Coronavirus & due diligence: Split screen

Finding the right balance between offline and online communication for completing due diligence processes is a tricky endeavor for PE and VC investment professionals in Asia

Two years ago, Permira bought I-Med Radiology Network, a medical imaging service based in Australia, where the private equity firm has no permanent presence. It took a team of six, comprising executives from Hong Kong and a few European offices, to Sydney for about 10 days of on-site diligence. There were several return visits as the auction progressed.

Now Permira is exploring uncharted territory. Once again, the GP finds itself pursuing a deal in a jurisdiction where it has no office, but coronavirus-related travel restrictions are preventing executives from flying in. While locally based lawyers and advisors offer some support, Permira is relying on videoconferencing to much of its due diligence, including meetings with the target company management.

"I don't think you can get 100% of what you would normally get, but we were surprised by how much we got and how we were able to make progress without ever having physically met the cast of characters nor having been able to visit facilities," says Alex Emery, head of Asia at Permira. He adds that the vendor went as far as to schedule no-agenda "chats" with senior executives to help build up some personal rapport.

It begs the question as to whether PE and VC investors could sign off on deals with fewer face-to-face meetings – or perhaps even none whatsoever. As activity gradually returns to markets across Asia, at different speeds and to different extents, industry participants will assess what aspects of due diligence can feasibly be performed without physically being in the room. Some have been done this way for years; others might be added to the list.

Remote working has become a feature of all business activity in recent months and this enforced change is likely to have a lasting impact on how people approach travel, pursue process efficiencies, and find ways to collaborate. Private equity is no exception. Indeed, if a second wave of infections hits Asia, investors might be forced to adapt or watch their deal pipelines run dry.

Reengagement points

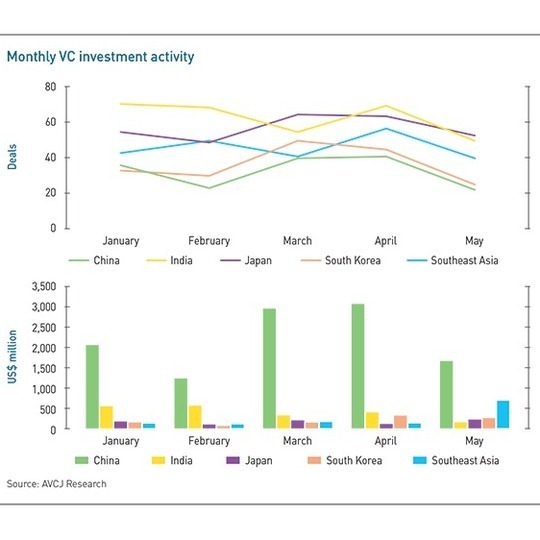

It's early days but Asian venture capital investment is bouncing back, arguably helped by virtual tools. In February, a paltry $1.3 billion was deployed. Last month, it rose to $3 billion, although China accounted for more than half. Private equity activity, meanwhile, rose from $4.1 billion in February to $6.7 billion in May. This was largely due to a disproportionate jump in India. Most of the traditional buyout markets remain relatively quiet.

For many of the deals that have been announced, due diligence started before COVID-19 restrictions were introduced. The transaction Permira is currently working on does not fit this profile, but it is to some extent exceptional. It is an auction run by investment banks, so there is no need to cultivate relationships with founders wavering on a sale or wade through non-standardized documentation. English is also the first language of those involved.

The need for a face-to-face meeting goes both ways as well. "Most companies are not going to just say here are all my financial statements, management accounts and the secrets of my business," says Kyle Shaw, a managing director at Shaw Kwei & Partners. "The company needs to feel comfortable that people at the PE firm will be discreet and want to get the deal done. They need to know it will be somebody they want to spend time with."

With start-ups, there is generally less to work from, perhaps not much more than proof of concept. And then some businesses are cloud-based, with little in the way of physical assets. However, investors caution that the lack of relevant financial data on early-stage start-ups means it's important to get in front of the key persons. A VC must be convinced it has backed the right entrepreneur, especially one who can rally a team, from the outset.

"You have to be local and talk, meet, dine and drink with the people every day to get to know one another. From February to the middle of March, it was difficult to build that kind of connection with a new entrepreneur just through a laptop screen," says Wei Zhou, a managing partner at China Creation Ventures (CCV). "During those two months, our team was actively working on deal opportunities we had uncovered in the past or entrepreneurs we know who are trying something new."

That does not mean workarounds are impossible. CCV was busy in the lockdown months even if the work involved more video calls, split-screen conversations, and e-mails of scanned copies of signed documents.

It remains to be seen how this pans out in other markets. The spike in activity in India last month was driven by deals involving a single company – Reliance Industries' Jio Platforms business – and it masks a troubling fact. Given low testing rates nationwide and the fact that densely-packed Mumbai, the country's financial hub, is the epicenter for the virus, a return to normalcy will take a while. But investment professionals have their fingers on the trigger.

Srikrishna Dwaram, a partner at True North, says his Investment committee has given preliminary approval for a current deal in the expectation that meetings with senior management held at a later date will confirm the investment thesis. "If the situation persists for six months, will we do the deal? At this point, my sense is we will not, but we are also learning and maybe things will evolve," Dwaram observes.

At the end of the week, India is expected to come out of a two-month nationwide lockdown. The situation is similar elsewhere with smaller markets like Vietnam and Thailand and more developed jurisdictions with strong public healthcare systems – such as Australia, Singapore and Hong Kong – expected to recover faster.

The remote way

In the meantime, people have gotten used to a new normal. "We've become more efficient because we don't have to wait for face-to-face meetings," says Jun Tsusaka, founding partner at Japanese private equity firm NSSK. "For the legal and accounting due diligence, for example, maybe there were 20-30 in-person meetings and it will go down to five. You already have virtual data rooms, so a lot is already being done remotely."

The past few months have allowed due diligence specialists to take stock as well. Much of the typical financial, legal, and personal integrity diligence can be done remotely. For years, background checks on founders and management teams have relied on a combination of phone calls, reference checks, adverse media research and database mining. Environmental due diligence continues to require on-site inspection although a lot can be done within a 24 or 48-hour window with careful scheduling.

Due diligence specialists are also using alternative data to supplement financial analysis. This is especially important during a period when broader economic volatility complicates efforts to make an accurate judgment of a company's financial health. For example, footfalls and correlation between stock-keeping units give deeper insights into an offline retail operation, according to Xuong Liu, a managing director at Alvarez & Marsal. Meanwhile, online activity and conversation rates can help in the analysis of e-commerce businesses.

"In the past, we were not trained to make full use of such digital information. Working in conjunction with our in-house data science team, we are developing that analytics capability," says Liu. "It's incredibly detailed at almost the transactional level and so our use of data analytics is increasing, partly driven by the increasing number of such deals."

The co-founders of Bobobox, an Indonesian capsule hotel chain, saw this play out in real life. Data relating to bookings and positive customer survey responses validated the start-up's decision to pivot, which in turn helped win funding from US-based Mallorca Investments and Horizons Ventures, a VC unit affiliated with Hong Kong billionaire Li Ka-shing. A deal was signed at the end of May. Indra Gunawan, co-founder and CEO of Bobobox, has yet to meet his new investors, although his co-founder did catch up with Horizons in January.

The story was a lot different earlier. As lockdown measures led to a fall in domestic travel, investors were concerned. "When COVID-19 came here, the discussions turned to our strategies to deal with it. Every day, there was a Zoom call meeting with our investors to monitor and validate our hypothesis and validate our guests' experience," says Gunawan.

Sensing rising demand for long-term stays from Indonesians living in suburbs and those with hygiene-related concerns at their current residences, Bobobox rolled out a contactless check-in policy, same-day cancellations and increased cleaning measures. This swift action caught Mallorca and Horizons' attention, even though they were outside Indonesia.

Reliable information?

However, the use of non-financial data needs to be considered carefully. "As the landscape of alternative data sources continues to increase and grow more complex, vetting the authenticity and quality of these data sources will become more important in gaining transparency in these businesses," adds Alvarez & Marsal's Liu.

The discovery of large-scale fraud at private equity-back coffee shop chain Luckin Coffee, in particular, has become a somber reminder. The Chinese company, which has grown from nothing to more than 3,500 stores within two years, admitted that RMB2.2 billion ($310 million) worth of sales booked in 2019 were fabricated. Some of the misbehavior predates Luckin's NASDAQ IPO last year, for which third-party due diligence was required.

"We saw it with Luckin Coffee. It's important to go on-site and talk to customers and suppliers," says Junchao Fu, co-founder of Smart Fabric, a start-up that wants to digitize China's textile industry. "In the past, many funds made judgments based on gross merchandize value but that only forms part of a company's real value."

Global investigational services firm Berkley Research Group (BRG) has seen an uptick in inquires of late as clients worry that struggling companies might look to hide their shortcomings in financial data to secure much-needed capital. Apart from founder or company background-related concerns, BRG is vetting the financials of companies.

"Unfortunately, there is still too much reliability on desktop due diligence, particularly in emerging markets where there is a lack of information generally," says BRG managing director Stuart Witchell. "A bigger component should involve interviews with reliable senior sources that have access to the information you are looking for."

The situation is compounded by the fact that the economic outlook is difficult to gauge. BRG is also receiving requests to check supply chains in China that had previously been shut down. Regulatory risk is a concern for many clients.

"Today, it's such an uncertain outlook with the coronavirus, geopolitical tensions and trade tariffs that forecasting future demand and supply chains and figuring out how the competition is behaving is a real challenge," says Shaw of Shaw Kwei. "Anybody doing due diligence today is probably spending at least twice the effort to understand the business and what the impact will be going forward. "

For private equity firms willing to do the work, those with a decentralized model will be well-positioned. "A lot of people used to say, ‘Why do you have so many offices?' Now they might say that a bit less," comments Rodney Muse, a managing partner at Navis Capital Partners, which has six offices across Southeast Asia and Australia. "I want to use it as a tactical weapon."

Navis is willing to compromise on its traditional practice of flying the management of target companies to Kuala Lumpur for an interview session with the entire investment team. That can now happen by video, even though watching people operate under pressure in a foreign environment offers plenty of insights. However, without on-site diligence by local executives and a fly-in visit by Muse and co-founder Nick Bloy, deals will not get done.

Similarly, private equity firms that have a presence in Hong Kong and target investments in China are not as hamstrung by travel restrictions as their Singapore-based peers who cover multiple markets within Southeast Asia. CCV's Zhou adds that his partners have leveraged personal connections to set up temporary bases in different cities and ensure normal processes, including in-person meetings, are followed. Even now, Beijing returnees have to abide by a strict 14-day self-quarantine.

Beware the flood

Under the most optimistic scenario, private equity investors admit it might be weeks before they can travel more freely. This may coincide with economic stabilization, making it easier to establish fair valuations and encouraging companies to engage in negotiations. When that happens, industry participants worry that haste to meet annual investment quotas might lead to looser diligence processes.

"It's going to be a race to deploy capital and I hope investors decide to be the tortoises, not the hares," says BRG's Witchell. "But you need a balance between the two. If you are going to be a tortoise, you may miss out on opportunities."

If it takes longer for international flights to return to normal – not unlikely given countries have yet to establish processes for inbound travel – virtual meetings will remain part of the fabric. There is only so much that can be achieved remotely, but temporary changes in habit could lead to longer-term alterations in perceived best practices. For example, Permira's Emery suggests there could be hidden benefits in conducting more initial meetings online.

"Remote processes might even allow companies to test out some potential buyers that would otherwise be too busy," he says. "You might be working on too many transactions and can't squeeze in that flight to Kuala Lumpur to meet a company but by working remotely you can participate in the first round and get a better understanding of business."

Perhaps taboos around virtual communication will be reconsidered – or the elevated importance of physical meetings called into question – even faster within the venture capital community. J.P. Gan spent more than a decade with Qiming Venture Partners before leaving to establish Ince Capital Partners last year. He notes that Qiming had 15 associates traveling all over China meeting companies. These could have been done remotely, if it weren't for people's psychological need to meet in person.

Gan is already detecting change in this regard. "I think in general people are getting more comfortable [with remote interaction]," he says. "It's just a matter of time before people do investments remotely. And I like it – it's more efficient."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.