Articles by Tim Burroughs

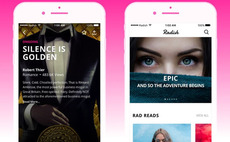

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

EQT backs Indonesia flavors, fragrances player

Product innovation and geographic expansion are on the agenda for Indonesia-based flavors and fragrances (F&F) provider Indesso Group following EQT’s acquisition of a minority stake in the business.

China self-driving truck start-up agrees $3.3b SPAC merger

Plus, a China-based autonomous driving technology developer that specializes in trucks, has agreed to merge with a special purpose acquisition company (SPAC) at a valuation of $3.3 billion.

Deal focus: L Catterton backs Social Bella to emulate Perfect Diary

Social Bella has risen to prominence in Indonesia as an omnichannel distributor for other beauty brands, but the start-ups is now developing some of its own. L Catterton is backing this diversification drive

Deal focus: The e-commerce agglomeration effect

Inspired by Thrasio buying up e-commerce brands in the US and using its resources to drive growth, Una Brands wants to do the same in Asia. The start-up has secured $40 million to kick-start this effort

Deal focus: Bibit lays claim to be Indonesia's Robinhood

A couple of quickfire funding rounds for Bibit reflects global investor appetite for robo-advisory businesses and the Indonesian company’s rare double-headed product offering

Nordstar, Insignia back Asia Amazon marketplace consolidator

Southeast Asia has seen its second e-commerce aggregator investment in a matter of days, with Rainforest securing $36 million in seed funding from Nordstar and Insignia Venture Partners.

KKR relaunches IPO bid for Australia's Pepper

KKR has returned to the market with Australia-based mortgage and asset finance lending business Pepper Money – a year after a previous IPO failed to get traction – seeking to raise up to A$500.1 million ($394 million).

Carlyle makes $536m realization from India's SBI Life

The Carlyle Group has sold more than two-thirds of its remaining stake in India-listed life insurance company SBI Life for approximately INR39.4 billion ($536 million) via a bulk transaction.

China's ANE Logistics files for Hong Kong IPO

ANE Logistics, a Chinese road freight transportation business backed by Centurium Capital, CDH Investments, and CPE among others, has filed for a Hong Kong IPO.

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.

TA buys Singapore corporate services provider, EQT exits

TA Associates has acquired a majority stake in In.Corp Group, a Singapore-headquartered corporate services provider, facilitating an exit for EQT.

Asia brand aggregator raises $40m

Una Brands, an aggregator of e-commerce brands with a presence across Asia, has launched with A$50 million ($40 million) in seed funding from 500 Startups, Kingsway Capital, 468 Capital, Presight Capital, and Global Founders Capital.

Apollo offers $3.1b for Australia sports betting business

Apollo Management has submitted a A$4 billion ($3.1 billion) bid for the wagering and media and gaming services businesses of Tabcorp Holdings, Australia’s largest gambling company.

Yale's David Swensen dies aged 67

David Swensen, head of the Yale University endowment who pioneered a new approach to institutional investment management, has died aged 67 following a long battle with cancer.

DCP, Sequoia lead Series B for China's Valgen Medtech

DCP Capital has continued its run of investments in China’s medical devices industry by participating in a Series B funding round for Hangzhou Valgen Medtech.

CVC, CDPQ carve out China ad agency's global portfolio

CVC Capital Partners and Caisse de dépôt et placement du Québec (CDPQ) have agreed to acquire a majority stake in the international business of China-based advertising and marketing agency BlueFocus Group at a valuation of $350 million.

Blackstone appoints leadership for Asia PE business

The Blackstone Group has moved Amit Dixit and Ed Huang into leadership positions in its Asia private equity business as part of a round of promotions within the division globally.

CBC Group founder backs healthcare-focused SPAC

Wei Fu, the founder and CEO of Asia-focused healthcare investor CBC Group, has launched a special purpose acquisition company (SPAC) to pursue deals in the sector.

Ocean Link joins consortium pursuing 51job take-private

DCP Capital Partners has enlarged the consortium seeking to acquire Chinese online recruitment services platform 51job with the addition of Ocean Link Capital and the target company’s CEO.

Asia technology: Anatomy of a rebound

Tech investment has been on a tear in Asia, with private equity joining venture capital at the party. While COVID-19 has contributed to these dynamics, the revival is rooted in deeper structural change

Quadrant returns to Australia's pet services space

Quadrant Private Equity has ventured into the pet services space for a third time with the acquisition of a majority stake in Australian pet food manufacturer Prime100.

Ince seeks $450 million for second China VC fund

Ince Capital is preparing to launch its second China venture capital fund with a target of $450 million, less than 18 months after closing its debut vehicle.

Korea's IMM makes debut credit investment

IMM Private Equity has made the first investment under its newly launched credit strategy, picking up a 40% stake in SK Lubricants, which is controlled by Korean conglomerate SK Group, for KRW1.09 trillion ($984 million).