Australia's CPE exits Cell Care to US strategic

Australian middle-market private equity firm CPE has agreed to sell cord blood banking business Cell Care to Generate Life Sciences, a US-based provider of cellular services for fertility and therapeutic purposes.

The size of the transaction was not disclosed but the Australian Financial Review reported that it valued Cell Care at approximately A$200 million ($153 million). It still requires approval from the Australian Foreign Investment Review Board. CPE bought the business in 2018, reportedly paying an enterprise valuation of more than A$100 million.

This is the private equity firm's second announced exit in three months, following a deal to sell Gourmet Food Holdings, a local producer of crackers and biscuits, to US-based food multinational Mondelēz International. Both investments came from CPE's fourth fund, which closed at A$735 million in 2017. The GP typically targets companies with enterprise values of A$100-750 million.

The Cell Care parent company controls Cell Care in Australia, and Insception Lifebank, Cells for Life, and the Victoria Angel public bank in Canada. It is one of the top 10 players in the cord blood banking space globally with more than 200,000 cord blood and tissue samples currently in storage.

Cell Care claims to be Australia's largest family cord blood and tissue bank, having served parents of more than 35,000 babies over the past 10 years. Insception Lifebank enjoys a similar status in Canada, with the parents of 200,000 babies making deposits over a period of 20 years.

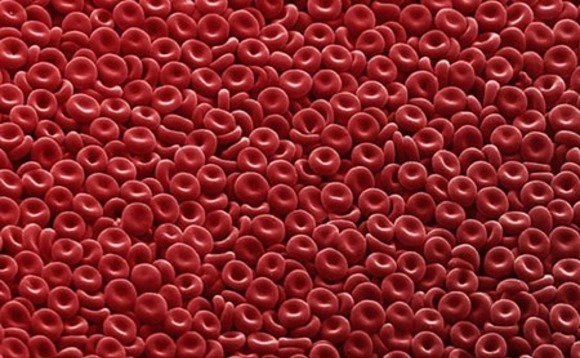

Stem cells derived from umbilical cord sources have numerous emerging clinical uses in regenerative medicine, given their anti-inflammatory, immune-modulating, and tissue reparative properties. Treatments for various conditions – including autoimmune disease, acquired neurological diseases, and lung disease – that rely on umbilical cord blood and tissue are in development.

Cell Care has supported clinical trials in Australia to investigate the impact of autologous cord blood in type-one diabetes and sibling cord blood in cerebral palsy. Most recently, it helped develop a cord blood trial for patients with COVID-19 respiratory complications.

Generate, which is owned by US mid-market buyout firm GI Partners, runs a stem cell bank with more than 900,000 newborn stem cell units, maintains catalogs of sperm and egg donors, operates IVF clinics, and provides DNA sequencing services that predict responsiveness to medication. The Cell Care acquisition will expand its footprint across three countries.

"We envisioned a truly global platform from which to offer our reproductive, genetic and stem cell services when we established Generate Life Sciences," said Richard Jennings, CEO of Generate, in a statement. "This acquisition is consistent with our strategic growth plan and reflects our enthusiasm for the next generation of newborn stem cell-based regenerative medicine therapies."

CPE – previously known as CHAMP Private Equity – has six Fund IV portfolio companies, including Cell Care. The others are defense industry supplier Marand Precision Engineering, shipping business StraitNZ, used car wholesaler Dutton Group, construction industry supplier Jaybro, and recycling business Banksmeadow Recycling.

It exited foreign exchange broker Pepperstone via a management buyout in 2018 and sold Singapore logistics software provider Containerchain to WiseTech Global the following year. Debt collector Panthera Finance is no longer mentioned on the CPE website. Last year, the company was reportedly seeking a growth capital round, part of which would have been used to take out CPE's minority position.

The private equity firm launched its fifth fund in the second half of 2019, targeting A$800-900 million.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.