Region

Navis buys majority stake in Thai hospital operator

Navis Capital Partners has invested an undisclosed sum for a majority position in NP Medical, owner and operator of S-Spine, a spine and nerve specialty hospital in Thailand.

Korea's Viva Republica raises USD 225m

Viva Republica, operator of the Korean money transfer app Toss, has raised KRW 296bn (USD 225.5m) in series G funding from an investor group that includes Altos Ventures, Goodwater Capital, Greyhound Capital, and Kleiner Perkins.

Sequoia leads Series A for China automotive chipmaker

SiEngine Technology, a China-based developer of chips for the automotive industry, has raised around CNY 1bn (USD 148m) in a Series A round led by Sequoia Capital China.

Australia's mx51 secures $22.5m Series B

Mx51, an Australia-based payments technology platform that emerged as a partnership with Westpac, has raised AUD 32.5m (USD 22.4m) in Series B funding.

Korea's NPX confirms $160m media platform acquisition

Korea’s NPX Capital has acquired online comics publisher Toomics via its Terapin Studios media platform for USD 160m.

China's Jaka Robotics raises $150m Series D

Prosperity7 Ventures, a USD 1bn venture capital fund established by Saudi Arabia state oil giant Saudi Aramco, has continued its run of robotics investments in Asia by joining a USD 150m Series D for China’s Jaka Robotics.

Navis enters Asia credit space

Navis Capital Partners has launched a credit unit that will provide financing to companies in Asia that require growth capital but are reluctant to bring in equity investors.

Mutiples commits $30m to India neo-banking platform

Multiples Alternate Asset Management has invested USD 30m in India-based neobank Niyo, entering on the heels of a USD 100m Series C round that closed in February.

RRJ to invest $251m in Singapore's Fullerton Health

RRJ Capital is poised to invest SGD 350m (USD 251m) in Singapore-based integrated healthcare platform Fullerton Healthcare Corporation after the target company settled a dispute with two of its co-founders.

B Capital raises $250m for global early-stage fund

Los Angeles and Singapore-headquartered B Capital Group has closed its first dedicated early-stage fund with USD 250m in commitments. It will target the US and Asia.

Indonesia's Pintarnya raises $14.3m seed round

Indonesia’s Pintarnya, a one-stop platform for blue collar workers, has closed a USD 14.3m seed round backed by General Catalyst, Sequoia Capital India, and East Ventures.

GP profile: Falcon House Partners

Falcon House Partners is one of the few survivors in Indonesia’s promising but challenging middle-market private equity space. Being hands-on is part of the secret

Fund focus: Lightspeed ramps up in India, Southeast Asia

Lightspeed Venture Partners is leaning hard into developing Asia with long-range vision, added operational resources, and a new USD 500m war chest

Deal focus: Seeing light at the end of the COVID-19 tunnel

Taiwan travel start-up KKday continues to raise capital seemingly on its own terms despite flights remaining largely grounded. It expects a boom toward year-end and near-normalcy in 2023

Deal focus: SJL fills Korea's cross-regional gap

Steve Lim launched SJL Partners to help Korean corporates pursue M&A in the US and Europe, having seen global GPs pass on such opportunities. Meridian Bioscience is the latest addition to the portfolio

Asia logistics: Cost and complexity

Investment opportunities are expected to emerge as companies look to technology as a means of easing inflationary pressure on supply chains. Will Asia’s shallow pool of specialist logistics GPs deepen?

Australia's Fortitude exits Shopper Media to Woolworths

Australian grocery giant Woolworths has agreed to buy Shopper Media Group, an out-of-home digital advertising business with 2,000 screens across more than 400 shopping centres, for approximately AUD 150m (USD 102m).

India blockchain player raises $100m Series A

India’s 5ire, a one-year-old blockchain infrastructure provider focused on promoting sustainable crypto-relate practices, has raised USD 100m in Series A funding at a valuation of USD 1.5bn.

Glade Brook leads $20m round for Indonesia's Kitabeli

Glade Brook Capital Partners has led a USD 20m round for Kitabeli, which claims to be the largest fast-moving consumer goods social commerce platform in Indonesia’s lower-tier cities.

ANZ withdraws from MYOB acquisition talks

Australia and New Zealand Banking Group (ANZ) has ended its pursuit of KKR-owned Australian accounting software provider MYOB just days after confirming talks over a potential acquisition.

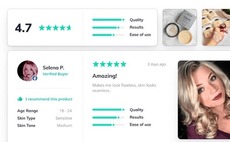

Australia customer reviews specialist gets $26m Series A

Okendo, an Australia-founded customer review platform for e-commerce brands, has received USD 26m in Series A funding led by US venture capital firm Base10 Partners.

Australia retail AI player raises $30m

Tiger Global Management has led a USD 30m Series B round for Australia’s Hivery, an artificial intelligence (AI) developer for the retail industry.

Japan's MPower backs construction workers' platform

Japanese environmental, social, and governance (ESG) focused private equity firm MPower has led a JPY 1.8bn (USD 13.4m) investment in Sukedachi, a jobs platform for construction workers.