Unison Capital

PE-owned Japanese drug maker seeks bankruptcy protection

Kyowa Pharmaceutical Industry, a Japanese generic drug manufacturer owned by Unison Capital, has applied for alternative dispute resolution, an out-of-court process that allows companies to continue operations while negotiating with creditors on a restructuring....

Korea's UCK Partners surpasses $770m on Fund III

UCK Partners, a South Korean private equity firm formerly known as Unison Capital Korea, has accumulated approximately KRW 1trn (USD 777m) across two incremental closes on its third fund.

Japanese GPs maintain strong investment pace - AVCJ Forum

Deployment remains robust in Japan’s mid-cap space with private equity firms continuing to see plentiful opportunities in carve-outs and founder-succession situations, the AVCJ Private Equity & Venture Forum Japan 2023 heard.

Japan buyouts: Bucking the trend

Japan remains a private equity hotspot despite muted buyout activity elsewhere in Asia. Take-private and sponsor-to-sponsor opportunities make for a more textured local market

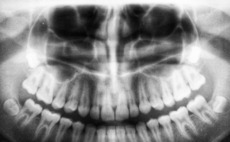

MBK, Unison Korea pursue dental implant buyout

MBK Partners and Unison Capital Korea have launched a tender offer for Osstem Implant, a Korea-based manufacturer of dental implants, that values the company at approximately KRW 2.85trn (USD 2.3bn).

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Unison Korea targets $680m for Fund III

Unison Capital is targeting KRW 800bn-KRW 900bn (USD 603m-USD 680m) for its third Korea fund, nearly twice what was raised in the previous vintage.

Japan PE sees digitalisation as national imperative – AVCJ Forum

Digital transformation is an urgent social issue as much as an operational one, Japan-focused investors told the AVCJ Private Equity & Venture Forum.

Currency, exit, labour issues worry Japanese GPs - AVCJ Forum

Currency depreciation, dwindling domestic IPO opportunities, and labour shortages are all their toll on the portfolios of middle-market Japanese private equity firms, the AVCJ Japan Forum heard.

Japan's D Capital nears target for debut PE fund

Japan’s D Capital, a private equity firm specialising in digital transformation that spun out from Unison Capital last year, has raised JPY 26bn (USD 188m) for its debut fund against a target of JPY 30bn.

Japan middle market: Crowded field

The expansion of Japan’s middle-market private equity scene has not kept pace with the rise in global investor interest. Spiking competition is inducing GP formation, but impediments are myriad

Activists, growth equity among Japan deal drivers - AVCJ Forum

Private equity deal flow in Japan is likely to increase in the coming years, spurred by factors ranging from activist investors to the rise of growth equity, industry participants told the AVCJ Japan Forum.

GP profile: Unison Capital

Unison Capital hones its game and holds tight to its heritage as one of the pioneers of private equity in Japan, even as its tentacles begin to span the breadth of Asia

Unison makes two Japan healthcare acquisitions

Japan’s Unison Capital has confirmed two local healthcare deals in the space of a week with pharmacy chain Reliance and outpatient nursing provider N Field.

Q&A: Unison Capital's Tatsuo Kawasaki

Tatsuo Kawasaki, a partner at Unison Capital, on supporting existing investments and making new ones, expectations of distress in Japan, and why a platform approach makes sense for healthcare

ASEAN to see rise in opportunities despite high valuations – AVCJ Forum

Industry professionals at the AVCJ Southeast Asia Virtual Forum predicted a rise in regional acquisition opportunities although valuations remain stubbornly high for now.

Japan carve-outs: Profit from the core

Private equity firms hoping for a coronavirus-driven uptick on Japanese corporate carve-outs must be patient – and come armed with considered value creation plans when the time arrives

Coronavirus in Asia: Ongoing analysis

Coronavirus concerns among GPs not solely focused on China vary based on their direct or indirect exposure to China, but gauging private equity responses to the crisis is like chasing a moving target

Portfolio: Unison Capital and CHCP

Through its Community Healthcare Coordination Platform, Unison Capital wants to bring efficiencies and economies of scale to parts of Japan’s healthcare sector that have been isolated from private markets

AVCJ Awards 2019: Exit of the Year - Small Cap: Gong Cha

Unison Capital took a Korean game plan global with the Gong Cha bubble tea chain. Attention to local tastes, however, was the key to the enterprise

Unison agrees $526m Japan pharma carve-out

Unison Capital has agreed to buy Kyowa Pharmaceutical Industry, a Japanese subsidiary of India-headquartered drug manufacturer Lupin for an enterprise valuation of JPY57.4 billion ($526 million).

Deal focus: Gong Cha's global push pays off for Unison

Unison Capital achieves a rare feat in helping the Korea franchise of bubble tea retailer Gong Cha take over its Taiwanese parent before facilitating a sale to TA Associates. Entering Japan has been a key value-add

TA invests in Unison-backed Gong Cha - update

TA Associates has acquired a controlling stake in Gong Cha, the Taiwan-based bubble tea chain backed by Unison Capital.