VC-backed Chinese AR start-up raises $26m in US IPO

WiMi Hologram Cloud, a PE-backed Chinese augmented reality (AR) technology developer, traded flat on its opening day on NASDAQ following a $26.1 million IPO.

It is said to be the first successful public offering on a US exchange since the World Health Organization designated the coronavirus outbreak a pandemic. According to AVCJ Research, this is only the fourth US IPO this year by a financial sponsor-backed Asian company, with the other three completed by mid-February.

Across the region, only $3.8 billion was raised from 30 PE-backed offerings in the first three months of 2020. The SBI Cards IPO in India accounted for over one-third of the total. In the final quarter of 2019, there were more than 50 offerings and the cumulative proceeds came to $11.3 billion.

WiMi sold 4.75 million American Depository Shares (ADS) for $5.50 apiece. The company originally planned to sell 5 million shares at $5.50-7.50. The stock opened at $5.45 on April 1 and dropped as low as $4.77 during morning trading before closing at $5.50.

UOB Venture Management is only significant private equity shareholder in WiMi, having invested in 2018 through its ASEAN China Investment Fund IV. The vehicle, which launched the same year with a target of $500 million, makes growth investments in small and medium-sized enterprises, primarily in Southeast Asia and China.

The prospectus indicates that WiMi received $20 million in Series A funding in November 2018. The number of shares issued – 8.6 million – is equal to the number held by UOB. The investor holds 8.8% of WiMi's class B shares, which translates into a voting interest of 2.9%. Jie Zhao, the company's founder and chairman, has more than 80% of the voting power by virtue of the dual class share structure. Zhao previously established Weixun Yitong, a mobile internet platform in China.

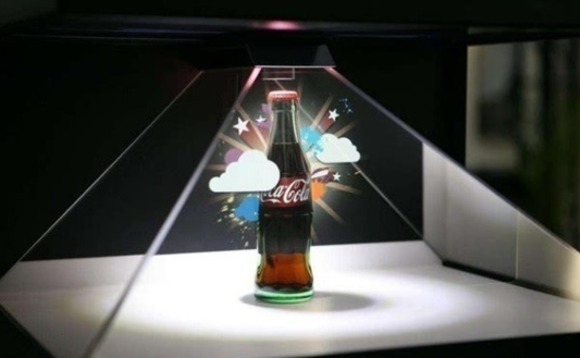

WiMi generates the bulk of its revenue from holographic AR advertising software that allows users to insert real or animated 3D objects into video footage. These ads are embedded into films and shows hosted by online streaming platforms in China. In 2019, ads produced by the company generated 9.7 billion views, up from 6.6 billion a year earlier. It had 153 customers and generated RMB1.7 million in average revenue per customer.

A second business line focuses on holographic AR entertainment products. This category primarily comprises payment middleware software that connects mobile apps to a variety of payment channels, enabling in-app payment. WiMi's middleware has been embedded into more than 1,100 marketed mobile apps launched by over 300 customers. Most of these apps have AR functions.

According to Frost & Sullivan, China's AR holographic market will generate RMB454.8 billion ($65 million) in revenue by 2025, with advertising and entertainment accounting for 31.6% and 39.6%, respectively. Industry revenue came to RMB3.6 billion in 2017.

WiMi acknowledged that the coronavirus outbreak would likely have an adverse effect on business, noting that online advertising budgets might be reduced and that some customers may have difficulty paying for services. Some have already asked for deadline extensions, though to date no contracts have been terminated.

However, UOB believes WiMi is well-positioned to ride on the increasing use of AR technology. "Given the impact of the COVID-19 pandemic, more companies are reviewing their business models and are adopting greater use of technology, such as enterprise SaaS [software-as-a-service] solutions," said Seah Kian Wee, a managing director and CEO of UOB Venture Management.

WiMi posted RMB319.2 million in revenue last year, up from RMB225.3 million in 2018. Over the same period, net income rose from RMB89.2 million to RMB102 million.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.