Japan middle market: Crowded field

The expansion of Japan’s middle-market private equity scene has not kept pace with the rise in global investor interest. Spiking competition is inducing GP formation, but impediments are myriad

The fragmented, ageing nature of Japan's small to medium-sized enterprise (SME) space and growing momentum in corporate divestments, coupled with strong and rising LP appetite for exposure to these themes, suggests the local middle-market private equity scene is set to be flooded with new players. But no one expects that.

Middle-market GP creation in Japan has ticked along at a rate of about one or two new managers every few years since the 1990s, and the industry unanimously expects this to continue. The reasons for the slowness despite a host of snowballing incentives to the contrary should not be ignored.

The supply-demand equation is tiered: Are there enough GPs to serve LP demand for exposure to local SMEs, and are there enough SMEs for sale to justify the existence of those GPs?

This question is arguably more complicated in Japan, however, due to cultural factors. Private equity has firmly entrenched itself as part of the business and investment landscape, but it's still a long dance getting companies comfortable with MBOs and carve-outs, which makes the theoretical deal opportunity significantly larger than the realistic or practical one.

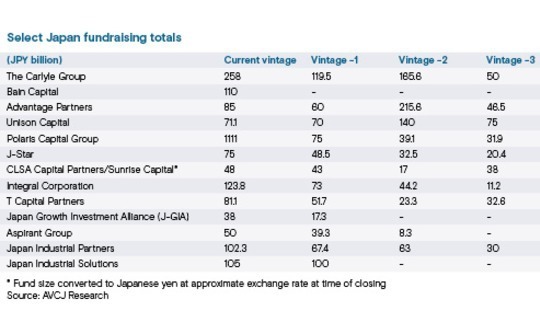

At the same time, the dividing lines between middle-market segments have blurred as competition rises. Global and regional actors like Bain Capital and The Carlyle Group are venturing into the small end of the market, while traditionally lower-end investors such as CLSA Capital Partners (CLSA CP) and Integral Corporation are now raising big enough funds to spar in the large-cap space.

Furthermore, the smattering of new entrants with international exposure is only half the story. There is a less visible but rapidly expanding universe of corporate PE and quasi-strategic joint ventures. For example, MSD Investment – a GP controlled by Mitsui & Co, Sumitomo Mitsui Banking Corporation, and Development Bank of Japan – reached a second close on its second fund in March. Fund I quietly closed on JPY 30bn (USD 217m) in 2015.

"People don't realise that there have been a lot of new entrants in this market. Probably the biggest concern is that the number of GPs exceeds the supply of deals," said Kirk Shimizuishi, a partner at KPMG. "A lot of people won't admit it just because they want to raise capital, but even in the USD 100m to USD 200m EV [enterprise valuation] range, it's gradually becoming a red ocean."

Supply-demand issues

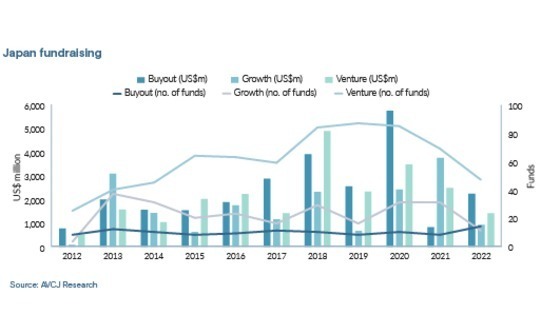

For the moment, rising LP interest has mostly manifested itself in larger funds among the established names. Annual buyout fund closes have hovered around 10 for the past decade, but there has been a noticeable shift in size. The average raised per year in 2018-2021 was USD 3.2bn, up 66% on the prior four despite an anomalously low total in pandemic-hit 2021, according to AVCJ Research

For 2022 to date, there have already been 14 buyout fund closes with total proceeds amounting to USD 2.2bn. The most recent of these was a final close of JPY 75bn for J-Star's fifth flagship fund, which beat a target of JPY 65m after six months in the market.

Bigger funds are a symptom and a driver of increasing competition, but there are several natural checks on the phenomenon. They include LP suspicion that deploying larger funds is outside the skillset of middle-market managers, a sense of discipline among managers that recognise oversized funds will be unwieldy with a small-cap strategy, and general LP caution amid macro uncertainty.

It therefore remains an open question how the local industry can service growing LP demand for access. Even when spinouts are achieved from reputable managers, the track records don't come with them, and global investors tend to hold on for Fund II or Fund III. For local investors, first-time funds from spinouts are of significant interest – if they come to market at all.

"Some people consider spinouts in the back of their heads, and experienced professionals get approached by people thinking about starting a fund. But most people ultimately don't take the final step because there are fewer opportunities available than in markets such as in the US and many obstacles to consider," said Shota Kuwaki, an executive director at CLSA CP.

"If they are successful in their current role, they may have a lot to lose. When spinouts happen, there's usually a specific motivator which may not always be just positive, which makes things cumbersome."

CLSA CP is experiencing a cumbersome – although friendly – spinout of its own from China's CITIC Securities. The GP, currently a 50-50 joint venture with CITIC-owned Hong Kong investment unit CLSA, is expected to rebrand and formalise its separation on launching the next fund in its Sunrise series. Kuwaki declined to comment.

In this case, the specific motivating factor is the current difficulty raising global money with Chinese organisational heritage. In other cases, there could be disputes about strategy (J-Star), LP wariness of strategic parentage (MCP Capital), or a global parent shutting down operations locally (NSSK).

Points of differentiation

Pure entrepreneurialism is seldom the primary motivation, which indicates such separations are likely to continue to happen piecemeal rather than as a growing trend. But Unison Capital, one of Japan's first private equity firms, has proven a breeding ground for exceptions to this rule.

Three middle-market managers have spun out from Unison, including Integral and Japan Growth Investments Alliance (JGIA), both of which have gone on to attract foreign capital. Integral aims to distinguish itself as a long-hold, operational player, while JGIA claims unique in-house capacities in consulting, marketing, and branding.

"You can no longer go to the international market and ask for capital just because you're a Japan expert. That playbook was played by us 20 years ago, and I don't think it's viable anymore," said T.J. Kono, a partner at Unison.

"Performance is important, and it originates from a GP's ability to add value. New GP ideas must bring a specific value-add strategy. In more mature markets, new GP leadership sometimes include specific industry experts. Today, not many of Japan's first-time funds have presented such value propositions."

Buyouts are the focus because comprehensive digital transformation is seen as requiring top-down buy-in at the company level. But the first two investments are minority stakes: multi-modal transport provider FC Standard Logistics and JGIA-owned furniture retailer Franfranc. Targets typically have an EV of around USD 100m.

The debut fund is targeting JPY 30bn. A second close of JPY 20bn happened in April and the running total is now JPY 26bn. LPs include some Unison relationships, as well as technology majors like KDDI and SCSK Corporation. The initial concern was that conservative investors would baulk at the untested concept and youth of the team. But regional banks, for example, have shown strong support.

"Fundraising has actually been a good experience which has been very surprising for us," said Koichi Kibata, a co-founder and partner at D Capital.

"By definition, we don't have a track record, which is a huge issue. But a lot of LPs see us as part of the third or fourth generation of PE firms in Japan, like NIC [Bain spinout Nippon Investment Corporation] and JGIA, which are doing well. They see the younger generation as an opportunity, not a risk."

Global LP access to these kinds of opportunities is limited by more than their rarity. D Capital's website is entirely in Japanese, and the firm refrained from setting up an overseas fund structure, citing the expense. The rule of thumb is that unless a fund is likely to raise JPY 10bn from overseas investors, it is uneconomic to pay for everything that goes into setting up a parallel feeder.

Other deterrents are operational in nature, such as a new GP's inability to meet higher environmental, social, and governance (ESG) requirements or to deploy at the speed of more mature ecosystems. "I have found global LPs frustrating because they expect much more speed in terms of deployment. One year after fundraising, they expect it fully deployed, but we take five years," said one manager.

Language is likewise a recurring sticking point, even for firms such as Aspirant Group, which committed to targeting international investors with its third fund, closing the vehicle on JPY 50bn in 2019. When Monument Group was brought in to advise, none of the presentation materials were in English. The placement agent placed about 55 reference calls, 50 of which were in Japanese.

"If the website is in Japanese, all the documentation is going to be in Japanese, and it's going to be very difficult to assess the opportunity. That lends itself to a certain subset of LPs that are willing to take on the work," said Niklas Amundsson, a partner at Monument.

"But once it's all been translated and brought up to global standards in terms of what investors expect to see, then the interest is definitely there."

Size matters

Still, the most important factor keeping global LPs out of the emerging manager space in Japan may be GP wariness around raising large funds to target the small-cap – and most prospective – end of the middle market.

JGIA, as a case in point, started attracting overseas investors with its second fund, which closed at a modest hard cap of JPY 38bn in 2020, up from JPY 17.3bn in the previous vintage. The firm's website is Japanese only. Founder, Koichi Tateno, speaks English fluently but notes the process has been long, difficult and largely strategic.

"We do see more overseas investors interested in Japanese private equity, especially in the mid to small end, and we do have a dialogue with them. But our goal is to maximise returns, not assets under management," Tateno said.

"We're in discussions with international LPs because we want the insights and expertise. There's a certain optimal fund size to be effective in this market space, and frankly, it's not going to be very large."

The best example of global LP success in accessing hard-to-access Japanese GPs is T Capital Partners, formerly Tokio Marine Capital. International investors had reached out to the firm without success for 15 years when it was performing strongly as a captive of Tokio Marine & Fire Insurance. By 2019, the GP's management was sufficiently inspired to buy out the business.

T Capital's debut as an independent closed on JPY 81bn in February with 40% of the capital coming from overseas LPs. This compares to JPY 51.7bn in 2017 for the prior fund.

"There were very strong voices overseas encouraging us to be independent. We raised our fund within one year, in the middle of coronavirus restrictions. It was an overwhelming response," said Koji Sasaki, president and managing partner of T Capital.

"There are big expectations when you're no longer captive. Can you survive and continue to replicate the track record you had in the past with the parent company? What is the continuity in the business plan? That's one of the main questions that we were asked by overseas investors."

Few industry participants expect this kind of story to become a significant opening for global LPs. The number of so-called institutional captive GPs with clear financial mandates is dwindling. And those that remain can be difficult to access. Daiwa Securities' Daiwa PI Partners is considered in this camp; it declined to be interviewed for this story.

Some of the latest activity on this front includes MCP Capital spinning out last year from Mizuho Bank, with the parent reducing its stake in the GP from 100% to 15% after a more than one-year negotiation process. MCP is currently looking to raise its first fund as an independent entity, targeting JPY 30bn by the end of the year.

The episode says much about why new GP creation in Japan remains sporadic, with MCP CEO Masahide Sato describing large conglomerates and private equity firms as "fundamentally incompatible" in terms of nature, culture, mindset, and speed of decision making. The separation was said to be needed to fulfil fiduciary duties as well as tap new domestic and foreign LPs.

"The road to independence was very bumpy. It was hard to get the understanding from the parent company on why we wanted to become non-captive. Such a request might have sounded to them as if we were just being selfish," Sato said, adding that one of his top priorities was to make sure that his team was properly incentivised in the long term.

"If we remained a captive firm, there would be no chance to invite foreign investors."

The next generation

The ultimate overarching variable in quality GP creation is talent. It can be difficult to convince the best and brightest to move toward the lower end of the middle market, where Japan deal flow is still good, but the return-versus-sweat equity ratio is less attractive.

The earliest movers – including Advantage and Unison – are working on leadership transition. This implies an influx of new ideas and personalities, which could in turn stimulate more spinoffs.

But any such splintering of the industry would face questions of credibility, especially given that a lull in hiring after the global financial crisis has resulted in a dearth of professionals with more than 10 years' experience. The number of talented people working in Japanese private equity has increased substantially in the past decade, but most of them are fairly young.

To some extent, the experience issue is about familiarity with economic cycles. But it's also about simply getting a seat at the table.

As competition mounts, GPs are increasingly under pressure to have experienced staff with broad deal intermediary relationships. Few deals are still 100% exclusive in the middle market, and many auctions don't have the resources to invite more than 15 buyers. At most, five of those invites would be for funds, so getting in the conversation is about deep networks and hence elusive seniority.

"Our biggest bottleneck is not the number of deals – it's having the professionals to handle them. You need senior people to do the job right," said Shinichiro Kita, a senior partner and head of buyouts at Advantage. "You need established relationships with intermediaries, and that cannot happen in just a few years. Those relationships take time to develop."

As more large-cap GPs establish a presence in Japan, there is scope for talent spinning out and launching middle-market managers in-country. Although historically, this calibre of professional has tended to join established local funds rather than start something new.

There is also an expectation that as the ecosystem matures, the government could eventually establish some systematic programs for supporting rookie funds, which would encourage talent to enter the industry. But this is a long and theoretical game.

In the meantime, LP access to the middle market will be driven by some increase in fund sizes, the creep in spinouts, and the broadening of existing GPs' mandates to include adjacent asset classes. An uptick in sponsor-to-sponsor deals is expected, which could also be a driver, as could a perceived increase in delisting transactions.

"Right now, relatively speaking, the lower end of the mid-cap continues to be attractive. But it was like that decades ago in the US, and now it's competitive across the board there. I think we may be headed in that direction," said CLSA CP's Kuwaki. "There are good signs that the market is maturing with more institutional and capable GPs."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.