Southeast Asia VC: Different strokes

Ahead of an expected increase in LP interest, Southeast Asian VCs vie to stand out from the crowd by fine-tuning strategies to capture the virtues of both generalists and specialists

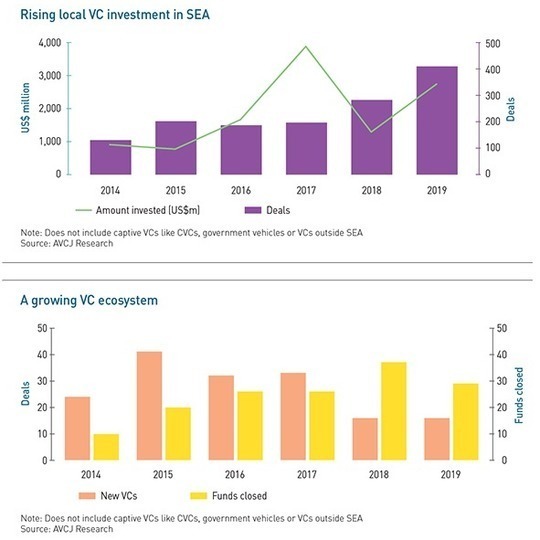

According to the standard 15-years-behind-China thesis, Southeast Asian venture capital is on the cusp of an international investment boom. COVID-19 notwithstanding, the key spoilers for this outlook have always been the scaling challenges inherent to its far more heterogeneous nature. But as regional and global investors begin to rethink the opportunity set, that added layer of complexity appears less likely to derail a China-style narrative.

Among the most common citations in this line of thinking are the IPOs of Chinese travel start-up Ctrip and Singapore mobile platform Sea. Ctrip, which raised $75.6 million through a US offering in 2003, is seen as having sparked the first rush of global VC activity in China. Within a few years, international LPs were backing local funds, brand-name VCs were opening offices in-country, and there was a groundswell in domestic and imported start-up talent.

Sea, which achieved Singapore's largest-ever float in 2017 by raising $884 million, is believed to be re-conjuring the same atmosphere a decade-and-a-half later in Southeast Asia. ASEAN's most recognizable regionally headquartered VCs all set up shop in the preceding years, but the Sea watershed has been interpreted as a new kind of proof-of-concept from a global perspective.

This optimism is by no means unreasonable. The global VC industry has proven its capacity to tackle big, unproven growth markets where local players have short track records. But Southeast Asia's fragmented playing field introduces a whole new set of considerations around local partnering and the need to balance strategies of diversification versus specialization.

For GPs dedicated to this space, there is now increasing pressure to demonstrate shrewdness in understanding investment outcomes, not just macro-driven company outcomes. Defining the differentiated skills and insights necessary to navigate the regional growth story has displaced the growth story itself as the bone of contention. The question is no longer why Southeast Asia, but why this or that mode of entry.

"The macro could indicate that large company-level outcomes are possible, but how is a specific VC going to benefit from that," says Sunil Mishra, a partner at Adams Street Partners. "If you are talking about early-stage investing, it helps to have a local specialist, but you really have to keep a generalist nature in this region. The Southeast Asia venture ecosystem is still so early in its development that a lot of specialization can narrow it down too much."

Up close and personal

From a global LP perspective, assessing Southeast Asian VCs without the comfort of significant track records is largely a process of due diligence into the individual managers through second or third-party references. Specific domain knowledge, talent networks, and experience in a successful start-up are pluses, but these do not necessarily indicate a high level of competence in capital allocation and capital management.

Perhaps the hardest virtues to isolate are global awareness about markets and fund-level value monetization. This includes knowing how to right-size a fund for a given opportunity set, knowing when to double down on a promising prospect, and knowing when to cut losses with an early exit.

Marc Lau, a managing partner at fund-of-funds Axiom Asia, advocates a bottom-up approach that starts with an analysis of a manager's existing investments. Lau, whose experience includes backing some of the first Chinese VCs in the early 2000s with Axiom and the first US private equity outfits in the 1980s with Singapore's GIC Private, says this is essential to building up the necessary dataset.

It's possible there has never been a greater inhibitor to this kind of legwork than COVID-19 and its related travel restrictions. Although the situation is not a Southeast Asia-specific issue, its effects could be amplified in the region due to a relative lack of multi-fund managers. The concern here is that in a no-travel environment, re-ups are easier to push through than new fund commitments.

The coronavirus crunch could also rattle the region's otherwise encouraging corporate venture capital story. Southeast Asia is routinely cited as one of the most active areas for these investors, who have done much to legitimize venture as a concept. Now that macro pressures risk causing a retreat from corporate experiments, have these programs done enough to provide the ecosystem with a critical mass of believers?

The prevailing view is that once a fair number of Fund IVs are raised, the market will have hit its stride, creating a virtuous cycle that attracts ever-larger amounts of talent and capital, as well as an increased level of comfort with VC on regional stock exchanges. With a coronavirus overlay, the immediate result could see VCs increasing their specialization by defensively concentrating on their core strengths. The emergence of a class of diversified, multi-strategy firms is still considered inevitable, but harder to predict within 5-10 years.

"COVID-19 is really going to put portfolios under stress, and portfolio quality is going to come through in terms of the kinds of businesses managers back and how they help them survive this challenge. In terms of performance, we will see a power law, with a few funds that will do quite well vis-a-vis their peers while the bulk of funds will not," says Kuo-Yi Lim, a co-founder at Monk's Hill Ventures. "In a more mature asset class like that, the median performers are not compelling, so you can't index the market. You always want to invest in the outlier, whether that's a company or a fund."

Specialist vs generalist

Monk's Hill raised $80 million for its first fund in 2016 and closed a follow-up vehicle last month at $100 million with support from corporate VCs, regional family offices, and government organizations. It aims to separate itself from the Southeast Asia pack with a curated team of technical and operational experts and a relatively concentrated portfolio of around 15 Series A investments per fund representing company stakes of 15-25%.

The firm's investment strategy is tech-focused but sector-agnostic and geographically diversified with offices spread across Singapore, Vietnam, and Indonesia. A number of generalist Southeast Asian VCs in this vein are expected to thrive and build globally recognized brands in the years to come, especially as more later-stage funding is required.

But the onset of coronavirus fundraising pressures in an increasingly competitive landscape has put into question how this will unfold the foreseeable future.

"I'd be pretty skeptical of somebody raising a new generalist VC fund for Southeast Asia today. Unless a famous CEO of a unicorn is doing it, it's going to be easier said than done," says Eddy Chan, a co-founder at Indonesia-only investor Intudo Ventures. "A couple of the generalist funds that started before specialization was necessary will make it to the other side of the chasm in this current environment, but many will need to pull back to be more geography and vertical-specific. This down-market will cause consolidation among VC firms."

This predication appeared to bear out earlier this week with two Jakarta-based firms, Agaeti Ventures and Convergence Ventures, merging to form AC Ventures. The combined entity has to some extent differentiated itself by claiming to be the largest local VC in Southeast Asia's largest jurisdiction with four partners, six investment professionals and a supporting operational team. It plans to invest an upcoming fund in 35 early-stage companies in various tech categories over the next three years, primarily in Indonesia.

Intudo, which claims to be the first VC to invest exclusively in Indonesia, defines specialization in yet another way. Like Monk's Hill, it aims to invest in only about 15 companies per fund, emphasizing a high level of portfolio involvement including weekly visits with founders. The firm raised $20 million for its debut fund in 2018 and $50 million for Fund II last year, with the majority of the LP base hailing from the US.

"Country-specific funds are going to be the trend going forward, but that will require a change in mindset on the part of VCs to be very involved in their portfolios. The days of passive investing and cavalierly raising money on vanity metrics are gone," says Patrick Yip, a co-founder at Intudo. "A lot of funds are spreading themselves thin across six or seven different markets in Southeast Asia, but we're going to see them become more geography-specific in the next five years as the ecosystem matures."

On the opposite end of the spectrum is Singapore-headquartered Openspace Ventures which maintains a base in Indonesia and professionals on the ground in Thailand, Vietnam, and the Philippines. The team of 23 includes 10 nationalities speaking about 15 languages. Investment strategy is similarly diverse, with Series A and B deployments coving the gamut of B2C and B2B technologies variously seeking to access local, regional and global markets.

The idea is that global LPs are more interested in targeting the region as a whole, accessing the breadth of the 600 million-strong consumer market and spreading the risk. The regional-generalist approach also helps avoid heavy reliance on national success stories like Indonesia, which can quickly translate into unworkable valuations even as similar opportunities in areas such as Thailand and Vietnam are overlooked.

"The best thing about a diversified VC portfolio is that you spread risk from a geographic standpoint as well," says Shane Chesson, a co-founder at Singapore-headquartered Openspace. "Take COVID-19, for example. These sorts of potential recession environments show that you should not put all your eggs in one basket, and I think we're going to see that some people have been a little too bullish in their sectorial and geographic choices."

Openspace otherwise differentiates itself with a targeting methodology that prioritizes start-ups and categories that have not attracted substantial VC investment and a strong focus on in-house operational support, including data-driven market analysis. "If you've got a good business in education in Vietnam, you can take that to Thailand. We've done that with [online education provider] Topica," Chesson adds. "We show LPs case studies about how we help our portfolio companies go from one market to another market."

People power

An ability to facilitate cross-border moves in this way – even at early stages – could become an increasingly indispensable tool in the Southeast Asia VC kit as LPs take note of diverging fortunes of start-ups that reach outside of their home markets early and those that don't. Regional ride-hailing apps Go-Jek, which is backed by Openspace, and Grab offer an instructive example with the region's highest-profile rivalry.

"From the start, Grab has tried to be a regional player whereas Go-Jek has tried to be big in Indonesia," observes Victor Chua, a former vice president at Gobi Partners, who launched Malaysia's Vynn Capital in 2018. "While Grab has managed to capture leadership in the other markets, Go-Jek has not realized how Indonesian it has become."

Vynn, which is targeting $40 million for its debut fund, appears to have struck a compromise in the specialization debate by taking a sector-focused approach but broadening it to encompass four distinct but deep industries with substantial overlap. These include travel, consumer, logistics, and property.

This is seen as particularly useful in attracting regional corporates and family offices, which often have a specific industrial interest they are seeking to modernize. Ideally, such connections could support fundraising, deal sourcing, value-add, and divestment. "Most VC funds have been pretty much sector-agnostic. What that means is that you become a spray-and-pray machine," says Chua. "There is a certain flaw in that model because you're pretty much relying on chance when it comes to investment and exits."

Jungle Ventures, one of the region's earliest movers, has seen 10 exits out of about 60 investments and credits the performance in large part to the way it built out its team. For example, in 2015, the firm recruited David Gowdey, an M&A veteran who previously cut deals for TPG Capital and Yahoo, as its exit guru. When a portfolio company is ready, the relevant partner briefs Gowdey, who then works with management to get the asset in shape for public markets and strategic buyers.

"Exits do not happen, they need to be manufactured," says Amit Anand, a managing partner at Jungle. "Beyond a certain point, it's not luck. I think every GP in the region should be investing in people who understand how to create exits."

The regionally active and sector-agnostic early-stage investor also claims differentiation in a compact portfolio of 10-15 companies per fund, but interestingly, this concentration has been maintained even as the team expands and fund sizes inflate. Jungle closed its third fund last year at $240 million with a strong showing from global development finance institutions.

The takeaway here may be that, for Southeast Asia's most established managers, the fight to be different has finally shifted from an exercise in impressing LPs to a way of attracting the best in-house talent and investee companies.

"Founders are looking for people who've not just flown in. They want to see some serious commitment and relationships in the region that they can benefit them," says Anand. "If I was a founder today, I would not just look at the pace of decision-making and the VC's brand and so on. I would look for experience and networks in the region, as well as an operating understanding of the region because that's one of the most complex things."

SIDEBAR: Gobi - Global perspective

Few aspects of a fund manager are more convincingly differentiating than heritage, especially when it's possible to balance local credibility with a backstory further afield. China's Gobi Partners is one of the few VCs to achieve this feat in Southeast Asia.

Gobi raised S$10 million ($7.8 million) for its first Southeast Asia fund in 2010 and spent the next decade building a bridge between the two regions with four more funds, including a Philippines-focused vehicle in partnership with Manila-based Core Capital. It now has a network of six country offices across the region, which is managed from Kuala Lumpur.

"Operating in China, we sometimes think that we're from the future," says Thomas Tsao, a co-founder and managing partner at Gobi, who moved to Malaysia in 2015. "It's not always going to be the same way in Southeast Asia but there are going to be some very valuable lessons from China and that's something we bring to the table."

Exactly how this cross-regional strategy will play out remains to be seen, but Tsao says it has so far helped attract institutional interest from multinational companies like Unilever, Cisco, Bosch, and Sony as well as a number of companies in Gobi's Chinese portfolio.

Perhaps most importantly, the global thinking inherent in this strategy reflects industry momentum to do more than deliver above-average returns. Tsao sees a philosophical role for Gobi in Asia that involves the VC nurturing a portfolio of start-ups that can solve shared problems manifesting across the world.

This would include investing in companies addressing issues such as climate change and ecological damage but also ensuring that investees are mindful of the negative externalities created by their tech-enabled convenience-enhancing solutions. This kind of global awareness is expected to become increasingly important for LPs to consider.

"The current pandemic highlights that we are all dealing with borderless problems," Tsao says. "VCs in the past have all been focused on a specific country or zip code where they invest. That's probably going to change and many VCs are not equipped to do that. They don't have a bigger platform or think globally."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.