer people."

Tiger Fang, co-founder and CEO of Kargo Technologies, operator of an online marketplace that matches shippers with truckers that have vacant capacity, makes the same observation of Indonesia. The more pressing concern is fuel prices, the largest cost component in transportation and logistics, which are expected to rise 40% this year as the government starts phasing out subsidies.

Most of Kargo's business is on a per drop basis – aggregating individual shipments into logical truckloads based on distance and time. Outsourcing fleet operations to maximise flexibility and reduce cost is a general trend, but there has been a surge in enquiries about switching from monthly to weekly rental, or from weekly to daily or from daily to hourly or per drop.

"Business has been doubling every quarter since the end of last year, and I think that as inflation rises, business growth will accelerate because people will want to reduce costs," said Fang. "There is a lot of uncertainty. Is everyone going to increase prices by 15-20%? And who really has the pricing power to pass it on to consumers? These will be big questions in the second half of the year."

Follow the dots

Kargo – a mid-mile specialist like Deliveree – closed a USD 31m Series A round in 2020, becoming one of relatively few Southeast Asia supply chain start-ups to surpass USD 30m. Fang observes that it wasn't long ago when freight forwarders struggled to attract USD 10m.

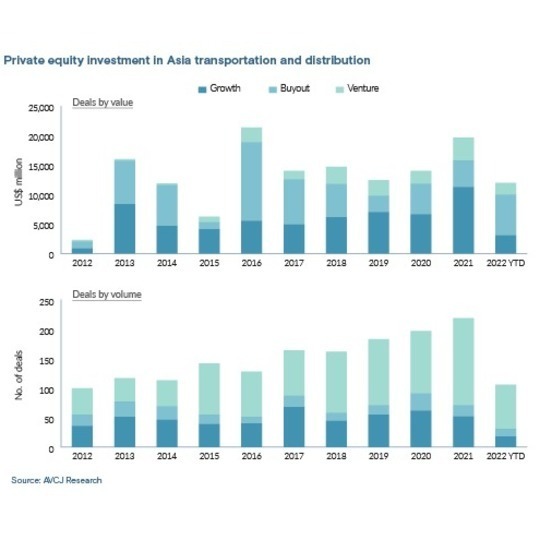

Overall private equity investment in Southeast Asia transport and logistics reached a record USD 25bn last year and USD 10.8 in the first six months of 2022. The sector is wide-ranging, stretching from ports to railroads to warehouses, and each year sees a few large buyouts.

However, the rise of VC activity is unmistakable, with USD 8.3bn deployed last year, more than 2019 and 2020 combined. Over USD 4bn was put to work in the first half of 2022. Of the 30 largest early and growth-stage rounds announced since 2012, 10 focused on last-mile services. Ninja Van and Flash Express were among the main recipients.

It is much the same for Asia as a whole, with USD 19.7bn deployed last year, the second-highest annual total to date, and then USD 11.9bn in the first half of 2022. Wider acceptance of technology is implied by a record USD 3.9bn going into venture deals. Last-mile is well-represented but as part of the broader trucking and courier services segment that accounted for 30 of the top 100 early and growth deals.

"We saw the biggest impediment to the growth of e-commerce a decade ago was a lack of modern warehousing space. The next challenge was last mile, how to get goods to consumers fast enough to compete against the peer group, and then it was trucks coming to warehouses full but leaving empty, so we invested in LTL platforms," said Perlman.

"After that, we started looking at robotics and efficiency in the warehouse, and now we're also doing broader distribution centres and last-mile logistics centres because delivery expectations have moved from 24 hours to 12 hours to 20 minutes."

Throughout, continued involvement with ESR has given Warburg Pincus insights into how these solutions play out on the warehouse floor. Although ESR and GLP are broadly comparable as real asset managers that move operational facilities from balance sheets into funds backed by third-party investors, they have different philosophies on ecosystem development.

A tale of two platforms

ESR wants to provide solutions that meet the evolving needs of customers, but it stops short of investing in those downstream technologies. Two years ago, the company established a future solutions group that brings together leasing and business development executives who share customer feedback and design professionals who think about how ideas can be integrated into current and future buildings.

Initiatives include a prototype warehouse in Japan that can make drone deliveries from the roof. Working with a Europe-based drone developer, ESR wants to launch test flights later this year of large-scale drones specialising in mid-mile delivery. The idea is to get ahead of regulatory reform in this area.

Renewable energy is another key theme, with ESR looking to increase solar rooftop capacity by 50% within three years. At the same time, warehouse interiors are being designed to accommodate charging stations for electric vehicles (EVs) and hydrogen refuelling capabilities. The company must also ensure it is up to speed on robotics and automation.

"A lot of facilities in China are already at a high level," said Michael de Jong-Douglas, a senior managing director at ESR who leads the future solutions group. "There are more multi-storey buildings, so you must work with the customer on that, on the implementation of conveyors and advanced robotics. The next step would be autonomous delivery, and you need local government cooperation for that."

GLP, meanwhile, supports these technologies as investor as well as strategic partner. The parent company divides its supply chain ecosystem into three layers: infrastructure; finance, energy, and materials; and business solutions. Hidden Hill occupies the upper two, targeting logistics services, digital supply chains, and technology enablement such as robotics and the internet of things (IoT).

The firm has USD 3.5bn in assets under management across renminbi-denominated VC and PE funds and a debut growth-stage US dollar fund. The latter vehicle, currently being raised, has a pan-Asia mandate.

"Around 80% of goods transported in China go by road and warehouses are the connecting point. As one of the largest logistics warehouse asset managers in China, we work with every large e-commerce player," said Xiaoyan Shu, head of investor relations and business development at Hidden Hill. "We see how e-commerce is changing and we invest in adjacent areas that are providing services to these e-commerce players."

Early investments included G7, an IoT fleet management platform that provides shipment tracking and related financial services. Inceptio, an autonomous driving technology developer specialising in line-haul trucking, spun out from G7 and was incubated by Hidden Hill and Nio Capital, an investment firm established by the founder of EV manufacturer Nio.

Hidden Hill claims to have leveraged its relationships in the original equipment manufacturer (OEM) space to hook up Inceptio with two of China's three largest truck makers and helped bring CATL, JD Logistics, and Meituan into a Series B round last year. Participation by strategic players served as an endorsement of Inceptio's technology and laid the ground for further investment from independent VCs.

In other instances, Hidden Hill introduces systems developed by portfolio companies into GLP warehouses and asks clients to try them out. One solution currently being tested by Lululemon and Uniqlo involves deploying robots at short notice during periods of peak demand.

Picking winners

Autonomous mobility and robotics are prevalent themes in supply chain investment because the potentially transformative impact they can have on cost. These segments are well-represented among the initial deals completed by Eastern Bell spinout Starlight, which is in the process of raising its first renminbi and US dollar funds.

Tang Tao, a managing partner at Starlight, points to line-haul trucking as an example. About 40% of the cost incurred by freight companies is driver salary. Deploying autonomous technology on routes of less than 12 hours means one driver can be used instead of two because they only need to take the wheel in urban areas. This represents a sizeable saving in an industry where the average gross margin is 10-15%.

However, economic logic is not necessarily uniform. In robotics, margins can be compressed by intense competition in the most standardised areas and demand for high levels of customisation elsewhere.

"Robotics and automation are well-recognised, but you need stable solutions, and it takes time for those to spread through the supply chain," said Tao. "Once you get into more complicated areas – where there are challenges around smooth implementation at peak times and how many AMRs [autonomous mobile robots] you can put into a limited space – margins can reach 50-60%."

Even among sector specialists, there is a wariness of technologies where the pay-off is long-term and it is hard to tell which of the incumbents will survive. At the same time, there are plenty of solutions that can deliver immediate change. Both EmergeVest's Zarin and Reefknot's Dragon are most excited about introducing digitisation and remote process automation (RPA) to traditional supply chain processes.

"Just look at customs clearance – it's very manual and data isn't standardised or shared," said Dragon. "There is so much low-hanging fruit, which can save time and resources, and improve customer service."

That combination of modern technology and traditional process arguably represents the biggest barrier to entry for generalist investors eyeing supply chain opportunities. While they might be familiar with technology-enabled disruption, it is difficult to contextualise the impact and plot timelines for how trends will play out across different markets without some domain expertise.

When asked what lurks on the horizon for the future solutions group, ESR's de Jong-Douglas identifies drone delivery as a medium-term opportunity, to be realised in 3-5 years. Beyond that, there is talk of hyperscale cargo trains that reduce hours-long journeys to minutes and underground warehouses in urban areas connected by tunnels. All have potential implications for technology providers.

Zarin notes that, when EmergeVest was established in 2013, supply chain and logistics was to some extent misunderstood. The firm's strategy was, in turn, labelled as infrastructure, asset-heavy, and real estate-only. The notion that it can be software – with a private equity-style return – took time to sink in, but the amount of capital now being deployed in digital supply chains suggest it has, he contends.

Greater recognition of the opportunity set will attract more mainstream investors and encourage more specialist strategies, following a pattern witnessed in other sectors. Rising supply chain costs and complexity, to the extent that corporates are willing to invest in solutions, could accelerate this trend.

"We know what problems traditional companies are facing and we know how new technologies may help solve those issues," said Starlight's Tao. "That increased focus on costs and cash flow will create a lot of investment opportunities for us over the next 5-10 years."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.