Trade sale

Deal focus: Indian cartoons poised for proliferation

NewQuest Capital’s acquisition of Cosmos-Maya from KKR-backed Emerald Media punctuates a crystallizing opportunity set in Indian animation. The next step is going global

Longreach buys pulp and paper industry supplier from Navis

The Longreach Group has acquired a majority interest in Amazon Papyrus Chemicals Holdings, a Hong Kong-headquartered chemical solutions provider to the pulp and paper industry, from Navis Capital Partners.

VC-backed Australia cloud business sold to US strategic

Panviva, an Australian cloud-based enterprise software provider backed by a number of venture capital investors, has been acquired by US counterpart Upland Software for about $23.3 million.

Quadrant buys Australia's Affinity Education from Anchorage

Quadrant Private Equity has acquired Australia-based childcare business Affinity Education from Anchorage Capital Partners for A$650 million ($490 million).

KKR buys controlling stake in India's Vini Cosmetics

KKR has agreed to pay $625 million for a controlling stake in Vini Cosmetics, a leading branded personal care and beauty products company in India.

Mercury exits Australia's MessageMedia via $1.3b trade sale

Australian mid-market GP Mercury Capital is on course to exit local B2C mobile messaging platform MessageMedia after Sweden-based Sinch agreed to acquire the company for $1.3 billion.

Deal focus: TEC goes back to the office

KKR and Tiga Investments have acquired Hong Kong’s The Executive Centre at a time when flexible office space is coming into focus, but expansion ambitions need to remain in check

Blackstone buys International Data Group from China Oceanwide

The Blackstone Group has agreed to acquire International Data Group (IDG) from China Oceanwide Holdings for an enterprise valuation of $1.3 billion.

Australia's CPE exits Cell Care to US strategic

Australian middle-market private equity firm CPE has agreed to sell cord blood banking business Cell Care to Generate Life Sciences, a US-based provider of cellular services for fertility and therapeutic purposes.

KKR, Tiga acquire Hong Kong's The Executive Centre

KKR and Tiga Investments have agreed to acquire Hong Kong office space provider The Executive Centre (TEC), facilitating exits for HPEF Capital Partners and CVC Capital Partners.

Tata buys majority stake in India's BigBasket

Tata Group has acquired a majority stake in India’s BigBasket, an online grocer backed significantly by Alibaba Group and several private equity investors. It has been valued previously at around $2 billion.

Vietnam middle market: Room for maneuver

There is a perceived sweet spot in Vietnam where check sizes are too big for local GPs and too small for pan-regionals. Taking advantage means addressing structural nuances and strategic competition

KKR invests $95m in India's Lenskart

KKR has invested $95 million in Indian eyewear retail leader Lenskart via a secondary transaction that facilitated partial exits of undisclosed size for TPG Growth and TR Capital.

Baring Asia exits SAI Global's assurance business

Baring Private Equity Asia is set to exit a significant part of Australia-based SAI Global, having agreed to sell the standards and assurance services business to UK-listed Intertek Group for A$855 million ($664 million).

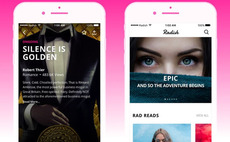

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

TA buys Singapore corporate services provider, EQT exits

TA Associates has acquired a majority stake in In.Corp Group, a Singapore-headquartered corporate services provider, facilitating an exit for EQT.

China's Mobvista acquires marketing business

Chinese digital marketing player Mobvista has acquired VC-backed local counterpart Reyun in a cash-and-stock transaction worth RMB1.5 billion ($232 million).

Warburg Pincus buys control of India's Parksons Packaging

Warburg Pincus has acquired a majority stake in India-based consumer goods packaging manufacturer Parksons Packaging, taking out positions held by Kedaara Capital, Olza Holdings, and IIFL Holdings.

Blackstone to cement control of India's Mphasis

The Blackstone Group is set to lift its controlling position in India-listed IT services provider Mphasis to 75% as part of a deal worth up to $2.8 billion.

Rising Japan exits staffing services business

Rising Japan Equity, a domestic private equity firm, has agreed to sell Progress, a staffing and contracting services provider, to listed staffing solutions business UT Group for JPY3.09 billion ($28.6 million).

Japan's J-Star partially exits jobs training service

Japan’s J-Star has exited a 20% stake in Aki-Japan, an employee training service provider for the local construction sector. It leaves the private equity firm with an 80% position.

Kakao spins out online fashion unit, buys VC-backed Zigzag

Korean internet company Kakao Corporation has spun out its fashion e-commerce business as an independent entity and merged it with Zigzag, a VC-backed local fashion marketplace.

Deal focus: Gobi sees 100x return on Airwallex

Gobi Partners became Airwallex's first institutional investor in 2016 due to a lack of support in the Australian company's home market. The GP made a partial exit in a recent Series D round at a valuation of $2.6 billion

Deal focus: Partners Group-backed IT play ripens early

Partners Group is set to generate a 5x return on the sale of its 45% stake in GlobalLogic to Hitachi as momentum in corporate digital transformation makes the IT services player a hot commodity