Navis buys majority stake in Thai hospital operator

Navis Capital Partners has invested an undisclosed sum for a majority position in NP Medical, owner and operator of S-Spine, a spine and nerve specialty hospital in Thailand.

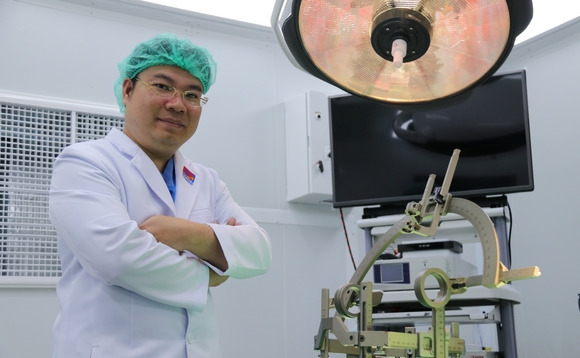

The private equity firm said it was committed to growing the company alongside chief neurosurgeon, Dittapong Boonampol (pictured), who established the hospital in 2017. It plans to develop complementary capacities around musculoskeletal services, while exploring M&A options and institutionalising operations.

S-Spine advocates using minimally invasive procedures to address the root cause of pain rather than simply treating symptoms. It has capacities in some advanced techniques in this vein, including a spinal surgery method called PSLD which benefits from faster recovery, lower risks, smaller incisions, less blood loss, and better cosmetics.

Navis observes that back and neck pain are among the most common major ailments in Thailand and represent a fast-growing market. The opportunity is believed to be underpinned by demographic and social trends around ageing, lifestyle changes, patient awareness, and chronic muscle pain and inflammation commonly known as office syndrome.

"We see great potential in S-Spine and the continued growing demand in spine, nerve and skeletomuscular care services as well as related specialties in Thailand and possibly neighbouring countries," David Ireland, a senior partner at Navis, said in a statement.

"With the strong medical expertise and team, led by Dr. Dittapong, we believe that S-Spine will play an important role in treating the next generation of patients in a safe, highly effective manner that leads to superior medical outcomes and faster recovery periods at competitive price levels."

S-Spine represents Navis' fourth transaction this month. It led a USD 38m Series C round for Eton Solutions, a US software provider for family offices expanding into Singapore, and made an investment of undisclosed size in Vietnam snack maker Dan-D Foods. Meanwhile, footwear industry supplier Texon, acquired in 2016 at a valuation of USD 75m to USD 125m, was sold to a UK strategic for USD 237m.

Navis raised USD 900m last year for its eighth pan-regional growth and buyout fund and currently manages about USD 5bn in private equity capital. Earlier this week, the GP launched a credit unit that will provide financing to companies in Asia that require growth capital but are reluctant to bring in equity investors.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.