Coronavirus & fundraising: Comfort levels

Personal contact with the manager remains a prerequisite for LPs when making fund commitments, but to what extent will recent travel restrictions change the parameters for on-site due diligence?

The fundraising process for Sequoia Capital's latest China and India vehicles is nearing an end. It has worked much like previous vintages, according to sources familiar with the situation. Sequoia informs existing LPs of the targets and timeline and asks for non-binding indications of interest. Some ask for more than they want in the expectation of being cut back. Two weeks ago, Sequoia informed LPs of their allocations ahead of a final close expected by the start of next month.

Somewhere in the region of $5 billion is likely to be raised across venture and growth funds. It is difficult – though not impossible – for new investors to get access. The status quo doesn't appear to have changed for the 2020 vintage, despite coronavirus-related travel restrictions preventing LPs from visiting local operations to conduct on-site due diligence.

In normal circumstances, Sequoia's approach to fundraising is typical of an established, in-demand venture capital firm and atypical of almost everyone else in the market. Now, though, the gap between haves and have-nots is widening. Unable to combine desktop analysis with intangible evidence derived from looking a senior partner in the eye or gauging the chemistry at different levels in a wider team, LPs are playing safe. Re-ups can be swept through, provided there is no significant change in strategy, personnel, or fund size; but new relationships are much harder to cement.

The International Finance Corporation (IFC) wants to be allocating right now: it isn't held back by concerns about the denominator effect or illiquidity; and part of its mandate as a development finance institution is to offer support in times of difficulty. While re-ups account for a portion of the 25 emerging markets funds IFC backs every year, a fair number are first-time managers that have been tracked for at least 12 months, including several in-person meetings. Diligence by video has become a necessity but it isn't ideal.

"Investing in first-time managers, where the investment professionals haven't yet worked together for a long time, it's about getting comfortable with the team dynamic and alignment between team members. You need to build personal relationships with them – usually over drinks, lunches and dinners. That's difficult to replicate virtually," says Ralph Keitel, a principal investment officer with IFC. "It also depends on who the other LPs are and how much we trust their due diligence. The worst situation is looking to build a new GP relationship with a team you haven't followed over a long period of time and you don't know the people around them."

Leaps of faith

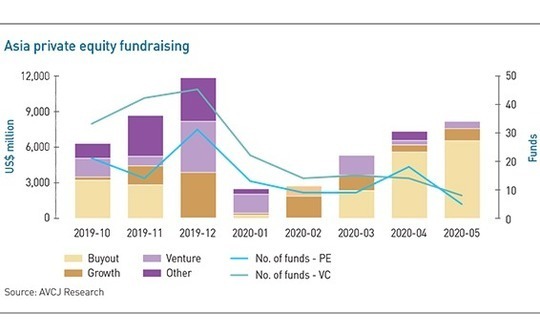

There has been a resurgence in Asia private equity fundraising since January, when less than $2.5 billion was committed. It reached $7.3 billion in April and then $8.1 billion in May, each time bettering the total from October 2019, but the data are deceptive. The number of closes has remained stubbornly low since the start of the year, according to AVCJ Research. A couple of large pan-regional vehicles – notably those from MBK Partners and CVC Capital Partners – have buoyed the headline fundraising number, but most of the due diligence work was completed last year.

Only one manager in region has launched and closed a fund of meaningful size under the shadow of COVID-19. Qiming Venture Partners raised $1.1 billion for its latest China venture capital vehicle, having moved on-site due diligence from Shanghai to San Francisco in mid-February because at that point international investors were wary of coming to China. The senior management spent 14 days in quarantine on arrival in the US, did their meetings, and the fund closed in early April.

"I'll never say never, but it would have to be an extraordinary circumstance where others we know exceedingly well could provide compelling references on the people involved, giving us high comfort on the soft issues," he explains. "PE and VC is a relationship business with a poor signal-to-noise ratio. Differentiating between the merely lucky GPs and truly skilled GPs is hard. For us, spending lots of time with the people running a fund is essential to reading skill, talent and culture."

For most LPs, on-site diligence comes after multiple in-person meetings with key personnel, strategy and track record reviews, reference calls, and perhaps attendance of an annual general meeting (AGM). It can last from half a day to a week, depending on the requirements. The framework may comprise: a general overview; sessions on the macro environment, the current portfolio and historical performance, pipeline investments, and operations and governance; individual and group interviews with team members; and a wrap-up.

Some LPs want to make site visits to portfolio companies, meet pipeline companies, and talk to the manager's local advisors. Others send in separate teams to conduct legal, operational, and environment, social and governance (ESG) due diligence.

The nature of the process is also driven by the size and status of the GP. "Global firms organize due diligence days where 30-40 LPs come in, migrate from one room to another, and then there are interviews where the partners sit on stage for an hour and answer questions. Unless you are a sovereign wealth fund that can drop $200 million, you're not getting any face time with Henry Kravis," one LP observes. "You could probably do all that just as well virtually."

Industry sources say that new investors are coming into KKR's latest pan-Asian fund solely based on desktop due diligence and video calls. Beyond the blue-chip names, it gets trickier. Some small and mid-cap private equity firms in Asia have replicated the entire on-site program online to bridge the gap. There are several obstacles: the technology isn't flawless, with some buffering and crackling; engagement is less fluid, more monologues and dialogues and less group interaction; and it is difficult to build the trust and camaraderie that often comes through in-person interaction.

"It works only where there have been long relationships. If I've known a person for 12 years and he walks in on a Zoom call, a lot of his trust barriers are low because we've always met in person and got on well," says Sunil Mishra, a partner at Adams Street Partners.

In the room?

There is a discernable step-up in gear when an LP conducts on-site due diligence. As one manager puts it: "When you go and see them it's a bit more get-to-know-you, a bit less structured. When they come to you, it's more thorough, a bit more check-the-box." This begs one question asked by several other industry participants: How many of these boxes could be checked without being in the room? If the LP has already met team members several times and achieved that personal rapport – and the GP isn't a first-time manager – perhaps Zoom is sufficient.

"When people come to our office for on-site, they sit in a meeting room and ask us questions. It's not like we have machines where you can see a bunch of analysis fed in one end and a deal comes out the other," observes another Asia-based manager who launched his fund in January. "Most of the LPs we are dealing with found that if you do these things on Teams and Zoom, it works just as well as sitting opposite someone when jetlagged and taking notes."

He compares preparations for a fund commitment to those for a private equity investment. You want to start talking to management well before an investment bank is appointed, because once a formal process begins, everyone is smart enough to know what to say.

Nevertheless, many LPs insist on conducting on-site diligence regardless of any embedded familiarity. Much like an AGM, the deepest insights often come from observations and exchanges on the sidelines, whether it is a chance exchange with a mid-level executive or scoping out the office. In some Asian markets, extravagantly decorated offices have prompted concerns about what management fees are being spent on.

Other investors are required to make a formal diligence trip to get approval for a fund commitment. There are numerous situations in which all boxes have been checked apart from the site visit and the LP has done everything possible – virtually – to get comfortable with the manager. This has led to attempted workarounds such as video calls in which someone walks through the office holding a camera, following the LP's directions, or a trusted third-party performs the necessary checks.

Responses will vary. One middle-market buyout manager has several prospective new LPs working in the data room and hoping that they will be able to get on a plane in the coming months. However, if a final close is nearing and that point hasn't been reached, he expects most of them to pull out. On the other hand, Vincent Ng, a partner at placement agent Atlantic Pacific Capital, has seen LPs proceed without physical meetings, having concluded that the rest of their due diligence is in order and they must adapt to the current environment if they want to continue deploying capital.

"If travel restrictions continue, service agreements that advisors have with LP clients requiring them to meet with GPs in person will have to be reworded and compliance offices will have to adapt," adds Niklas Amundsson, a partner at placement agent Monument Group. "People will have to start underwriting new managers and not just do re-ups. It might not happen this year, but LPs that paused their programs after the global financial crisis and ended up missing out on a couple of vintages that in hindsight were very good will not want to miss out again."

Going virtual

Even if some element of personal contact remains an integral part of due diligence, the strictures imposed in response to COVID-19 are expected to facilitate a tightening up of the process. It is generally agreed that introductory meetings could go virtual, plus several of the subsequent steps that stand in between an LP and a signed off fund commitment. In some cases, legal, operational and ESG diligence is already being conducted remotely.

A host of private equity firms have been forced to switch to virtual AGMs – an unexpected positive for several LPs that spoke to AVCJ. "I've been able to pay attention to the content whereas when I attend in person there are so many meetings on the sidelines," one investor observes. However, he adds the caveat that being based in Asia means he has frequent touchpoints with GPs. For those visiting the region once or twice a year, AGMs can be a useful beachhead.

Moving AGMs online could mean an increasing number of other investor events and some – but not all – ongoing portfolio oversight engagements go the same way. The LGT Capital Partners team in Asia does approximately 1,500 phone calls and meetings a year. Details of these interactions, including the names of the counterparties and the content of discussions, are listed on the second page of investment briefing books. For relationships that cover multiple strategies and products, for example where there are co-investments as well, the information doesn't fit on a single page.

Doug Coulter, a partner at LGT, estimates that half of these interactions are phone calls and half are meetings. In the past few months, that has changed to half phone calls and half Zoom calls. "At a minimum, any LP would want to meet a manager once a year in person," he says. "But what happens to all those other meetings? I'm sure there will be more scrutiny over what a trip is for and whether we really need to do it. Most of our due diligence work for secondaries and co-investment is already done through phone calls."

Holding pattern

Many investors remain in a holding pattern: instructed by their investment committees to hold all commitments until the macro picture becomes clearer, sticking resolutely to re-ups, or working on new relationships in the expectation that either normal business will resume later in the year or internal diligence requirements will change. This has left managers in limbo as well. There have been requests to extend fundraising periods, delayed fund launches, and deliberate slowdowns in new LP engagement in favor of concentrating on those that have already completed site visits.

For GPs already in the market, with a first close under their belts, they might as well press ahead even though momentum is likely to be slower. One manager hit target and was tempted to call a final close, but LPs said they wouldn't mind waiting until the fundraising period expired provided capital is being deployed. Another is short of target and was advised to proceed with prudence, right-sizing investments as if no more money were coming in.

Private equity firms that have yet to reach first closes or were preparing to launch new funds are arguably in the most difficult position. Next moves will be dictated by the appetite of existing LPs and, crucially, their remaining dry powder. No one wants to be out of the market for an extended period with no capital to deploy, especially in a climate of depressed valuations. Survival would likely be contingent on deal-by-deal co-investment or warehousing facilities until the market turns.

As a result, managers are currently taking soundings. "I've received a number of emails from firms saying they will launch their next fund shortly, without giving a date or a number," says one fund-of-funds LP. "They want to soft launch and get a sense of how interested you are. They don't want to formally say they are fundraising because the clock starts ticking."

Where there is that groundswell of existing support, GPs should not hold back. Some funds are already being launched through video conference-based roadshows, targeting new and existing investors. The view is that on-site due diligence can be figured out later. FountainVest Partners will soon follow suit with its fourth China fund. Talks are well underway with existing LPs and a private placement memorandum is expected within a month, according to sources familiar with the GP.

Speed is of the essence because as soon as the situation normalizes a fundraising glut will follow. "You want to get LPs to the point where they have done everything under the sun bar a two-hour in-person handshake meeting," says Atlantic Pacific's Ng. "You cannot rely on getting everything done when the market opens because it will be so busy."

SIDEBAR: Look and listen - Behavioral signals

An assortment of physical tells might suggest that someone is being evasive. Shifting the center of gravity is among the most common: an individual, on being asked a question they don't want to answer directly, buys time to cultivate an alternative response through resetting their seating position, crossing their legs, or even picking a piece of lint off their trouser leg. These tells aren't necessarily easy to pick up while engaging a fund manager via video conference.

"With everyone working on Zoom, you get the verbal side of things but you don't get the non-verbal in the same way you do when in the same room," says David Nydam, CEO of Business Intelligence Advisors (BIA), a US-based firm that specializes in behavioral analysis. "We advocate giving more thought as to what the strategy is around this interaction. What is the critical information you want and how are you going to get it in a way that makes you comfortable with an investment decision?"

When conducting on-site due diligence, LPs like to study how individuals respond to different questions in different contexts. They might ask about who was responsible for certain good deals and bad deals, their expectations in terms of the development of the firm, their feelings about expanding into new strategies, or how they feel about other team members. Whether this happens in formal one-on-one sessions or casual group settings, tone and body language are mentally logged.

Often the best insights come outside the office. "You might be stuck in a traffic jam in Jakarta or Manila for hours and you talk to them about everything and watch how they respond. And you need to see how they interact," says Ralph Keitel, a principal investment officer at the International Finance Corporation. "For example, you ask partner A a difficult question while observing partner B's facial expression as partner A answers."

BIA's methodology is based on techniques developed by the Central Intelligence Agency around identifying levels of transparency and deception in question-and-answer settings. Much of its work involves analyzing public company earnings calls for hedge funds. A Harvard Business School study of 3,000 analyses over eight years found that companies BIA categorized as high risk underperformed the market 59% of the time, while those deemed low risk outperformed the market 61% of the time.

It cannot definitively say if someone is lying. Rather, the focus is on helping clients understand how to ask questions in a non-threatening way, analyze verbal and non-verbal responses, and fashion follow-up questions. To this end, over 30 behaviors have been categorized, of which 20 are verbal and essentially help establish whether the interviewee directly answered the question.

"If you see across the spectrum of behaviors that someone is not being totally upfront, then you need to probe further and ask more questions," Nydam explains. "That rigor is more important in the teleconference world because you don't have that comfort and easy flow that happens organically when you're in the same room as someone."

Even with carefully crafted questions, Edward J. Grefenstette, president and CIO of The Dietrich Foundation, asserts that video conferencing can only take you so far. "By sitting across the table from three partners and watching their interaction closely, you have a better shot at understanding their chemistry and how well they work together in the investment committee to make hard decisions with your money," he says. "I'm not getting that same nuance from a Zoom call discussion, staring at six squares in one dimension. It's just not same, rich human interaction."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.