Articles by Tim Burroughs

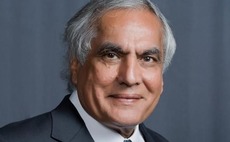

India PE stalwart Ajay Relan dies aged 67

Ajay Relan, one of the pioneers of private equity in India, has died at the age of 67.

EQT recruits Japan private equity head from JPIC

EQT has hired Tetsuro Onitsuka, formerly of Japan Post Investment Corporation (JPIC) and TPG Capital, as head of Japan private equity as it continues to build out a local presence in the country.

Carlyle buys Japan advertising business

The Carlyle Group has completed its acquisition of Japanese advertising content provider AOI TYO Holdings follow a tender offer that valued the Tokyo-listed company at JPY21.4 billion ($191 million).

Ex-Quadrant executive launches consumer-tech PE firm

Justin Ryan, who previously led Quadrant Private Equity’s growth capital strategy, has established a private equity firm that will back e-commerce platforms and consumer brands in Australia and New Zealand.

TPG, Potentia pursue Australia's Smartgroup

TPG Capital and Potentia Capital have submitted a buyout offer for employee management services provider Smartgroup that values the Australia-listed business at a market capitalization of A$1.38 billon ($993 million).

AVCJ daily bulletin returns October 4

AVCJ's daily bulletin will not be published on October 1 due to the public holiday in Hong Kong marking China's National Day.

EQT backs cybersecurity training business

EQT has invested in EC-Council, a cybersecurity training and certification business established by a Malaysian entrepreneur, through its Asia mid-market fund.

Deal focus: Southeast Asia's four-trick credit pony

Advance Intelligence Group has used its core risk assessment technology to expand into lending and e-commerce transaction finance and services. Membership of Southeast Asia’s unicorn club is its reward

GP profile: Advent Partners

Having spent the first half of the last decade undergoing a renewal in terms of leadership and strategy, Australia’s Advent Partners believes it has emerged stronger, smarter, and more focused on the future

PAG backs China AI investment management start-up

PAG has led a $100 million round for DataYes, a China-based provider of artificial intelligence-enabled investment management solutions for the financial services industry.

Lee Fixel's Addition backs India-based Delhivery

Addition, a private equity firm established by Lee Fixel, who was previously involved in many of Tiger Global Management’s early India deals, has invested $125 million in local e-commerce logistics provider Delhivery.

GM invests $300m in China autonomous driving player Momenta

General Motors (GM) has entered China’s autonomous driving industry with a $300 million investment in Momenta, a local developer of sensor technology.

China's Broncus raises $215m in IPO, struggles on HK debut

Broncus Holding Corporation, a China-based manufacturer of medical devices used to treat lung diseases, plunged 12.8% on its Hong Kong trading debut following a HK$1.67 billion ($215 million) IPO.

Riverside exits Japan bicycle business to Daiwa

The Riverside Company has sold Japan-based bicycle retailer Y International to domestic private equity firm Daiwa PI Partners for an undisclosed sum.

Brookfield's Asia head joins CapitaLand's fund management arm

Patrick Boocock, a managing partner at Brookfield Asset Management who led the firm’s investment and asset management activities in Asia, has moved to newly listed CapitaLand Investments (CLI).

SoftBank, Warburg Pincus back Singapore's Advanced Intelligence

Advance Intelligence Group, a Singapore start-up best known for digital identity verification and fraud prevention platform Advance.AI and buy now, pay later (BNPL) business Atome, has raised over $400 million in Series D funding.

Platinum sells Singapore's PCI for $306m

Platinum Equity has agreed to sell PCI, a Singapore-headquartered electronics manufacturing services provider it acquired in 2019, to US-listed Celestica for $306 million in cash.

True North exits India's RDC Concrete after 16-year hold

True North has agreed to sell India-based RDC Concrete, a company it has owned since 2005, to private equity-backed online construction marketplace Infra.market.

India's Freshworks flourishes on NASDAQ debut

Freshworks, one of India's leading software-as-a-service (SaaS) businesses, traded strongly on its NASDAQ debut following a $1 billion IPO.

FountainVest buys New Zealand pet food business

China-focused private equity firm FountainVest Partners has agreed to buy Ziwi, New Zealand’s leading exporter of pet food.

China warehouse robot supplier secures $200m

Hai Robotics, a China-based manufacturer of robots used in warehouses, has raised approximately $200 million across two funding rounds.

ESG best practice: From global to granular

The value creation-driven PE playbook on ESG in Asia converts marginal gains into big picture policy wins – provided investors focus on the right areas and the flow of information isn’t stymied

Singapore plans pre-IPO fund to attract listings

Singapore’s EDB Investments (EDBI) will establish a pre-IPO fund – with an initial commitment of S$500 million ($370 million) – that is intended to encourage high-growth companies to list in the city-state.

Partners Group backs continuation vehicle for Korean restaurant brand

MBK Partners has signed up Partners Group as the anchor investor in an approximately $500 million single-asset continuation fund for its majority stake in Korean fried chicken franchisor BHC.