ADQ launches $300m India, Southeast Asia VC fund

ADQ, a state-owned holding company in the United Arab Emirates, has launched an AED1.1 billion fund ($300 million) that will invest in Indian and Southeast Asian start-ups with expansion plans in the Middle East.

The vehicle will be called Alpha Wave Incubation Fund (AWI), according to an update on LinkedIn posted by the company. ADQ, formerly known as the Abu Dhabi Development Holding Company, is a holding company with a portfolio of 25 companies across 11 sectors. It was established last year in order to help Abu Dhabi, the largest of the country's seven emirates, transition its revenue base away from the oil sector in the long term.

Due to a crash in oil prices amid falling global demand, Moody's estimates that Abu Dhabi's economy could see its income shrink by as much as 30% in 2020. The emirate owns more than 90% of the country's oil reserves. However, sovereign wealth fund Abu Dhabi Investment Authority, which is estimated to have $580 billion in assets under management, is hoped to help Abu Dhabi weather the economic downturn caused by the COVID-19 pandemic.

ADQ is led by Mohammad Hassan Al Suwaidi, a former executive at state fund Mubadala Investment Company. Mayank Singhal, formerly associated with RNT Capital, a VC fund backed by Indian conglomerate Tata Group chairman Ratan Tata, heads ADQ's VC and technology unit. Singhal was formerly involved in investments in ride-hailing firm Ola, health and fitness company Curefit, room rental platform Nestaway, point-of-sale manufacturer MSwipe, and interior design marketplace Livspace.

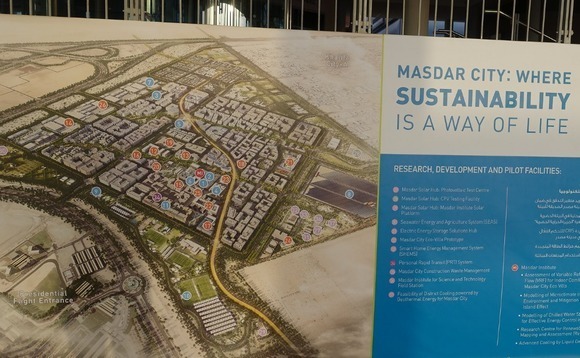

AWI will invest in early-stage Asian start-ups planning to set up Middle East or global headquarters in Masdar, a planned city being built next to the Abu Dhabi airport that is expected to be completed by 2030. According to the South China Morning Post, construction on Masdar began in 2008 with plans for an eco-friendly district where foreign companies would be exempted from corporate taxes and shareholders would be allowed to retain full ownership.

"With the launch of Alpha Wave Incubation Fund, we have the opportunity to invest in outstanding start-ups that will generate sustainable, long-term financial returns while also drawing young founders and teams to Abu Dhabi. These start-ups will also benefit from access to ADQ's leading companies in sectors such as healthcare, food and agribusiness, utilities and fintech," said Singhal, according to Dubai-based newspaper Gulf News. Companies belonging to ADQ are also involved in tourism, financial services, media and industrial activities.

The fund is expected to support the goals of Ghadan 21, a government initiative launched in 2018 and backed by AED50 billion in state funds that seek to establish a start-up ecosystem in Abu Dhabi by 2021. The program will support investments in start-ups, infrastructure development, and subsidies for businesses and individuals seeking to base operations in the city. Ghadan means ‘tomorrow' in Arabic.

A venture fund associated with Ghadan 21 has invested in several, mostly Dubai-headquartered start-ups as well. These include blockchain-based financial infrastructure technology provider Securrency, logistics aggregator Trukker, investment advisory platform Sarwa, nutritional management platform Yacob, and Okadoc, a healthcare booking platform.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.