Tencent

China snack maker Weilong raises $549m, pursues HK IPO

China’s leading spicy snack food company Weilong has raised a $549 million pre-IPO round at a valuation of $9.4 billion and filed for a Hong Kong IPO.

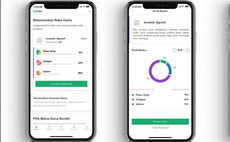

Deal focus: Bibit lays claim to be Indonesia's Robinhood

A couple of quickfire funding rounds for Bibit reflects global investor appetite for robo-advisory businesses and the Indonesian company’s rare double-headed product offering

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.

China audio platform Ximalaya files for US IPO

Ximalaya, China’s largest online audio platform, which counts the likes of Tencent Holdings, General Atlantic, and Goldman Sachs among its backers, has filed for a US IPO.

Sequoia India leads $65m round for Indonesia's Bibit

Sequoia Capital India has led a $65 million round for Indonesia robo-advisory app Bibit four months after leading a separate $30 million investment.

China's NextData raises $135m Series D

NextData, a China-based cybersecurity services provider, has secured $135 million in Series D funding led by CPE, Matrix China Partners, Hopu Investment, Tencent Holdings, and Xiang He Capital.

China home fitness brand Fiture raises $300m

Fiture, a Chinese developer of artificial intelligence-enabled home fitness devices, has raised $300 million in Series B funding led by All-Stars Investment, Legend Capital, DST Global, and Coatue Management.

PE-backed property platform Anjuke to go public in Hong Kong

Anjuke, a Chinese online property marketplace controlled by classifieds player 58.com, has filed for a Hong Kong listing. It follows a $250 million pre-IPO funding round featuring two Hong Kong property developers.

China's Zhihu completes $522m IPO, endures volatile debut

Chinese question-and-answer platform Zhihu endured a difficult New York Stock Exchange debut, closing at a 10.5% discount to its IPO price on a day when US-listed Chinese stocks fluctuated wildly.

China autonomous driving developer Momenta raises $500m

SAIC Motor, Toyota Motor Corporation, Robert Bosch, Yunfeng Capital, and Temasek Holdings are among the investors in a $500 million Series C funding round for Chinese autonomous driving technology developer Momenta.

China's Tuya completes $915m IPO, gains on debut

Tuya, a Chinese start-up that claims to be the world’s largest platform-as-a-service (PaaS) provider in terms of number of smart devices powered, raised $915.4 million in its US IPO. The offering was priced above the indicative range yet still registered...

Singapore's PatSnap raises $300m Series E

Singapore and UK-based market intelligence and analytics provider PatSnap has raised a $300 million Series E round led by SoftBank Vision Fund II and Tencent Holdings.

Hillhouse, Tencent lead Series C for China's Fenbeitong

Hillhouse Capital and Tencent Holdings have led a $92.5 million Series C round for Fenbeitong, a China-based enterprise payment and expense management software provider.

China e-signature specialist Fadada gets $139m Series D

Tencent Holdings, Centurium Capital, and ZWC Partners have contributed RMB900 million ($139 million) in Series D funding to Fadada, a Chinese e-signature and cloud contract service provider.

China regulation: Taming the giants

Recent regulatory reforms suggest that China will not let the growth of large technology companies go unchecked. The implications could be far-reaching, not least for VC investors and start-ups

Loyal Valley leads Series B for China vision therapy start-up

China-based eye disorder specialist Arctic Vision has raised a $100 million Series B round led by Loyal Valley Capital. Tencent Holdings, Octagon Capital, and New World Development CEO Adrian Cheng also participated.

China cloud IoT provider Tuya files for US IPO

Tuya, a Chinese software platform for internet-of-things (IoT) systems that mainly offers platform-as-a-service (PaaS) products is pursuing a US IPO.

PE-backed JD Logistics set for Hong Kong listing

JD Logistics, a supply chain solutions and logistics provider that spun-out from Chinese online retailer JD.com, has filed for a Hong Kong IPO. The company has received $2.57 billion in private funding.

Sequoia, Tencent lead Series E for China's Miaoshou Doctor

Beijing Yuanxin Technology, operator of China-based online healthcare services platform Miaoshou Doctor, has raised RMB3 billion ($466 million) in Series E funding led by Sequoia Capital China and Tencent Holdings.

China's Kuaishou surges on debut after $5.4b Hong Kong IPO

Kuaishou, a Chinese video-sharing and social networking platform backed by Tencent Holdings, 5Y Capital and DST Global, started trading at nearly three times its IPO price following a Hong Kong IPO that valued the company at HK$1.1 trillion ($142 billion)....

Tencent leads Series C for China gene sequencing player

Guangzhou-based precision diagnosis and gene sequencing company Vision Medicals has raised RMB200 million ($31 million) in Series C funding led by Tencent Holdings.

Tencent backs China enterprise training start-up

Yunxuetang, a Chinese online corporate training services provider, has raised more than $100 million in the first tranche of Series E round led by Tencent Holdings.

China math tuition platform adds $150m to Series E

Huohua Siwei, a China-based children's online education platform specializing in mathematics and science, has raised $150 million in the third tranche of the Series E round, taking the overall total to $400 million.

China e-sports business VSPN lifts Series B to $160m

VSPN, a Chinese e-sports broadcaster and events promoter backed by Temasek Holdings, has extended its Series B round to $160 million with a mix of VC and strategic investors.