Deal focus: Cityneon proves the show must go on

Singapore’s Cityneon has seen a robust rebound in its live events business, driven primarily by China. The company now has $177 million in new funding and deals covering everything from ancient Egypt to Avatar

Entertainment businesses focused on physical ticketed events are not normally expected to thrive amid the pandemic, and they're certainly not expected to raise S$235 million ($177 million) in private equity funding.

Nevertheless, that's exactly what Singapore's Cityneon has achieved, attracting Pavilion Capital and its fellow Temasek Holdings affiliate Seatown, as well as EDBI and Qatar's Doha Venture Capital, another government-connected entity. The plan was to raise S$100 million just to stay afloat, but that quickly proved too conservative for the market.

"Last year was very scary for us, at least in the beginning. When COVID-19 hit us in January to June, our revenue practically went to zero, and we couldn't do what we do," says Ron Tan, Cityneon's executive chairman and CEO. "But the recovery was equally quick. From July onwards, there was so much pent-up demand, especially in China. China contributed about 70-80% of our overall revenue last year, and in fact was the only market that opened."

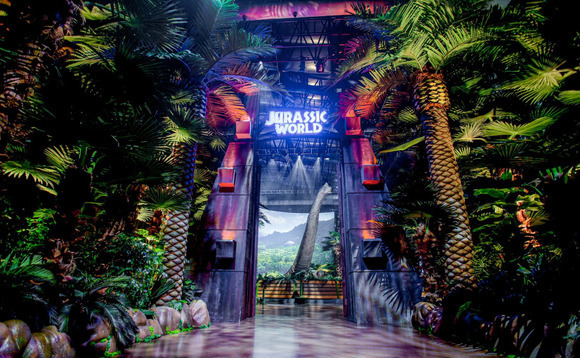

Cityneon, which previously received investment from CITIC Capital, specializes in staging elaborate events, displays, and exhibitions that trumpet movie releases and other branded entertainment ventures. In this way, the company is effectively a marketing services provider, but its practical operations go well beyond the graphics and media projects typically associated with the segment.

Cityneon produces massive, immersive promotional exhibitions, using animated lifelike robotic monsters, 3D stereoscopic screens, virtual reality and augmented reality experiences, and elaborately decorated walkthrough sets. These cost up to $12 million to install, and Cityneon has built up a track record spanning 50 cities globally. It has exclusive intellectual property (IP) agreements with brands such as Disney, Marvel, Hasbro, Universal, and Lionsgate.

"Our role is really to translate whatever people are watching on the big screen or on their computer screen into a live experience right in front of them," Tan says. "We have to make sure it's engaging and yet on-brand enough to meet the super-fans' expectations. We have to make sure we deliver that quality. Never cheat the customers."

Tan expects the rebound in demand for live shows to accelerate outside China as well, citing a recent bounce in Las Vegas, where Cityneon's numbers already exceed their pre-COVID-19 levels. This can be attributed in part to the mechanics of the events, which feature 30,000 square feet of showgrounds ready to accommodate any local social distancing rules.

"We are really the beneficiary of circumstances right now," Tan says. "In Vegas, there's no Cirque du Soleil, no Celine Dion, no live shows. We are one of the very few entertainment options that are allowed to open."

Plans for the new funding include a continued expansion into museum IP, and there are already two international tours underway focusing on Peru's ancient civilization of Machu Picchu and Egypt's Pharaoh Rameses II, respectively. Cityneon also wants to expand into video gaming, especially in China. As with superhero and science fiction franchises, gaming is expected to be a difficult category due to the super-fan factor.

The biggest rollout, however, is likely to involve Avatar. The 2009 blockbuster from 20th Century Studios recently reclaimed its status as the top-grossing film ever after a re-release in China that featured a Cityneon promotional exhibit. Four Avatar sequels are set to be released in the coming years and Cityneon is signed up for all four, with all-global, all-exclusive IP exhibiting rights.

"When I decided to start this business, the number one thing I wanted to make sure of was that we only work with big brands – brands I don't have to explain to my mother, who's 72 years old," Tan says. "If she can understand, I know the consumer will understand."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.