Asia technology: Anatomy of a rebound

Tech investment has been on a tear in Asia, with private equity joining venture capital at the party. While COVID-19 has contributed to these dynamics, the revival is rooted in deeper structural change

Biren Technology is the hot ticket at the center of a hot trend. Technology investment in China – at the early and growth stages – reached $31.7 billion last year, shrugging off the impact of COVID-19 as other sectors struggled. Capital deployed in the semiconductor space alone rose 20-fold, driven by China's desire to create a swath of domestic leaders that can ease its export dependency.

Chip design is a popular area among investors because it has high technology content and low capital intensity. However, it is also talent scarce. Biren, founded by Wen Zhang, a former president at artificial intelligence specialist SenseTime who has built a strong technology team around him, capitalized on these dynamics to raise $285 million across two rounds. A third closed in March at $410 million. The two-year-old company has yet to release a product.

"Only two companies with operations in China have done GPUs [graphics processing units] for servers, Nvidia and AMD. For GPUs embedded in mobile phones, it's only HiSilicon [owned by Huawei Technologies] and Qualcomm. And then only AMD and Huawei have R&D in China, so everyone looks there for engineers," says Guang Yang, founding partner of Glory Ventures. "Start-ups rely on fundraising to attract these talents, and then they rely on stock options and rising valuations to motivate them."

Another investor in Biren recalls that Zhang had a list of 10 potential recruits in 2019 and it was thought he would be lucky to get three. Within a year, there was a core team of 12, including three top executives from HiSilicon. Biren has since won backing from the likes of Qiming Venture Partners, IDG Capital, Walden International, Hillhouse Capital, Source Code Capital, and Gaorong Capital.

Similar feeding frenzies have emerged around other chip design start-ups. Nvidia spinout Moore Threads, for example, has raised several billion renminbi across two rounds despite being barely six months old. It is an extreme representation of an increasingly pervasive market trend: capital gravitating to early-stage rounds in search of alpha, to the point that the line between venture and growth – and the risk-reward that typically separates them – becomes blurred.

"We used to be comfortable going into Series C rounds, but the pace of fundraising has recently picked up so much we are probably Series D now," says Wanlin Liu, a China-based managing director with The Carlyle Group. "Many start-ups are raising lots of money in the Series A and B, but for us it's more a matter of risk profile – and whether we have the expertise and experience to evaluate the risk – rather than about check size."

Back with a bang

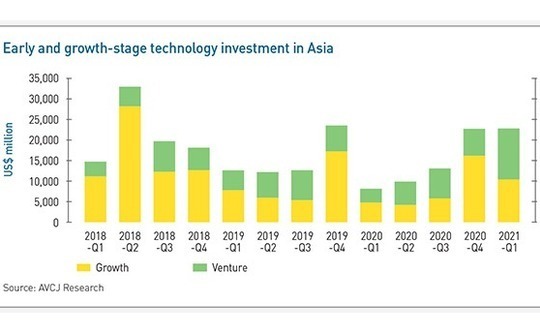

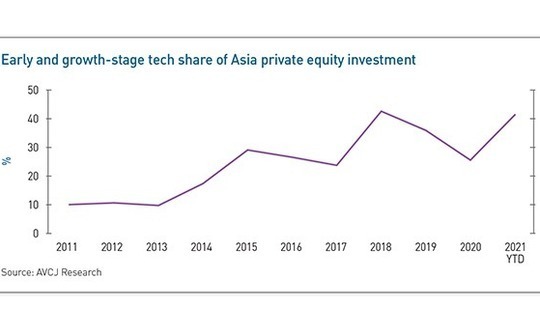

Since the middle of last year, the pace of fundraising has been relentless. Having fallen to $8.1 billion in the first quarter of 2020, Asia technology deal-making rebounded to $22.5 billion in the last three months of 2020 and the same again in the first three months of 2021. This compares to a quarterly average of $15.1 billion in 2019. Nearly 60% of the capital deployed in the past six months has gone into growth-stage rounds, according to AVCJ Research.

The impact is exacerbated by how other sectors have lagged. Of every $100 put to work in Asia private equity in the fourth quarter, $31 targeted technology deals. This rose to $39 in the first quarter of 2021. The latter level hasn't been seen since the previous growth-stage surge in 2018. These data do not include biotech, which is small compared to technology but on a rapid ascent.

"Several industries have really benefited, like online education, food delivery, and online healthcare. The profitability model has yet to be proven, but many people are investing," says Karen Zhang, who leads tech investing for KKR in China. "In enterprise services, it has become easier to convert clients into paid users, while in hard tech people are realizing that semiconductors, autonomous driving, and electric vehicles could be high momentum now for a very long-term play after consumer internet."

Ample liquidity is another factor. There were more than 300 IPOs by private equity-backed companies in 2020, which generated proceeds of $56 billion – the second-highest annual total on both counts. The technology sector accounted for about one-quarter of each. Already in 2021, 93 companies have raised $25.9 billion, with tech players responsible for one-third of the offerings and 60% of the proceeds. Some companies have seen their stock prices double in the past 12 months.

"The flood of IPOs has definitely made people more comfortable with high-cash-burn companies and later-stage tech deals," says J.P. Gan, founding partner of Ince Capital. "We are used to seeing the likes of Tiger Global, General Atlantic and Warburg Pincus in these rounds but increasingly see Blackstone, KKR, and Carlyle as well. And they are moving earlier. They used not to do anything less than $300-400 million, but now they will sometimes do sub-$100 million."

For many LPs, technology is behind the strong returns they have experienced in the past 18 months, with one investor suggesting it might explain 50% of his portfolio's outperformance. Yar-Ping Soo, a partner at Adams Street Partners, observes that her China growth managers have done well historically, delivering fund-level returns of 3x or more. But the desire to maintain these levels has prompted a transition from cash-positive companies in traditional industries to tech start-ups.

ClearVue Partners is perhaps a case in point – a consumer-focused growth manager with a portfolio that spans e-commerce, autonomous driving, online education, wellness, and lifestyle brands. William Chen, one of the firm's founding partners, defines the strategy as investing in companies reaching a growth inflection point. He acknowledges that the entry point might be a bit earlier for technology than for traditional businesses.

"You're seeing large private equity firms going into earlier growth-stage deals and venture capital firms doing later-stage investments, so it's becoming blended," Chen says. "It can be riskier for firms that don't have that DNA to make those types of investments. That's why we believe that sector specialization is important to understand the market you're investing in and mitigate the risk."

A matter of timing

Several larger GPs have sought to bring in people with the relevant experience and networks. KKR has a seven-strong Asia growth equity team that works alongside professionals from different strategies across the region. The firm is now deploying its second global technology growth fund, which makes investments of up to $300 million, mostly Series C onwards. That fund isn't active in Asia, but a dedicated Asia tech vehicle is imminent.

To date, most growth-stage technology investments have come out of KKR's main pan-regional funds. Carlyle does have separate Asia growth and buyout vehicles, but larger transactions go into the latter. It creates a curious dynamic – not limited to KKR and Carlyle – whereby funds generally associated with buyouts and value creation are increasingly going into minority deals in which access, financial resources, and comfort with elevated valuations are the main differentiators.

This is still happening on the margins, but the returns are so tempting investors are unable to resist. Baring Private Equity Asia has made several growth-stage investments from its seventh pan-regional fund, which closed in 2019 on $6.5 billion. The IRR is currently above 50%, thanks in part to online-to-offline healthcare services platform JD Health. Baring joined a $1 billion funding round in 2019 at a valuation of $7 billion. JD Health went public last year and is worth $49 billion.

Several Chinese companies responsible for some of the most in-demand Hong Kong and US IPOs over the past year raised capital in the 12 months prior to going public. Boyu Capital and Temasek Holdings make late entries into video-sharing platform Kuaishou; Primavera Capital Group, Coatue Management, Hillhouse Capital, and Mubadala Investment joined rounds for electric car maker Xpeng; and Carlyle and Warburg Pincus led a group into cosmetics brand Perfect Diary.

Wellington Management, which backs companies of sufficient scale to make an IPO likely within a few years, invested in Coupang in late 2014 at a valuation of $2 billion. Michael Carman, a partner and co-head of private investments at the firm, credits Vision Fund as a difference-maker. It was "the right amount of capital at the right time with a management team that could execute." However, if one element of this trifecta is lacking, the consequences can be severe.

"Capital is no guarantee of victory, it takes more than that – you need the supply and the demand side to mature at a comparable rate," Carman says. "When that doesn't happen, too much capital can be deadly, and it can destroy the economics of a sector. We saw that in ride-sharing globally."

This is a reference to the intense rivalry between Grab and Lyft in the US, characterized by substantial capital-raising activity that fed subsidies aimed at winning market share. It only really abated when both companies went public and rationalized their business models, leading to improved pricing and unit economics. Similar scenarios played out – or are still playing out – in different Asian markets. In the absence of IPOs, consolidation has often been the cure.

Getting comfortable

Asked where a growth strategy is most likely to go wrong, investors point to two factors: the management and the market. To this end, before committing, they want to see a fully formed senior management team led by a founder who can define the corporate culture and scale the business. The business model should be commercially proven, thereby minimizing product risk, and it helps if a company is an established market leader or an emerging player with a clear competitive edge.

Unit economics are also scrutinized to plot a path to profitability. "Positive cash flow is helpful but not key. We look at why a company is losing money and whether the business model works," says Carlyle's Liu. "If customer acquisition costs can be recovered, customer retention is good, and the margin is good, then burning cash to acquire customers this year is okay because those customers become recurring revenue next year. We look for them to recover most of the sales and marketing costs within one year of acquiring new customers, but that doesn't mean they must be profitable."

Industry participants note that the expansion of investment activity beyond consumer-facing businesses means user subsidy-driven models are not so prevalent. Moreover, COVID-19 has altered the commercial landscape. Even in areas like online education, where the battle for market share is brutal, rapid uptake in 2020 has made investors more comfortable with the industry outlook.

Nevertheless, market risks still lurk in the background. Growth-stage players have thrown their weight behind market leaders in online education, but consolidation, rationalization, and improved unit economics might not happen at the speed or to the extent required. Sudden changes in regulation or the emergence of new competitors backed by established internet giants could also disrupt certain segments.

Wellington's Carmen points to India a few years ago as a market where investment outpaced the opportunity set. "A lot of people went in with a China playbook and they didn't appreciate that the Indian market is materially smaller than the Chinese market, so applying all that capital wasn't the difference-maker they had expected. It's going to take more time. Too many players and too much capital went into a bunch of companies and it didn't turn out well," he says.

Now, though, he believes the market has rebalanced and some growth-stage winners are emerging. Food delivery platforms Swiggy and Zomato, for example, have each raised around $1.5 billion and Zomato recently filed for a domestic IPO. Wellington is an investor in Swiggy. Meanwhile, Reliance Industries raised $26 billion from financial and strategic investors last year for Jio Platforms and Reliance Retail, which are pushing a consumer digitalization agenda. Both are expected to go public.

"In India and Southeast Asia, there aren't many good data points yet around IPOs, but our hypothesis is that's about to change," adds Lucian Schöenefelder, head of technology investing in Asia at KKR, an investor in Jio Platforms and Reliance Retail as well as Southeast Asia start-ups like Gojek and PropertyGuru. "We expect the IPO route to mature over the next 2-3 years."

Magic number

If the combination of investment opportunity and sightline to liquidity is attracting more growth-stage capital into Asia, the question for start-ups is how much they should raise. Trax, a Singapore-headquartered retail industry technology provider, went through this process earlier in 2021 with its Series D round. The company targeted $100 million but ended up closing on $640 million with Vision Fund and BlackRock taking the lead.

According to Joel Bar-El, the company's founder, the Series D was intended to see Trax through to IPO on its current operational path. Raising more capital meant some early investors could exit, while allowing for greater flexibility on the timing of the listing.

"No one knows exactly when the IPO will be and don't want to be waiting on it and nearing the end of our cash. We thought we should have more funds as a contingency because we don't know what will happen with COVID-19. At the same time, we can develop faster, do more innovation, and accelerate M&A," he says. "Taking more is fine, but there are limits. You have to think about how much you are diluting yourself."

Others endorse such an approach. Wellington's Carmen adds that start-ups should ensure they have a broad investor base as well as cash in reserve. Relying on one or two big-ticket backers who dominate the round is fraught with risk because they may sour on the deal, leaving the start-up in a position of weakness when trying to raise capital from new investors at relatively short notice.

Preparing for the worst was top of mind for Plus, a China-based developer of autonomous driving technology for trucks, on closing a $220 million round in April led by FountainVest Partners and ClearVue. It came two months after a $200 million commitment featuring CPE. Wen Han, the company's CFO, tells AVCJ that he is mindful of the need to accumulate capital ahead of an expected economic slowdown. "We must take advantage of the excessive liquidity of the market," he explains.

Plus had not planned to raise so much money but simply responded to investor demand. Plenty of other Chinese start-ups are doing the same, resulting in funding rounds that roll on for many months. They appear to be sacrificing a significant uptick in valuation between formal rounds by opting to raise a single round across several tranches with more modest valuation appreciation.

Community group buying platform Nice Tuan secured nearly $500 million across three Series C tranches last year, closing the first in January and the last in December. Autonomous driving specialist WeRide's $310 million Series B was also across split across three tranches, while there are numerous examples of start-ups opting for two, often reasonably spread out, tranches. Grab and Gojek previously embarked on similar endeavors, though on a larger scale, in Southeast Asia.

There are various reasons for this incremental approach, from market education and initial difficulties getting traction with investors to accommodating excess demand and avoiding painstaking negotiations over terms and board seats. The cynical view is that they are sucking up as much capital as possible simply because they can.

Some investors are unhappy with this habit, arguing that big jumps in valuation are important to venture capital firms looking to market their own performance. Others are more equivocal. They appreciate the flexibility it brings to fundraising but worry about loss of focus. "Fundraising is usually tied to certain milestones," says ClearVue's Chen. "If you are perpetually fundraising, you may not reach these milestones because you aren't stretching yourself to reach the next level."

Here to stay?

It remains to be seen how long this phenomenon persists. To some extent, the frenetic activity of the past six months represents the satisfaction of pent-up demand for capital after start-ups delayed funding rounds earlier in 2020. On the investor side, Hao Li, a managing director at Chinese advisory firm Lighthouse Capital, observes that some groups have indicated internally that they will slow the pace of the deployment in the second half of the year.

Late-stage valuations are also inextricably linked to public markets, so any volatility created by broader macro developments might stymie investors.

However, few industry participants challenge the longer-term rationale that underpins most early and growth-stage technology investment: the digitalization of economies and the disruption of legacy industries. KKR's Schöenefelder sees no change here, although he does allow for "the aggressiveness and the amount of capital going into tech and thus in valuation levels," which may discourage hedge funds. "I could see that change if the environment changes," he says.

Should the structural trend outweigh the cyclical one, more later-stage capital is likely to be drawn to the sector. This places the onus on larger private equity firms to continue building out specialist teams that can handle coverage that differs markedly from traditional PE in terms of scope, metrics, and modeling. Dedicated Asia technology funds might also become a feature of the market, allowing greater flexibility in deployment, and disentangling mandates and exposures that already overlap.

"LPs used to have sub-sector allocations to early-stage venture, late-stage venture, buyout," says Soo of Adams Street. "Now maybe they are getting exposure to the same companies but across the spectrum. It's a lot more blurred in terms of asset allocation. I think this is unique to Asia, but LPs are okay with it for now because there have been so many success stories."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.