Facebook, PayPal invest in Indonesia's Gojek

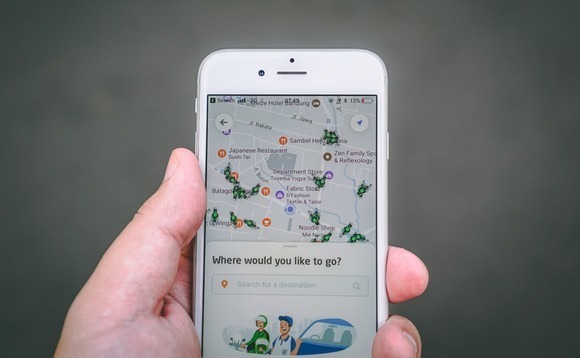

Facebook and PayPal have joined an ongoing Series F round for private equity-backed Indonesian ride-hailing and online-to-offline (O2O) services platform Gojek (formerly Go-Jek).

The round was launched early last year with existing investors such as Google, JD.com and Tencent Holdings committing around $1 billion. At the time, Gojek was said to be seeking $2 billion in total at a valuation of $9-10 billion. Later in the year, Visa and Mitsubishi came on board.

An internal memo released in March indicated the company had secured additional funding. It is said to have raised around $3 billion. Gojek closed its Series E at $1.5 billion in March 2018, achieving a valuation of $5 billion.

The addition of Facebook and PayPal comes three months after Japan's Mitsubishi UFJ Financial Group (MUFG) and TIS Intec Group committed $856 million in Singapore-based rival Grab. Grab's ongoing Series H has a target of $6.5 billion and previously valued the company at $10 billion.

Gojek's Series F is expected to support efforts to digitize payments across Southeast Asia. GoPay, the company's mobile wallet, is the most popular cashless payment option in Indonesia. It is also operational in Vietnam, Singapore, Thailand, and the Philippines, but Grab has a first-mover advantage in most countries in the region. Other prominent mobile payment service providers in Indonesia include Ovo and GrabPay.

Gojek said GoPay would be accessible to PayPal's network of 25 million merchants worldwide. In the future, PayPal users should be able to accept or send payments to GoPay users. Gojek did not specify how Facebook-owned WhatsApp, the country's leading messaging service, plans to partner with the Indonesian start-up.

"Gojek, WhatsApp and Facebook are indispensable services in Indonesia. Working together we can help bring millions of small businesses and the customers they serve into the largest digital economy in Southeast Asia," said Matt Idema, COO at WhatsApp, according to a statement.

Gojek operates a super app that offers at least 20 different in-app services. These include food delivery service GoFood and online commerce portal GoMart.

Facebook also recently invested in Jio Platforms, the holding company behind India's leading telecom carrier which is also working towards creating an ecosystem of apps to supplement a foray in broadband and cable services. Facebook has Libra and Novi, its own cryptocurrency and cryptocurrency-based digital wallet. It wants to use these to facilitate virtual payments between users worldwide. Few details have emerged since the announcement of these innovations last year after regulators in multiple markets expressed reservations.

It was reported in February that senior representatives of Grab and Gojek had discussed a possible merger, prompting a denial from Grab. The start-ups have long engaged in a fierce battle for market share and financial support in the region. At the start of the year, Gojek CEO Nadiem Makarim stepped down to take an Indonesian government position.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.