GP profile: Unison Capital

Unison Capital hones its game and holds tight to its heritage as one of the pioneers of private equity in Japan, even as its tentacles begin to span the breadth of Asia

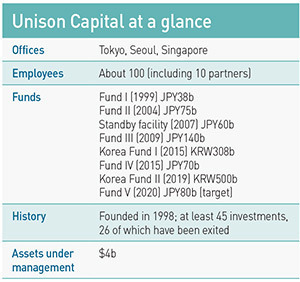

Japan's Unison Capital recognizes there is a temptation among private equity firms of its size and standing to become pan-regional, multi-strategy asset management organizations with expansive, highly corporatized teams. The GP, which has grown to about 100 staff and $4 billion in cumulative assets under management since its founding in 1998, has ended up going in the opposite direction.

The evolution was organic. With success in some areas and failures in others, a thematic approach to investment emerged. Consumer, B2B services, and healthcare came to the fore, and this specialization added fuel to an industry-wide narrative that saw GPs sharpening niche operational capabilities to remain competitive. All the while, Japan's midcap buyout market remained core, even as the geographic footprint expanded.

"A time comes for every GP when you have to test your thoughts and ideas about where you want to go. GPs can seek size increase and strategy extension, such as geographic expansion, but we wanted to take a more specialized route," says T.J. Kono, a partner at Unison. "We wanted to focus on areas where we were confident in our ability to add value and consistently generate good returns. For us, going into Korea was its own kind of specialization."

Unison's first international foray was the establishment of a Singapore-based office in 2008, although the fragmented nature of the Southeast Asia opportunity set has largely relegated that business to operational back-office functions. The firm set up in Seoul in 2014 and closed its first Korea fund at KRW308 billion ($269 million) the following year. A second Korea fund closed at KRW500 billion in 2019.

Into Korea, India

The idea that diversification is in fact an example of specialization is to some extent supported by a locally contained approach. Unison sees the Korea opportunity set as comparable to Japan but with little overlapping exposure between the two countries at the business level. Philosophically, the expansion was not about broadening strategy with grand cross-border ambitions – it was a chance to double-down on existing skills in a new setting.

Unison's latest overseas venture will be an interesting test of this concept. Last month, the firm confirmed its entry into India through a partnership with the government-backed National Investment and Infrastructure Fund (NIIF). The plan is to raise about $500 million from Japanese LPs with a view to participating in Indian private equity deals from buyout to venture. Unison and NIIF will each manage separate pools of capital as part of the joint venture.

Unison has engaged some of its network contacts – who happened to be originally from India – to do exploratory work on the ground since before the start of the pandemic, and this continued throughout the dislocation of the past 18 months. The firm's Singapore head, Osamu Yamamoto, is leading the charge. A permanent office has yet to be established.

"India is a strategic move for us although it has the look of an opportunistic move. We have our 23 years of experience being in a PE business and have a lot of ecosystem to take advantage of," says Tatsuo Kawasaki, a founding partner of Unison.

"As we considered our options to expand our business, we wanted to think outside the box in terms of extending our ecosystem and contacts, and the India strategy has come up where we could go deeper. With the NIIF partnership in place, we're now formalizing the details at all levels. Our team members have been doing a lot of work on the ground and will continue to do so until we are ready to deploy capital."

Lessons learned

Unison's founding team – comprising Kawasaki, Tatsuya Hayashi, and John Ehara, all three former Goldman Sachs executives – came together in the primordial days of Japanese private equity. Ehara has stepped back from the business in recent years.

Balance sheet restructuring was the investment thesis du jour, and there was a significant field of quality, distressed assets to target. They raised a debut fund of JPY38 billion ($344 million) in 1999 and a successor vehicle of JPY75 billion five years later.

The Fund III process coincided with the global financial crisis and saw several LPs request that their commitments be reduced due to liquidity issues. Nevertheless, at JPY140 billion, the vehicle was almost twice the size of its predecessor as PE continued to gain citizenship in Japan.

This was also a time of greater focus on operations and value-add contributions in light of what appeared to be increasingly irreversible secular trends. The age of digitalization provides the most straightforward macro trend-to-operations thesis, with businesses achieving modernization through technology. But Unison also wanted to explore traditionally top-down sector-targeting themes in terms of company-level value-add work.

For example, urbanization has influenced the way retail chains expand, making proximity a far more important factor than comprehensive inventory. Likewise, recognizing how aging has shifted consumer behavior patterns, Yuko Yuko pivoted from paper-based magazines into a travel agency targeting seniors frequenting domestic hot spring inns.

"To a degree, I think there was some truth to the view that GPs in the early stages had limited value-add capability other than financial solutions," Kono says.

"When we started in the late 1990s, private equity firms' main role was to be the supplier of risk capital, including us. Of course, GPs can't do that anywhere anymore, but especially not in Japan, which has gone through deflationary markets for two decades now. The investee companies are seeking far more business building value-add than simple cost reductions."

This was also a period of lessons learned in terms of understanding strengths and limitations, perhaps especially in the form of Toshiba Ceramics, now Covalent. Unison and The Carlyle Group jointly paid JPY91 billion for the semiconductor substrate maker in 2006, supported by JPY65 billion in debt. The company's silicon wafers business was offloaded in 2012 for JPY35 billion, and its remaining operations were sold in 2014 for an estimated JPY50 billion.

The disappointing deal is useful in illustrating a turning point for Unison around Fund III, when it became clear that long-cycle industries were not the firm's forte. Covalent needed an extended timeline that could not be accommodated and it suffered from a high-concentration business model. Apple was a disproportionately large customer whose changes in strategy had a tendency to rattle operations.

Getting focused

By the time Fund IV closed at JPY70 billion in 2015, Unison's sector preferences were firmly in place – and none more so than healthcare. Early investments in this space focused on drug development, with a $1 billion exit of Ayumi Pharmaceutical to The Blackstone Group in 2019 providing much of the confidence needed to branch into hospitals and other services.

Ayumi was one of three healthcare investments in Fund III, while about 40% of Fund IV was invested in the sector. Fund V – on track to hit a target of JPY80 billion after achieving multiple closings – is expected to be 50% allocated to healthcare. Fund V's most recent commitments include pharmacy chain Reliance and outpatient nursing provider N Field.

"Today, healthcare is still based on this idea of patients going out and seeking medical attention and services in specific settings, such as hospitals and pharmacies. But we feel the biggest underlying trend is that it's going to become more patient-centric, such as at-home care and synchronized medical services across multiple platforms," Kono says.

"Digitalization of medical services is the easiest example. COVID-19 has really proven to us that it's far more efficient to provide these services online. The shift will not be a straight line – a lot of regulation will be needed – but it's inevitable. And digitization is going to play a big part in that."

The shift toward sector specialization and operational capacity has naturally informed the expansion of the firm in terms of talent. Today, all healthcare services investments are managed as part of the Community Healthcare Coordination Platform (CHCP), which was set up in 2019 to roll up various fragmented segments. CHCP has about 10 staff led by Tsutomu Kunisawa, a healthcare veteran who joined Unison in 2017.

Consumer and B2B, the firm's other sectoral targets, are not seen as areas where building out specialized internal staff is necessary. However, cross-portfolio work in functional constituencies such as environmental, social, and governance (ESG) and IT has done much to direct the hiring process in recent years.

"The important thing was to internalize key functions such as digital transformation skillsets, ESG implementation and general corporate services where our portfolio companies have consistent needs for support from us," Kawasaki says.

"So for recruitment, we didn't want to just hire a bunch of number crunchers. We needed talent – whether they were young or seasoned professionals – who could imagine business scenarios and cope with the realities of medium-sized businesses in the context of Japan."

Applying expertise

Unison currently has two internal IT professionals and one data scientist, as well as three directors and three associates who are tasked with managing digital initiatives. At least one of the directors or associates taps the IT and data science team for each investment, with external professionals also typically brought in when deeper industry-specific expertise is needed.

Here again, healthcare is in a class by itself. Outside professionals in consumer, and to some extent B2B services, are seen as relatively well versed in tech-supported operations, such that upgrades by Unison's digital team can be completed as quickly as within one year. In healthcare, by contrast, cultural resistance to shaking up the status quo means extensive overhauls with supervision spanning the entire investment period are often required.

"Digitization initiatives work really well in private equity because we accumulate knowhow and we stay invested in a company for 3-5 years, so we have time to implement," says Rei Murakami, an IT professional who joined Unison in 2018 as an associate and recently became a healthcare-focused director on the investment team.

"Also with Unison, we're not just talking to the IT department people. We can work with sales and marketing people and top executives, which makes it much easier to think about the whole project."

Some of the latest work in this vein is being done at N Field, which offers in-home nursing services. During the diligence phase, Unison's digital team liaised with KPMG's data and healthcare units to design optimized routes for nurses to visit patients' houses. Despite Unison having 85% control of the company, the practical rollout of this plan has not been easy.

Murakami observes that digital transformation in healthcare can be as much about diplomacy as technology. As with other similar businesses, persuading nurses at N Field to take up new systems has involved forging a close relationship with a trusted manager, who can interpret its merits to staff.

"It's often the case that even though a CEO is reluctant, there are frontline managers who believe in the digital initiative. And sometimes, it's faster to apply a less effective optimization idea because that's what is easier for the managers to understand," says Murakami. "Managing those kinds of governance issues is a lot more important than having a sophisticated data analysis."

Sense of identity

The blending of skillsets required to make these kinds of plays work with a relatively small team is arguably Unison's secret sauce. It's likely much of this DNA traces back to the firm's lineage with Goldman Sachs, which is recognized for having maintained a partnership culture even as it has become a global entity.

"We try to share the economics of the firm with as many of those who can share in our value as one team, with all the carry and bonuses coming from one bucket," says Kawasaki. "There's no cherry-picking mechanism, where one professional gets more upside because they're working on a certain deal. That concept has never existed with us."

Unison's name is a reference to the musical term for playing together in harmony. The idea is that portfolio companies can grow when management, employees, and shareholders share the same values and cooperate. Likewise, within the GP, unison is the stated goal.

The firm's mission statement prioritizes a message that common goals trump individual goals, internal trust is as important as trust with external partners, and that hard work need not be at the expense of personal lives.

"The sharing of economics is a reflection of our guiding principles, which we wrote even before the firm has formed in a company sense. And we're still not really corporatized in the sense of having hundreds of people working under the same umbrella," says Kawasaki. "There is a lot of personal touch in everything we do."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.