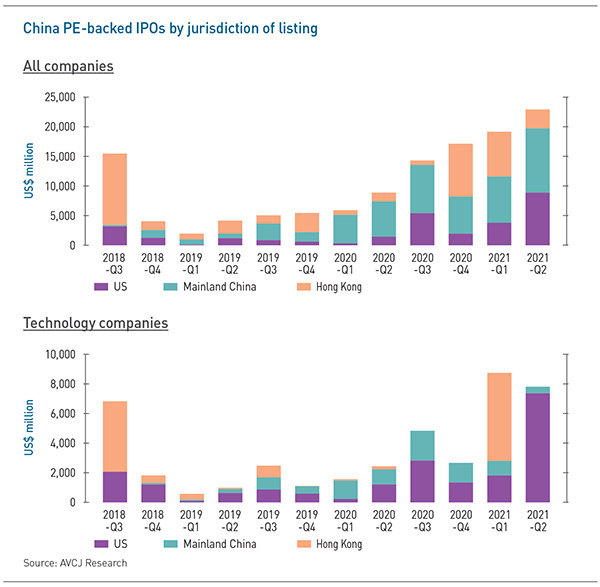

By the Numbers

AVCJ RESEARCH

LOCATION, LOCATION, LOCATION

The prospects for Chinese tech IPOs in the US are uncertain following the introduction of security reviews for companies that hold a lot of consumer data. Two points worth noting. First, perceived valuation premiums are a big draw. US bourses seldom contribute the bulk of PE-backed IPO proceeds on a quarterly basis. However, in the tech sector alone, they routinely account for at least half, rising above 90% in the second quarter of 2021. Second, Hong Kong has yet to pose a consistent competitive threat - although regulatory action may ultimately strengthen its hand. The market attracts intermittent, large-cap IPOs by companies with brand-name recognition - such as Meituan and Kuaishou - rather than a steady stream of mid-cap offerings.

|