Coronavirus & Vietnam: Hobbled winner

A successful COVID-19 containment plan has underlined Vietnam’s status as a leading investment destination in Southeast Asia. GPs are impressed but still hamstrung

At the jurisdictional level, the trade-off between public health and economic health has proven the most difficult calculus of the COVID-19 outbreak. Too much lockdown to protect the people can slow business activity to a point that is difficult to speed back up, resulting in a different kind of long-term social pain. Too little lockdown and the unthinkable could quickly become reality.

Vietnam might be the only market in Southeast Asia to have gotten this balance right. The country's partial lockdown and targeted testing, quarantining and track-and-trace program are believed to have helped a population of some 100 million limit infections to only 300. No deaths have been associated with the virus.

"It was easy to be caught up in that if you were in the wrong restaurant or the wrong plane, or at a meeting with the wrong person, you could quickly find yourself and your family being taken away to camps," says one industry participant. "But that worked."

This approach contributed to the IMF's projection that Vietnam would see the strongest GDP growth in Asia this year at 2.7%. The only other ASEAN countries expected to eke out gains are Indonesia and the Philippines with 0.5% and 0.6%, respectively. The most developed economies will be the hardest hit; Singapore is tipped to contract 3.5% this year. This pattern casts a strange light on Vietnam's rapid modernization, whereby warmly embraced trends around increasingly sophisticated consumerism and industrial capacity could be the main checks on recovery.

"The biggest risk now is what's happening on the external front on the export side and how much of Vietnam's exports can weather the global downturn," explains Khoon Goh, an economist and head of Asia research at ANZ. "Vietnam is more vulnerable now that it has become an export-driven economy, but by the same token, that has seen quite a large increase in FDI [foreign direct investment] flows in the last few years, and these are sticky investments."

Positive outlook

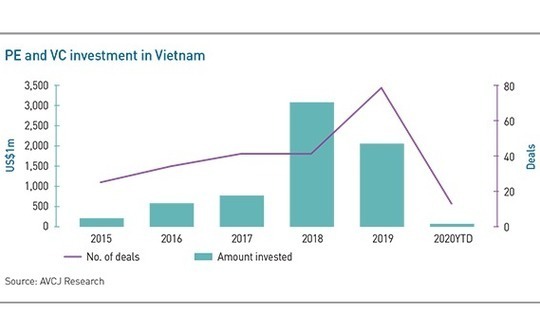

Private equity has played a significant role in this story. Investors deployed about $3 billion in Vietnam in 2018 and $2 billion in 2019, compared to a range of $210-$770 million during the prior three years, according to AVCJ Research. Activity to date this year has been limited to $74 million, with most investors pointing to practical deal execution difficulties rather than concerns around the macro outlook.

Still, the industry is on alert. Portfolio companies will be sensitive to the most directly consumer-relevant metrics, including net salaries and unemployment. If exports take a big hit due to softening global demand, it will flow through to the jobs market and discretionary spending. This could be aggravated by a general tendency toward the conservative in household budgets; the switch from spending to saving could be fast and difficult to reverse.

Confidence is building, however, as data trickles in. ANZ's preliminary numbers for April, for example, suggest Vietnam's exports fell by only 2.5% month-on-month compared to double-digit slides in other export-focused economies such as Korea. Part of this durability can be attributed to an aggressive push to establish free trade agreements in recent years, while part may be explained by a contrarian view on whether the diversification of supply chains away from China is actually helping Vietnam transition to higher-end manufacturing.

"While Vietnam has been in the business of exporting products like mobile phones, the actual value-add hasn't been that high," Cleine says. "A lot of the components are coming from elsewhere in Asia, and Vietnam is just the assembly point. So a drop in global demand isn't necessarily going to massively impact the domestic economic situation."

Global investors naturally have the best vantage point for appreciating these dynamics. EQT, which follows a thematic investment strategy focused on technology, healthcare and education, sees Vietnam as being in a good position to recover from COVID-19. The firm aims to leverage its experience with multiple crises across different markets to help adapt and future-proof its existing portfolio in the country.

EQT's standout investment here is ILA Vietnam, a local leader in the premium education space. In order to maintain customer engagement while physical classrooms were closed, the company launched two online channels – ILA@Home and ILA@Live – that are said to have received positive feedback from parents and students and strong participation rates.

The most interesting takeaway in this case relates to ILA's success as an upmarket service at a time when premium and luxury categories are expected to be hardest hit. Brian Chang, a Southeast Asia-focused partner at EQT, believes that Vietnamese consumers will continue to become more sophisticated and discriminating despite the pressures of the downturn and that the companies courting them must do so as well.

"Whilst COVID-19 poses severe challenges to societies and businesses, it also reveals and highlights to customers and investors the differentiators among companies in the same industry," Chang says. "Those with a greater understanding of what customers value at different times, and the ability to adapt and offer high-quality products and services will emerge in a better position."

Darwin's way

Bert Kwan, a managing partner at BDA Capital Partners, compares the latest stress-testing of corporate Vietnam to the dotcom shakeout of the late 1990s, when the weakest players were exposed and those able to survive on minimum funding defined the most prospective sectors. Most of the companies BDA is tracking have some online capability, but pure offline businesses are also under consideration. What they all have in common are strong, data-driven management teams. Areas of interest include the usual coronavirus survivors such as logistics and healthcare, but also restaurants if they are able to scale profitably post-virus.

"We're also going back to basics on some level," Kwan says. "We've become even more focused on businesses where our capital can fully fund the business plan. Vietnam continues to be an attractive place to invest in the medium to long term, but it's a little bit too early to tell whether the broader economic disruption from the virus is going to reduce the amount of capital available in the near term for emerging markets."

Optimism on this point has flourished in the past three weeks as Vietnam has reclaimed its business sector with the lifting of social distancing rules and a series of lockdown relaxations. Bars and nightclubs were the latest segment to reopen last week. Restaurants, banks, shops, and offices are now all trading normally.

Hope has persisted even in tourism-related businesses following a recent holiday weekend that saw significant domestic travel. High-level talks around potential "travel bubbles" between Vietnam and other countries with well-managed coronavirus situations have added to the confidence.

Hong Kong-based Excelsior Capital Asia seems likely to agree. The sector-agnostic, middle-market investor, which is primarily active in North Asia, expects Vietnam's consumer sector to struggle in the medium term but sees ongoing upside in industrial relocation. The firm's only investment in the country, wood products manufacturer Tekcom, has been able to recruit new staff relatively cheaply since rising unemployment in the suppressed consumer space has created labor availability. This capacity is being leveraged to service a rise in demand for building materials among customers steering supply chains away from China.

"For many companies, Vietnam was part of China-plus-one strategy, but now with the trade war and COVID-19, alongside improvements in Vietnamese infrastructure and macroeconomic growth, it's become a more concrete decision for strategic investors," says Hoang Xuan Chinh, a managing director at Excelsior. "It has also attracted big names, making it easier for many to base their decisions."

An issue of access

New foreign investments targeting this trend will continue to face due diligence difficulties, however, as long as Vietnam's national borders remain shut. There is a willingness to work with third parties that have teams in-country to access the expected post-virus story, but the relative lack of accountability that comes with such an approach has clearly proven too problematic for most. According to AVCJ Research, 98% of PE and VC investment came from foreign players in 2019. That figure has dropped to 65% so far this year.

"Deals with foreign and regional investors are still happening because the Vietnam economy is looking like it's going to see robust growth over the next 6-12 months," says KPMG's Cleine. "Usually they fly in and do due diligence hand in hand with in-country organizations like ours, but now that physical element has to be completely outsourced. That's sometimes true even for investors with offices here because there was a lot of repatriation in the weeks before the borders closed, and for now, they can't get back in."

Domestic operators may also be better placed to shepherd existing investments through COVID-19 thanks to their immediate access and familiarity around fast-changing local circumstances. VI Group, which has taken to assessing its portfolio in terms of pre- and post-virus revenue as opposed to quarter-by-quarter, reports that many of its brands have done better than budget. This is partially due to large exposures in last-mile delivery and retail related to panic-buying, but there have also been some surprise winners in areas like mother-and-baby and home furnishings.

David Do, a managing director at VI Group, notes that companies with a strong delivery or e-commerce component are currently at 70% of their January revenues. If these operators can follow the recovery arc of their Chinese counterparts, they'll be at 85% in about six weeks. But this may only be achievable with a hands-on approach to rewiring companies for an increasingly remote-operated business environment, even when digital capabilities have already been established.

VI Group is well versed on this point. It implemented Vietnam's first enterprise resource planning (ERP) system for use by restaurants. The ERP and a loyalty app have now been launched across a portfolio of three quick-service restaurant chains. These innovations would be advisable in any pandemic-shaken market, but they may be more feasible in Vietnam. That's because the deployment of IT professionals, like everyone else, is currently limited by national boundaries, and Vietnam already has all the knowhow it needs at home.

"We've been able to invest in a lot of technology upgrades in companies not just because we're doing a lot of control deals, but because the talent is available. I've always been shocked by the money that's gone into other parts of Asia where they just don't have enough software developers," says Do, who previously served as a managing director in charge of global technology strategy for Microsoft. "That's a huge advantage in Vietnam versus other markets and a unique investment angle. It means Vietnam's ability to go digital during a lockdown is inherently better."

This advantage could translate into a parallel opportunity for technology investment, especially for investors that cut across the value chain of small to medium-sized enterprises and the start-up IT suppliers that often service them. VinaCapital, which has interests in Vietnam spanning middle-market industrials and early-stage technology, sees opportunities in the current environment around business efficiency upgrades and improving convenience for remote users.

"There will be higher demand for SaaS [software-as-a-service] and cloud service opportunities – solutions to minimize paperwork and physical contact, reimbursement apps and digital solutions for accounting, and the growth of contact-less devices for an infinite number of environments – and we are experiencing this with our portfolio," says Trung Hoang, a partner with VinaCapital's VC unit.

Digitization drive

If Vietnam is a particularly amenable market for virus-savvy value-add and synergistic portfolio building, this status could be further enhanced as the longer-term ramifications of COVID-19 sink in. That's because the country's head start in opening for business appears likely to precipitate a rural digitization ahead of the curve in developing Asia.

For example, tech-enabled logistics serving various forms of retail has not yet made much of a market outside of the main cities. But as the country – including regional areas – emerges from its commercial hibernation with a new appreciation for last-mile delivery, the situation could change quickly.

"We see a very rapidly growing consumer demand in rural areas for online only shopping because there's very little modern trade in the rural areas or tier two or three cities," says Chad Ovel, a partner at Mekong Capital. "We're currently scaling some of our investees into these markets. Oftentimes, we see higher average transaction sizes in those locations."

One of these is Vietnam's largest pharmacy chain, Pharmacity, which plans to grow from 328 stores to 1,000 across all 63 provinces by the end of 2021. This process appears to have accelerated with COVID-19. Ovel notes that the closure of separate struggling businesses has facilitated the search for shop-space, allowing 36 new stores to be opened during the peak of the local lockdown in April. Within two days of the government's stay-at-home order, the company built an e-commerce channel and launched a 60-minute delivery service.

All this is not to suggest that Vietnam has been spared the economic pain of the day. GDP growth this year is less than half ANZ's 6.4% forecast, some five million workers were either furloughed or terminated this year by mid-April, and unemployment in the working-age demographic has hit a five-year high of 1.1 million people. But the key differentiator here isn't about the damage – it's about the normalcy.

During a four-day weekend spanning Reunification Day on April 30 and May Day, Vietnamese airlines achieved 70-80% capacity from travel between Hanoi and Ho Chi Minh City. Trips to Danang, an historic port and holiday destination, were at 60-70% capacity. Later that week, the local aviation authority ramped up the recommended flight frequency and removed distancing restrictions.

Investors must now consider an awkward juxtaposition of business-as-usual optics with one of the worst recessions in memory. That will mean recognizing that although this frontier market may have found itself ahead of the curve, these are still early days, and the blue-sky outlook must be approached accordingly. "I actually got caught in traffic on my way home from work," says Ovel. "Things seem to be getting back to somewhat normal although the skies are still clear – the pollution is not back yet."

SIDEBAR: VC perspective – 500 Startups

Eddie Thai, a partner at 500 Startups Vietnam expects domestic consumer demand to largely recover in the second half of 2020, but consumer spending will lag until 2021. That's because it will take time for a rehiring phase to mend a recent spike in unemployment, credit growth is likely to remain dampened, and shuttered businesses could be slow to reopen.

"On consumer demand, Vietnamese people have taken COVID-19 largely in stride, viewing it as a temporary effect rather than a new normal. They are very proud of their nationwide response – rightly so – and point to it as further evidence of Vietnam's strong long-term prospects," Thai explains. "However, converting consumer demand into consumer spending requires capital and spending channels [businesses to take the money]."

This might not be too discouraging an outlook for 500 Startups. By chance, 11 of the VC firm's past 14 deals have eschewed the normally dominant consumer space to target enterprise-facing start-ups. This is seen as a better risk-return profile during the current slump because corporations are more likely to be able to pay for relief solutions than individual consumers.

Thai notes that in the past two months alone, 500 Vietnam's portfolio companies have closed more than $100 million in follow-on funding. "Enterprise start-ups that I think are going to be particularly well-positioned during this period are those that facilitate distributed workforces or otherwise digitize corporate operations as well as those that help companies access new markets," he says.

This is a small market for the US-based seed investor but clearly a priority. Since closing its debut fund at $14 million at the end of 2018, 500 Vietnam doubled the size of its team to 10 and launched the only accelerator under the 500 Startups brand in Southeast Asia. The momentum has reflected a local VC boom that saw investment reach $900 million in 2019, a more than fourfold increase on 2016, according to Topica Founder Institute.

The question is not whether this fledgling parabola will flatten in 2020, but by how much. Thai says overseas investment stalled by travel restrictions will continue to be hampered by an environment where due diligence is still meaningfully dependent on face-to-face interaction. He speculates, however, that there is likely to be a rise in entrepreneurship as COVID-19 creates societal problems that need to be solved and higher unemployment results in people starting their own businesses out of necessity.

"COVID-19 has certainly gunked up the gears for a few months," Thai says. "But between Vietnam's strong public health response and Vietnamese entrepreneurs' experience operating with limited resources, I think the Vietnam ecosystem is better than most others to get things going again in the third quarter."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.