coronavirus

BGH, OTPP sweeten deal for New Zealand's Abano

BGH Capital and Ontario Teachers’ Pension Plan (OTPP) have improved their take-private offer for New Zealand dentistry chain Abano, reflecting a relatively strong business recovery.

PE & Asian banks: Once-in-a-decade opportunity

GPs like targeting banks during downturns, investing in stronger players at discount valuations and backing them to come out the other side with increased market share. Will it be more of the same with COVID-19?

Coronavirus & infrastructure: Trial by fire

Conservative investors who trust infrastructure for its stability have received a rude awakening with COVID-19. With appetite for the asset class unchanged, it’s time to get smart about risk

Temasek sees portfolio shrink, ups investment pace

Temasek Holdings has deployed a record S$32 billion ($23.3 billion) in the past year – with technology and healthcare the main beneficiaries – even as the impact of COVID-19 saw its overall portfolio shrink in value for the first time since 2016.

COVID-19 flexibility can exacerbate PE gender issues

Working from home has been a mixed experience for women in private equity, with greater flexibility counterbalanced by heightened feelings of isolation in environments that are already dominated by men.

Fund focus: Remote diligence underpins Adamantem's first close

Australia's Adamantem Capital launched its second fund shortly before COVID-19 began to escalate, but the first close still features sizeable commitments from new investors that were unable to perform due diligence in-person

BGH, OTPP reengage with New Zealand's Abano

BGH Capital and Ontario Teachers’ Pension Plan (OTPP), which recently terminated an acquisition of New Zealand dentistry chain Abano, have renewed their bid at a lower price.

China's VC-backed CanSino raises $748m in Star Market IPO

Chinese vaccine developer CanSino Biologics, which counts Lily Asia Ventures (LAV) and Qiming Venture Partners among its investors, has raised RMB5.2 billion ($748 million) in an IPO on Shanghai’s Star Market.

BGH to buy Australia's Village Roadshow for $543m

BGH Capital has agreed to acquire Australian cinema and theme park operator Village Roadshow for A$758 million ($543 million).

China's Harbour BioMed raises $103m Series C

Chinese biotech start-up Harbour BioMed has raised $102.8 million in Series C funding. It comes four months after it closed an extended Series B round of $75 million.

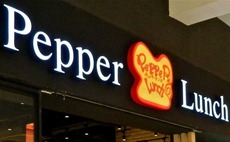

Deal focus: J-Star maneuvers Japan's restaurant lull

J-Star's acquisition of Pepper Lunch is driven by a willingness to look past COVID-19 dislocations and focus on the long-term fundamentals of the fast-casual dining space in Japan

EQT revises offer for New Zealand's Metlifecare

EQT has submitted a revised offer to acquire New Zealand retirement village player Metlifecare at a lower valuation after facing a legal challenge over its attempt to terminate a previously agreed deal.

Coronavirus dislocation funds: Runway watchers

Southeast Asia has emerged as a hotspot for VC funds targeting COVID-19 dislocation. They are flirting with strategies requiring private equity and short-term value investing skills

Korea commits $1.7b to start-up ecosystem

Korea has committed KRW2.1 trillion ($1.7 billion) to local start-ups in biotechnology and non-contact technologies as part of a KRW5.8 trillion private sector COVID-19 recovery agenda.

Singapore's Vulpes launches COVID-19 opportunities fund

Singapore-based Vulpes Investment Management has launched a special opportunities fund of undisclosed size targeting VC-backed companies struggling with the effects of COVID-19.

Coronavirus & fundraising: Comfort levels

Personal contact with the manager remains a prerequisite for LPs when making fund commitments, but to what extent will recent travel restrictions change the parameters for on-site due diligence?

Singapore VCs commit $204m in COVID-19 support

Singapore government-connected VC investors Seeds Capital and EDBI have committed S$285 million ($204 million) to support local start-ups facing challenges related to COVID-19.

Korea GPs back $281m Malaysia VC fund

Korea’s SK Group, Hanwha Asset Management, and KB Investment have contributed to a MRY1.2 billion ($281 million) VC fund launched by the Malaysian government.

Deal focus: IMM overcomes distancing disruption

Health and safety was a priority when IMM Private Equity negotiated a $413 million carve-out of Korea Kolmar Holdings' drug outsourcing business against the backdrop of COVID-19

Coronavirus & due diligence: Split screen

Finding the right balance between offline and online communication for completing due diligence processes is a tricky endeavor for PE and VC investment professionals in Asia

EQT faces legal action after scrapping NZ aged care deal

New Zealand retirement village operator Metlifecare has filed legal action aimed at forcing EQT Partners to fulfill an acquisition that it decided to terminate due to COVID-19.

BGH submits revised offer for Australia's Village Roadshow

BGH Capital has been granted a four-week period of exclusive due diligence by Village Roadshow, having submitted a revised bid for the Australian cinema and theme park operator that is 40% lower than its original offer.

Coronavirus & Vietnam: Hobbled winner

A successful COVID-19 containment plan has underlined Vietnam’s status as a leading investment destination in Southeast Asia. GPs are impressed but still hamstrung

Coronavirus thwarts PE partial exit from Indonesia's BFI Finance

Italian lender Compass Banca has abandoned its purchase of a 19.9% stake in Indonesia’s BFI Finance from TPG Capital and Northstar Group, citing economic disruption created by the coronavirus outbreak.