Indonesia

Facebook, PayPal invest in Indonesia's Gojek

Facebook and PayPal have joined an ongoing Series F round for private equity-backed Indonesian ride-hailing and online-to-offline (O2O) services platform Gojek (formerly Go-Jek).

Deal focus: Bobobox rethinks budget hotels

Bobobox's flexible solution to accommodation for frontline healthcare workers in Indonesia led to support from the Li Ka Shing Foundation and helped secure a Series A from Li's Horizons Ventures

Singapore's GoBear raises $17m

Singapore-headquartered GoBear, a financial services platform focused on Asian consumers, has raised $17 million from Netherlands-based Walvis Participaties and Aegon

Convergence co-founder joins MDI Ventures as CEO

Donald Wihardja, co-founder of Indonesia-focused Convergence Ventures, has become CEO of MDI Ventures, the corporate VC arm of state-controlled telecommunications giant Telkom Indonesia.

Indonesia capsule hotel Bobobox raises $11.5m

Bobobox, an Indonesian start-up that operates capsule hotels, has raised an $11.5 million Series A round led by Horizons Ventures and Alpha JWC Ventures.

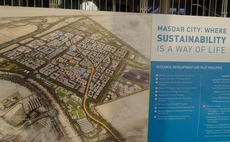

ADQ launches $300m India, Southeast Asia VC fund

ADQ, a state-owned holding company in the United Arab Emirates, has launched an AED1.1 billion fund ($300 million) that will invest in Indian and Southeast Asian start-ups with expansion plans in the Middle East.

Deal focus: Validus takes holistic approach to SME financing

Singapore peer-to-peer lender employs algorithm-based credit assessment tools and an unorthodox approach to origination as it seeks to address inefficiencies in Southeast Asian supply chain finance

UAE's EMPG acquires Rocket-backed Lamudi Global

EMPG, a real estate classifieds marketplace group headquartered in the United Arab Emirates, has acquired Lamudi Global, which runs property market portals in the Philippines and Indonesia.

Deal focus: GudangAda fills FMCG distribution void

Keeping every small store in Indonesia well-stocked is a monumentally complex challenge that GudangAda tackles by bringing buyers and sellers together online.

Sequoia leads $109m round for Indonesia coffee chain

Sequoia Capital India has led a $109 million Series B round for Kopi Kenangan, an app-driven grab-and-go coffee chain based in Indonesia.

Singapore SME financing platform gets $20m

Validus, a Singapore-headquartered financing platform for small to medium-sized enterprises (SMEs) in Southeast Asia, has raised $20 million in a Series B+ round co-led by Vertex Growth and Orion Fund.

Deal focus: Oriente's plastic alternative

Well-capitalized though not immune to COVID-19 disruption, Indonesia and Philippines-focused online lender Oriente is waiting for the market to get back to normal

Cashlez gains on debut after Indonesia IPO

Indonesian mobile point-of-sale solution provider Cashlez - a portfolio company of Mandiri Venture Capital - traded up on debut following an IDR87.5 billion ($5.7 million) domestic IPO.

Indonesia's GudangAda gets $25m Series A

Indonesian B2B e-commerce platform GudangAda has raised $25.4 million in a Series A round led by Sequoia Capital India and Alpha JWC Ventures.

Deal focus: Circulate makes early moves in a must-win battle

Specialist venture capital firm Circulate Capital is targeting overlooked start-ups with a view to stemming a global environmental crisis that puts Asia at center stage

Go-Jek completes acquisition of VC-backed Moka

Indonesia’s Go-Jek has completed its acquisition of Moka, a local financial technology provider with several VC backers, in a deal estimated to be worth $130 million.

Coronavirus thwarts PE partial exit from Indonesia's BFI Finance

Italian lender Compass Banca has abandoned its purchase of a 19.9% stake in Indonesia’s BFI Finance from TPG Capital and Northstar Group, citing economic disruption created by the coronavirus outbreak.

Singapore's Circulate Capital makes debut investments

Circulate Capital, a Singapore investor dedicated to ocean pollution management, has made its first investments in two plastic recycling start-ups in India and Indonesia.

Indonesian insurtech player Qoala raises $13.5m Series A

Qoala, an insurance technology start-up in Indonesia, has raised $13.5 million in a Series A round led by Centauri Fund, a vehicle jointly run by KB Investment and MDI Ventures.

Deal focus: Kargo serves Indonesia's logistics needs

Kargo Technologies, Indonesia's only pure online marketplace for the trucking industry, has responded to the coronavirus outbreak by focusing on the transportation of consumer staples

Northstar hits first close on fifth Southeast Asia fund

Northstar Group has reached a first close of approximately $260 million on its fifth Southeast Asia fund, which has an overall target of $800 million.

Indonesia's KoinWorks raises $20m in debt

KoinWorks, an Indonesian financial technology start-up primarily known for P2P lending, has raised $20 million in debt by selling convertible notes to existing investors.

Tenaya Capital leads Series A round in Indonesia's Kargo

Indonesian logistics platform Kargo Technologies has finalised a IDR504 billion ($31 million) Series A round led by Tenaya Capital, formerly the venture arm of Lehman Brothers.

Southeast Asia VC: Different strokes

Ahead of an expected increase in LP interest, Southeast Asian VCs vie to stand out from the crowd by fine-tuning strategies to capture the virtues of both generalists and specialists