Exits

PE-backed Chinese pop toy retailer pursues Hong Kong IPO

Pop Mart International Group, China’s largest fashion toy retailer, has filed for a Hong Kong IPO. Sequoia Capital China, Loyal Valley Capital and Huaxing Growth Fund are its three largest institutional backers.

China's Burning Rock Biotech files for US IPO

Burning Rock Biotech, a venture capital-backed, China-based provider of genetic testing services used in cancer diagnosis, has filed for an IPO in the US.

Advantage completes exit from Japan's FMI

Advantage Partners has completed its exit from Japanese kitchenware products manufacturer FMI Corporation to Toho Group, a Tokyo-listed food wholesaler that bought a majority stake in the business two years ago.

PE-backed Kintor Pharma raises $240m in Hong Kong IPO

Kintor Pharmaceutical, a Chinese drug developer backed by the likes of HighLight Capital and Shenzhen Green Pine Capital Partners, posted a 7% gain on debut following a HK$1.86 billion ($240 million) Hong Kong IPO.

Hong Kong ups disclosure requirements for biotech IPOs

The Hong Kong Stock Exchange has tightened disclosure requirements for companies looking to take advantage of two-year-old reforms permitting listings by pre-revenue biotech companies.

UAE's EMPG acquires Rocket-backed Lamudi Global

EMPG, a real estate classifieds marketplace group headquartered in the United Arab Emirates, has acquired Lamudi Global, which runs property market portals in the Philippines and Indonesia.

China last-mile delivery platform files for US IPO

Dada Nexus, a Chinese last-mile delivery platform backed by the likes of JD.com, Walmart, Sequoia Capital China, and DST Global, has filed for a US IPO.

Everstone sells Asia payroll business to US strategic player

India and Southeast Asia-focused private equity firm Everstone Group has agreed to sell Singapore-headquartered human resources software provider Excelity Group to US peer Ceridian. The size of the deal has not been disclosed.

Cashlez gains on debut after Indonesia IPO

Indonesian mobile point-of-sale solution provider Cashlez - a portfolio company of Mandiri Venture Capital - traded up on debut following an IDR87.5 billion ($5.7 million) domestic IPO.

China's Kingsoft Cloud files for US IPO

Kingsoft Cloud, China’s largest independent provider of cloud-based IT services, has filed to list in the US. Kingsoft Corporation and Xiaomi, the two largest shareholders, have indicated they will commit $75 million to the offering.

Go-Jek completes acquisition of VC-backed Moka

Indonesia’s Go-Jek has completed its acquisition of Moka, a local financial technology provider with several VC backers, in a deal estimated to be worth $130 million.

Coronavirus thwarts PE partial exit from Indonesia's BFI Finance

Italian lender Compass Banca has abandoned its purchase of a 19.9% stake in Indonesia’s BFI Finance from TPG Capital and Northstar Group, citing economic disruption created by the coronavirus outbreak.

Baring Asia restructures retailer Cath Kidston

Baring Private Equity Asia has agreed a restructuring of Cath Kidston, a UK lifestyle retailer it has backed since 2014, under which the company has entered administration and will reemerge as a smaller business.

Akeso Biopharma trades up after $333m Hong Kong IPO

Akeso Biopharma, a private equity-backed Chinese drug developer specializing in treatments that use the immune system to fight cancer, saw its stock jump 50% in early trading on the Hong Kong Stock Exchange following a HK$2.58 billion ($333 million) IPO....

Hong Kong's 8 Securities acquired by US player

8 Securities, a Hong Kong-headquartered app-based brokerage, has been acquired by SoFi, a financial technology company based in the US.

Carlyle achieves partial exit in India's Metropolis Healthcare

The Carlyle Group has sold 6.5 million shares of Metropolis Healthcare for INR7.5 billion ($98.7 million) to exit nearly its entire position in the Indian medical diagnostics chain.

Blackstone-owned Burger King NZ enters receivership

The Burger King New Zealand franchise, which was acquired by The Blackstone Group for NZ$108 million ($86 million) in 2011, has been placed into receivership.

HighLight-backed Zentalis raises $165m in US IPO

Zentalis Pharmaceuticals, a US-based cancer drug developer, raised $165.2 million in its NASDAQ IPO, facilitating a liquidity event for Chinese healthcare investment specialist HighLight Capital.

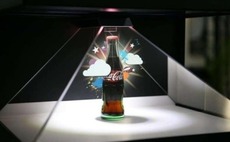

VC-backed Chinese AR start-up raises $26m in US IPO

WiMi Hologram Cloud, a PE-backed Chinese augmented reality (AR) technology developer, traded flat on its opening day on NASDAQ following a $26.1 million IPO.

Deal focus: Carlyle's SBI Cards bet pays out

The Carlyle Group achieved an 8x return through a partial exit via SBI Cards’ IPO. The private equity firm still holds a 16% stake and is a resolute believer in the growth potential of India’s credit card market

Australia's Carnegie exits Assetic in PE-backed bolt-on

Australian VC investor MH Carnegie has exited asset management software specialist Assetic to Dude Solutions, a similar private equity-owned company in the US.

Coronavirus & secondaries: Niche dilemmas

Anecdotal feedback from secondaries professionals reveals a quick onset of stagnation in the market due to COVID-19. Creative workarounds are not impossible, but almost

AVCJ Awards 2019: Operational Value Add: EuroKids International

Gaja Capital put its India buyout philosophy to the test with EuroKids International in 2013. Operational improvements – and a lucrative exit – have vindicated the approach

Australia's PE-owned Tigerlily enters administration

Tigerlily, an Australian swimwear brand acquired by Crescent Capital Partners in 2017, has entered administration following a collapse in sales attributed to the COVID-19 outbreak.