Southeast Asia

Deal focus: Cityneon proves the show must go on

Singapore’s Cityneon has seen a robust rebound in its live events business, driven primarily by China. The company now has $177 million in new funding and deals covering everything from ancient Egypt to Avatar

Asia technology: Anatomy of a rebound

Tech investment has been on a tear in Asia, with private equity joining venture capital at the party. While COVID-19 has contributed to these dynamics, the revival is rooted in deeper structural change

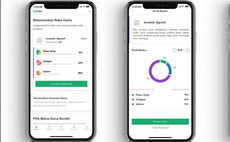

Sequoia India leads $65m round for Indonesia's Bibit

Sequoia Capital India has led a $65 million round for Indonesia robo-advisory app Bibit four months after leading a separate $30 million investment.

Indonesia social commerce start-up raises $28m

SoftBank Ventures Asia has led a $28 million Series B round for Aplikasi Super, which claims to be Indonesia’s first and leading social commerce platform.

Q&A: B Capital's Raj Ganguly

In the past few months, B Capital Group has closed a late-stage fund, entered China, and moved forward with a seed-stage vehicle. Co-founder Raj Ganguly explains the firm’s thinking

Sequoia joins $25m Series D for Singapore's StashAway

Sequoia Capital India has joined a S$33.3 million ($25 million) Series D round for Singapore-based wealth management platform StashAway.

Pavilion joins $177m round for Singapore's Cityneon

Pavilion Capital has joined a S$235 million ($177 million) round for Singapore’s Cityneon, a company that markets entertainment brands by staging elaborate events, displays, and exhibitions.

Novo Holdings joins $80m Series C for Indonesia's Halodoc

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has made its first investment in an Asian healthcare company by participating in an $80 million Series C round for Indonesia healthcare technology provider Halodoc.

GM leads $139m Series D for Singapore EV battery maker

General Motors (GM) has led a $139 million Series D round for Singapore-based electric vehicle (EV) battery maker SES, also known as SolidEnergy Solutions.

Mobility: Gravitational shift

The automotive industry’s VC overtures might be in retrograde, but traditional carmakers are finding new ways to make a mark in mobility innovation. This creates new dynamics for financial investors

Fund focus: Lakeshore remains one of Thailand's few

Thailand is hardly a hotbed of private equity activity in Asia, but Lakeshore Capital has demonstrated an ability to deploy and return capital. It now has a $150 million second fund to put to work

Profile: FCC Partners' CY Huang

Moving from advisor to investor and back again, C.Y. Huang has carved a niche in Taiwan’s M&A and private equity world. But he remains conscious of the need to adapt and evolve

Indonesia's Shipper gets $63m Series B

Indonesian logistics start-up Shipper has raised a $63 million Series B round led by DST Global and Sequoia Capital India.

Alpha JWC seeks $250m for third Indonesia VC fund

Alpha JWC Ventures is targeting $250 million for its third Indonesia-focused venture capital fund, with the International Finance Corporation (IFC) proposing a commitment of up to $20 million.

Singapore's Genesis closes $80m venture debt fund

Singapore’s Genesis Alternative Ventures has closed its debut venture debt fund, which will target Southeast Asia, with $80 million in commitments.

India's PE-backed Pine Labs acquires Malaysia's Fave

Pine Labs, an India payments start-up backed by MasterCard, PayPal, and Sequoia Capital India, has acquired Fave, a Malaysian counterpart also backed by Sequoia India, for $45 million.

Southeast Asia's Grab to merge with SPAC at $30.4b valuation

Southeast Asia-focused ride hailing and local services platform Grab has agreed to go public in the US through a merger with a special purpose acquisition vehicle (SPAC) at an enterprise valuation of $30.4 billion.

Thailand's Lakeshore closes second fund at $150m

Lakeshore Capital, a mid-market private equity firm focused on Thailand and the Greater Mekong region, has closed its second fund oversubscribed at the hard cap of $150 million.

1Q analysis: American dreams

New York makes an unexpected reappearance as the preferred IPO destination for Asian companies; the growth-stage tech investment revival continues; KKR lights up lackluster fundraising environment

Indonesia e-commerce platform Orami sold to local strategic

Orami, an Indonesian mother-and-baby-focused e-commerce platform backed by numerous venture capital investors, has been acquired by Sirclo, a local e-commerce enabler. Financial details were not disclosed.

Vision Fund, BlackRock lead Series D for Singapore's Trax

Trax, a Singapore-headquartered start-up that uses computer vision technology to help retailers link sales to in-store and on-shelf positioning, has secured $640 million in Series E funding led by SoftBank Vision Fund 2 and BlackRock.

B Capital expands into China, raises follow-on fund

US and Singapore-headquartered VC investor B Capital Group has established a China presence and closed a late-stage follow-on fund of $415 million for existing portfolio companies.

Asia-Middle East: Bridge builders

Back-and-forth investment and business building between Asia and the Middle East is a fertile theme for private equity. Such activity appears set to steadily increase rather than boom

Sequoia India raises $195m for latest seed fund

Sequoia Capital India has closed a second seed fund under its Surge accelerator program at $195 million. Like its predecessor, it will target start-ups in India and Southeast Asia.