Asia-Middle East: Bridge builders

Back-and-forth investment and business building between Asia and the Middle East is a fertile theme for private equity. Such activity appears set to steadily increase rather than boom

Abu Dhabi-based Gulf Capital knows its portfolio companies need to break out of the Middle East to become meaningful targets for global strategics. And that's not going to happen by itself.

Since its inception in 2006, the private equity firm has focused on building companies from the Gulf Cooperation Council (GCC) into global leaders, largely via Asian expansions. Over time, there has also been a shift to a thematic approach, favoring technology, business services, environmental industrials, and healthcare.

The most recent foray came this week, with a $30 million investment in ART Fertility Clinics, an IVF specialist based in the United Arab Emirates (UAE) that plans to establish 18 locations in India during the next 12 months. Longer-term plans include breaking into Southeast Asia and creating a dominant IVF operator in Asia, if not globally.

Gulf has a convincing track record with this strategy. Its first major investment, UAE-based wastewater treatment company Metito, started its journey in Indonesia and China before spreading out to 22 countries globally. The business was sold to Mitsubishi in 2014. Similar buildouts have been realized in energy and travel.

However, it is the growing preference for defensive growth sectors – in tandem with geographic expansion – that has moved the dial most recently in terms of performance. Gulf will only target sectors it deems to be growing by double-digit bounds. The IVF market in India, for example, is set to grow 12% a year for the next five years.

Karim El Solh, co-founder and CEO of Gulf, notes that fourth-quarter sales and EBITDA across the Fund III portfolio were up 20% and 190% year-on-year, respectively. The vehicle, which closed at $750 million in 2015, is 78% invested.

"We haven't done a single oil and gas deal with this fund, or construction, retail, or hospitality. We saw the writing on the wall, and we realized these sectors are facing a lot of headwinds," El Solh says. "We're investing in the sectors of the future, and every time we buy a company, we like to take it immediately to Asia and Africa to build a global leader in emerging markets. We like to play the Silk Road corridor. Finally, the near East and the far East are meeting."

Maturing ecosystems

Despite witnessing significant growth in the Middle Eastern and Asian private equity ecosystems, Gulf considers its model somewhat anomalous. Still, Richard Dallas, a managing director focused on PE strategies in Asia, believes a broader trend is in the making, perhaps especially in Southeast Asia. He notes that the Middle East is every bit as fragmented as ASEAN, with family-dominated business sectors and regulatory hurdles that cross-regional investors will understand.

"The UAE is the largest trading partner of Singapore in the GCC," Dallas says. "There's a free trade agreement between them that dates back to 2013, so there's a lot of bilateral activity. You also have two huge Muslim countries in ASEAN in Malaysia and Indonesia, so I think you'll see increasing trade and investment back and further because of the similarities in culture. There are a lot of natural drivers that will increase interactions."

Indeed, Gulf does reflect a broader industry sense that the opportunity around Asia-Middle East expansion and cross-investment is maturing. Investors have begun to describe Middle Eastern entrepreneurs in the same terms that have been applied in developing Asia in the past decade. The impression is that founders understand the asset class, the need to exit and the strategic advantages. Improved sentiment has come in step with the professionalization of the regional investors themselves.

Taimoor Labib, a founding partner and the Dubai-based head of MENA (Middle East and North Africa) at Singapore's Affirma Capital observes that a new private markets association for the region has been enthusiastically received by the industry. The traction has come as regional businesses increasingly see feasible inroads to the Asia growth story and travel connections, pandemic restrictions notwithstanding, proliferate. In the past 10 years, Emirates Airlines alone has launched 13 new Asia routes, including some relatively small cities.

"When I walk into the office of a future portfolio company based in the Middle East and tell them I can help you expand into India and China, it's music to their ears. That wasn't the case only 10 years ago. It would have been interesting back then but not top of mind for them. Now, it really resonates," Labib says. "We have entrepreneurs coming to us talking about second-tier and third-tier cities that I personally haven't been to. They're fascinated by what they're seeing there."

To date, the most active corridor in this narrative remains UAE-India. In further activity this month, PolicyBazaar, India's largest insurance comparison portal, jumpstarted its Middle East expansion agenda with a $75 million funding round for its a heretofore experimental UAE subsidiary. US-based Falcon Edge Capital is the investing GP, but it is effectively being 100% bankrolled by ADQ, a state-owned holding company in UAE, via a vehicle called Alpha Wave Incubation.

Much of the strategy here is based on the huge Indian minorities in Dubai and Abu Dhabi. PolicyBazaar CEO Yashish Dahiya claims that about half of the population already recognizes his company's brand and that the expatriate presence will create marketing synergies. For example, advertising in southern Indian cities is expected to generate results in UAE and vice versa. The ability to access Indian cultural familiarity with higher-cost products is also a major draw.

"I was surprised to find out half the people there are Indian nationals, and their connections with India are very deep. Almost everybody in the UAE travels back home every year. The Indian diaspora in the UK and the US tend not to be as strong as in the UAE," says Dahiya, adding that PolicyBazaar's ticket size is 3-4x larger in UAE. "As a market, it seems to be an extension of India, another one and half or two Indian cities, but much wealthier."

Local expansion

PolicyBazaar's current UAE operation has generated about $100 million in sales to date but the goal is for 10x growth in the next 18 months. The 10-strong local team will expand to up to 100, at least half of whom will be Emirians. Their biggest challenge will be product education amid surprisingly low public uptake for digital insurance for a developed market. Only 3-5% of insurance is sold online in UAE versus 10% in India.

"In the Middle East, there is not a single platform where I can go for any of my insurance or financial needs and just complete a transaction," says Neeraj Gupta, head of PolicyBazaar's UAE business. "It doesn't exist as of now, and nobody is educating the consumer about the need for insurance. We're going to spend a lot on this – and not just in motor insurance comparison, but also health and life. We mean to become a market leader in the next 18 months."

Food delivery platform FreshToHome is working on a similar expansion following a $120 million round last year that featured India's Iron Pillar, UAE-based Investcorp, and the Investment Corporation of Dubai. The Indian start-up is already among the top five online grocers in UAE and looks to use the country as a springboard to a broader Middle East footprint.

"We definitely need to build a different supply chain from what we have in India, and you do need to localize that in UAE because it's a faster delivery model with different expectations," says Anand Prasanna, a Dubai-based managing partner at Iron Pillar. "If people are paying 3x the price, you can afford to do better packaging, but you also have to consider that it's extremely hot in the Middle East. Iceboxes that you use in India cannot be used here. Everything will melt. The changes in the back end go down to that level of detail."

Iron Pillar has focused on building Indian tech companies for global markets since 2015, and FreshToHome became its first entry into the Middle East in 2019. While its Indian software plays have mostly targeted the US, the VC firm believes the Indian diaspora in the Middle East could underpin viable consumer expansion strategies. Meanwhile, the idea that IT teams across the Middle East tend to be filled with Indian talent is seen as evidence that Indian B2B companies could use the region as a transition market on their way to Europe and the US.

To date, Iron Pillar has three portfolio companies with a Middle East presence – a further 10 are in the pipeline – and touts an extensive regional strategic network. It claims a number of large corporates and two UAE sovereign wealth funds as LPs. Prasanna tapped a personal contact at UAE-based consumer goods giant IFFCO to co-invest in FreshToHome and support its reginal expansion. About 25% of the capital in Iron Pillar's various funds is said to be from the Middle East.

The LP angle

As a case study, Iron Pillar is a solid example of how PE crossover between Asia and the Middle East is gaining traction, at least anecdotally. The idea is that as Asia's PE and VC-backed companies explore the Middle East as an expansion market, LPs with corporate and civic motivations such as food security are backing Asian funds with a view to bringing innovation to their home markets. The result is an inter-regional connectivity trend with two mutually supportive drivers.

There are sturdy underlying truths in this theory, but it remains to be seen to what extent it plays out region-wide. One of the biggest dampeners could be the limited scope of the potential Middle Eastern LP base. In terms of large institutions, a typical rollcall would include about 15 sizeable entities in UAE, six big names in Saudi Arabia, three in Kuwait, two in Bahrain, two in Qatar, and two in Oman. Large, family groups active in private equity would be only slightly more plentiful.

Several operators are well known for large direct investments in Asia as well as fund commitments with the largest managers, usually via separate account mandates. Their overall Asia exposure rarely cracks the global average of 10-15%. Saudi Arabia's Public Investment Fund and the UAE's Mubadala Investment are commonly cited as the leaders of a possible region-wide pivot toward Asia for strategic reasons, but the momentum is questionable.

"Institutions in the Middle East have always had a dialogue with Asia, and Asia's a huge source of trade for them, but I'm not picking up any shift in strategic policies," says Mounir Guen, CEO of placement agent MVision.

"If there's a new CIO with a view on a certain jurisdiction in Asia, that kind of thing happens, but I don't see a pattern. Whether it's tech, consumer, middle class growth or internet usage, it's all happening in Asia, so Middle Eastern investors have to be a part of the action from a global portfolio construction perspective. But in terms of strategic positioning in Asia, that activity is very concentrated."

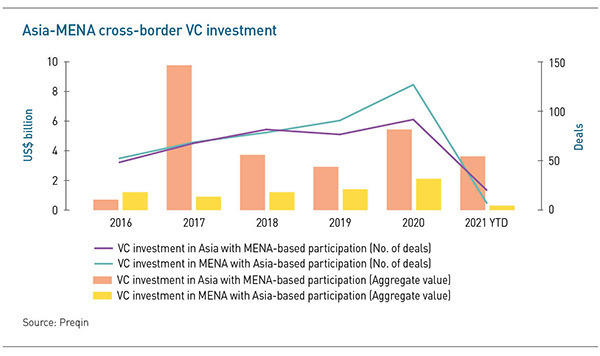

To some extent, this can be seen in the available data. According to Preqin, Asian buyout deals that included MENA investors have mostly stagnated at $200-900 million a year since 2017, with 2018 being an anomalous exception on $4.7 billion. MENA-based buyouts with Asia participation have also been weak, totaling only $8.6 billion between 2016 and 2019.

A slightly different narrative emerges at the venture end of the private equity spectrum. While VC investment from Asia into MENA start-ups remains similarly anemic, capital flows in the opposite direction appear to have enough scale to begin snowballing with the right impetus. The annual value of Asia VC deals with MENA participation in the past four years has ranged from $2.9 billion to $9.7 billion.

"It's definitely accelerating in the last two years. We're seeing more crosspollination and more interest from VCs in the Middle East," says Philip Bahoshy, founder of MENA venture capital data platform Magnitt.

"In the start-up world, scale is the name of the game. To get your unicorn valuation and beyond, you need to be able to operate in geographies across multiple continents. Valuations are a lot lower in MENA, which provides a great opportunity for Asian investors to acquire companies in MENA to build out their proposition toward IPO or acquisition."

A matter of timing

MENA start-up exits have been mostly US-led to date, with standout examples including Uber's acquisition of ride-hailing app Careem for around $3 billion last year and Amazon's acquisition of e-commerce marketplace Souq for $580 million in 2017. The latter deal provided an exit for Affirma. Most recently, Anghami, a music streaming service backed by Middle East Venture Partners and Samena Capital, has been set up to be the first MENA tech company to list on NASDAQ. The plan is to go public via a merger with a special purpose acquisition vehicle (SPAC).

These deals offer a reminder to mid and large-cap investors about the role of timing, market familiarity, and creative approaches when entering new regions.

Bahrain's Investcorp knows this is not easily achieved. The firm was founded in 1982 with a global mandate but didn't make a concerted effort to enter Asia until 2017. Its first private equity investment in the region came in late 2018 – a commitment to a pre-IPO fund managed by China Everbright. Investcorp now has $3.2 billion in assets under management in Asia out of a global portfolio of $35 billion. Asia is expected to represent 30% of the firm's revenue within 10 years. Interestingly, most of this investment has occurred post-pandemic.

"When the [pandemic] recovery happened in Asia, we were ready to capture that momentum. Our clients in the Gulf that were looking to diversify their investable wealth found the opportunity with us. Europe and the US were closed. At a time when the world was frozen, we offered this opening after five years of diligence," says Y.C. Tang, vice president of IR at Investcorp.

"It was a diversification tool they were eager for, and it came with the trust of a 40-year heritage in the Gulf. You can go to the big names, but they don't exist here the way we do. We are part of the social fabric here, and that's what we're trying to do in Asia. We don't want to be visitors."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.