Coronavirus & infrastructure: Trial by fire

Conservative investors who trust infrastructure for its stability have received a rude awakening with COVID-19. With appetite for the asset class unchanged, it’s time to get smart about risk

Macro events normally strike the most vulnerable parts of the economy first, chipping away at banks, factories, and retail until, after months of losses, the sturdier stuff of infrastructure finally sees an impact. COVID-19, however, is not playing by the rules.

This time, infrastructure, and transport assets in particular, took the first and hardest hits. In a sign of how the asset class is integral to every industry, the reversal has proven an effective way to shut down the global economy quickly. Whereas the onset of the global financial crisis (GFC) was characterized by several quarters of gradual contraction, COVID-19 realized similar damage within weeks. The best analogy is a military campaign: hit the supply lines first and the rest crumbles.

The consequence is a wake-up call for LPs. Infrastructure became a popular asset class following the GFC precisely because it diversified their risk away from volatile public equities, offering stable cash flows from yield-generating assets underpinned by inelastic demand, often with inflation-linked contracts, in a low-interest-rate environment. For two decades, asset managers were able to sell infrastructure products in mature markets as solid and unspectacular – but virtually unshakeable – performers because that's what they appeared to be.

COVID-19 shatters that perception by providing the first evidence of strong risk. After listed infrastructure contorted wildly in the first two quarters of the pandemic, regulators globally, led by Europe, starting asking new questions about valuations and losses in the traditionally more stable private sector. LP risk teams have now followed suit, giving rise to an unprecedented active and widespread conversation about where money is going and why.

"Previously, a typical investor would put infrastructure in a separate bucket in their portfolio and assume there was no correlation with anything else," says Frederic Blanc-Brude, a director at EDHECInfra. "Now there's an understanding that there are correlations with the economy over a long period, it should help the asset class grow. COVID-19 is not a good moment for the world, but it's probably going to be a turning point in terms of the maturity of infrastructure and the level of information that will be required to invest."

Better informed?

EDHECInfra, a research institute backed by the Singapore government, attributes a tendency for flying blind in infrastructure not only to a historical lack of evidence around risk but also a lack of data. It estimates that information scarcity has resulted in only 30% of infrastructure investors using market-relative benchmarks to value assets. Within this group, 75% are benchmarking against listed infrastructure rather than more reliable peer group appraisals.

The gradual emergence of new project classification standards and benchmarking tools should allow LPs to better clarify counterparty strategies in the context of infrastructure-sensitive events such as COVID-19. This may be especially useful for institutions such as pensions, insurance companies, and sovereign wealth funds in terms of decoding traditionally data-light language around allocations, project type and expected returns.

"It's not like investors didn't know about the differences between infrastructure sectors, but it was fuzzier before in terms of which asset was in which category and what exactly was the difference between the categories," Blanc-Brude adds. "Most of it was referred to using terminology from private equity and real estate such as ‘core' and ‘core-plus' but these things are not very well defined. It made for very unclear investment proposals."

Meanwhile, GPs traditionally focused on operations, financial restructurings and deal-level specifics will be more informed on portfolio-level issues around diversification and balance. The increasing sophistication – at both ends of the fund management equation – appears set to maintain appetite for the asset class during its most volatile period in memory, even in the most rattled sectors.

Ontario Municipal Employees Retirement System (OMERS) offers a case in point. The Canadian pension's infrastructure arm has about $83 million in assets under management, 19% of which is in infrastructure, and plans to increase this exposure to 22.5% by 2025 despite the pandemic. It was active in Asia Pacific as recently as July with the acquisition of a 20% stake in Australian electricity network operator TransGrid in a deal estimated to be worth around $1.4 billion.

This has coincided with a renewed show of confidence in a broader regional strategy. In August, Prateek Maheshwari, a managing director in OMERS' London office was appointed as head of infrastructure for Asia. He will relocate to Singapore next year, leveraging a background that includes helping with GIP's $5 billion acquisition of pan-regional platform Equis Energy, the largest-ever renewables deal in Asia.

Acknowledging the hardships befalling transportation, Maheshwari expects the sector to be one of his primary focuses going forward. He will look especially closely at India, where the fund bought a 22% stake in toll road operator IndInfravit Trust last year for about $120 million and is tracking a significant rebound in highway traffic following an initial shock.

Maheshwari, who sits on the boards of OMERS-owned London City Airport, also sees light at the end of the tunnel for airports, although timing the rebound is not yet possible.

"The logistical constraints [of COVID-19] on diligence are an issue, but as we're seeing things open up, a lot of that is easing," he says. "There are also sectors that have shown remarkable resilience in the face of COVID-19 where deals are going on. Renewables is one. There may be certain sectors like airports, where for the time being, it's difficult to get your head around a business plan, but that doesn't mean we don't believe in their long-term prospects."

According to Australia's AMP Capital, energy and transportation are the worst-performing infrastructure sectors in terms of listed assets this year, with each posting a 20% fall in returns up to end-June. This reflects a steep drop in the first quarter and a substantial claw-back in the second.

Energy was the best performer in the second quarter, gaining 20% in terms of listed-asset valuations as cooler heads began to understand the risk of lower power usage by a weaker industrial sector. At the same time, there are concerns about an oil price war between Saudi Arabia and Russia and reduced oil output from the US.

Consequently, market share for associated gas – which is produced when oil is drilled – has fallen away relative to dedicated, non-associated gas projects. AMP says this is driving some basin-by-basin dynamics and creating investment opportunities in non-associated gas projects in the US.

The long view

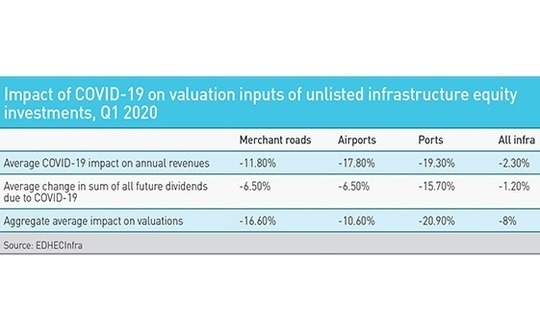

EDHECInfra estimates that the average private infrastructure project has seen an 8% decline in valuation across the first two quarters of the year, but that the falls are noticeably worse in transportation. Merchant road, airport, and port values are down 16.6%, 10.6%, and 20.9% respectively during the first half.

Anecdotally, airports are reporting revenue declines as much as 95% while roads are enjoying a return to form, especially where heavy vehicle traffic can be optimized over commuter traffic. The idea is that as work-from-home protocols dent individuals' road use, a corresponding lift in e-commerce is increasing demand for trucking. Feedback of this kind hinges utterly on local variables, most importantly the severity of lockdown rules, but there appears to be a general expectation that roads will be first to recover in transportation.

For investors free of exit horizon expectations, however, airports can claim an advantage in longer timeframes. These assets can remain relevant for 50-60 years, whereas road concessions typically last only 20-25 years. This reduces the proportional impact of a temporary event like COVID-19 on airports relative to roads.

There is also reason to believe that airport resilience will be exaggerated in Asia, with China, India and Indonesia having laid plans for hundreds of new airports. Importantly, these will mostly serve the relatively resilient domestic travel segment.

"Investors are unlikely to look at airports until the path to pre-pandemic tariff levels is clear. On most indications, it will take between 12-24 months to reach that level of normal operations," says Sharad Somani, KPMG's head of infrastructure for Asia Pacific. "Once the roadmap to recovery is clear, we will see some good airport pipeline projects coming to the market. Investors with view of 10-15 years should be keen on investing in transport projects in general given these projects will be fundamental to economic growth."

AMP believes transportation's vulnerability to changes in traffic volumes are significant but overplayed in listed markets. It is therefore looking to allocate more capital to the sector while pulling back on areas where success during COVID-19 has led to high valuations such as communications. The firm's latest global infrastructure fund, which closed earlier this year at $3.4 billion, has already made at least one investment in this space with London Luton Airport.

Other areas where virus-related mispricing is seen as creating an opening include utilities, where a 10% fall in returns globally in the first two quarters is not considered linked to fundamentals and exposure to volumes volatility is differentiated by geography. AMP is currently looking to reallocate its UK utilities exposure to the US to take advantage of a mismatch. UK utilities are considered generally less exposed to volumes and consequently price-stable, whereas US utilities are more exposed and therefore available at a discount.

"We're very aware there is a lot of short-term money flowing in and out of markets, particularly at the moment, and the impact that could be having on different infrastructure sectors and regions. So, we're monitoring our portfolios on a day-to-day basis as to how valuations compare to share prices," says Joseph Titmus a portfolio manager and analyst focused on global listed infrastructure.

"We don't have a crystal ball, but we do incorporate expectations of when the downturn might start to recover in our analysis. We believe in some cases, the market has been too pessimistic. In others, there have been some positive tailwinds but perhaps more so in terms of sentiment than fundamentals."

The right fit

Moves by players such as AMP and OMERS bode well for the asset class in terms of investors maintaining diversification when flailing categories like airports present a temptation to adopt less holistic targeting strategies. The prevailing feeling is that just because certain sectors do not necessarily benefit from safety nets such as a long-term revenue contract with a creditworthy counterparty, it doesn't mean they're untouchable. It's merely a matter of understanding what they are and where that risk profile fits in the portfolio.

Indeed, there is a view that transportation infrastructure, despite being the most wounded sector, could be the key to a broader economic rebound in Asia. For much of the region, shifts in global supply chains brought about by geopolitical tensions are the ticket to GDP recovery. Manufacturing supported by logistical and transportation-related infrastructure, including airports, roads, and ports, could be a major driver of employment creation post-pandemic.

This will not be achievable without new strides in privatization policy in developing markets. There has been significant traction in areas such as asset recycling, whereby governments sell brownfield assets to private investors and put the proceeds into newer projects. India has leveraged mechanisms in this vein to bring international investors – including OMERS – into its toll road space. Indonesia has launched a similar program, known locally as a limited concession scheme.

However, countries that have a mixed track record dealing with virus containment in recent months have inspired little confidence among investors that they will be able to quickly accelerate their privatization agendas.

The likes of the World Bank and the Asian Development Bank will lobby hard for the necessary changes in the coming months. But even in jurisdictions where government decision-making during the pandemic has proven savvy, doubts remain that effective frameworks can be put in place in a reasonably timely manner.

Vietnam the regional leader in coronavirus containment, for example, has historically equitized state assets via capital markets, affording little influence to sophisticated investors, local or foreign. There is a view therefore that it may fail to parlay its COVID-19 success into a private sector-backed, logistics infrastructure-driven rebound.

"When we come out of this pandemic, a large proportion of the economic recovery will be driven by logistics infrastructure and global trade. This crisis is an opportunity for governments to make some tough decisions in the interest of economic sustainability," says KPMG's Somani. "The biggest challenge is that some countries are going through both economic and political stress. Countries need a national consensus on the path to recovery. Multilateral institutions are expected to play a key role in catalyzing such economic transformation."

Sustainability agendas

The problem with confidence in infrastructure assets experiencing a temporary spell of COVID-19 setbacks is the possibility that the disruption is not so temporary after all.

Notions that the pandemic could amplify existing trends toward more climate-conscious project development is not farfetched. Sustainability compliance will be necessary for many struggling Asian markets to join global supply chains, and public acclimation to locked-down lifestyles could translate into broad support for policies that reduce travel for environmental reasons.

Yet these views tend to lose credibility with investors – perhaps especially those already committed to transportation – when the suggestion comes up to prepare for permanently lower travel volumes. "I don't think infrastructure investors are planning to adapt their investment plans according to very long-term and perhaps not very realistic scenarios," says one industry participant. "The question infrastructure investors have is more ‘What kind of project is going to run out of cash in the next six months, and what can we do about it?'"

Still, infrastructure investors by their very nature must think in decades, and the convergence of existing sustainability trends and COVID-19 social behavior upheavals makes a powerful case that big changes in infrastructure usage and design are on the horizon. This is perhaps especially true in terms of how quarantining, social distancing, and remote working could influence urban environments. If the trend toward increasing urban density will not change, cities will have to.

Kotchakorn Voraakhom, founder of Thai landscape architecture and urban design firm Landprocess believes COVID-19 is going to be a longer global fight than most investors seem to recognize and will require new thinking in infrastructure.

She is tracking an uptick in public-private partnerships around sustainable infrastructure projects in Thailand in recent months but notes much work needs to be done around shifting investor and policymaker mindsets to include the world beyond the property line of any particular development project.

This means applying a lens of public health considerations to future infrastructure designs and thinking about urban green spaces not as a luxury but a basic need. In the case of tourism-related infrastructure – a post-pandemic imperative for the Thai economy – it could also entail creating trust with travelers through projects with virus-safe features.

"Whether it's in green roof technologies or repurposing wasted rooftop space, green design solutions are available and affordable, but few choose to invest in them because of our addiction to maximizing profit," Voraarkhom says. "In our world right now, it should be about returns on social equity and impact on even distribution of development. The pandemic has urged us with an opportunity to redefine what kind of impact we want and need from our decisions and investments. It's adapt or die."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.