Weekly digest - July 20 2022

|

By the Numbers

AVCJ RESEARCH

ASIAN OUTPOSTS

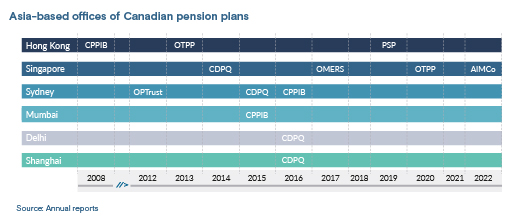

Where is the optimal location for a global LP's Asian base of operations? This question has been asked numerous times as Canadian pension plans, typically driven by a desire to put more money into private markets and have more direct exposure to assets, have put down roots here.

Alberta Investment Management Corporation is about to join the party, with Peter Teti, the group's head of private equity, explaining why Singapore was chosen over Hong Kong. There were two key points: Hong Kong is too close to mainland China and associated geopolitical issues; and Singapore is the best place to execute a truly pan-Asian strategy rather than one skewed towards China. It further stirred ongoing debate about Hong Kong's future as a regional financial hub and how China's role in the portfolios of large global institutional investors may change. The reality is that these decisions can be idiosyncratic, determined by the resources and risk appetite of individual pension plans. Canada Pension Plan Investment Board (CPPIB) has 20x the assets of OPTrust and employs several times as many people. It has offices in Hong Kong, Mumbai, and Sydney. OPTrust is only in Sydney. The distribution of Asian portfolios across different private asset classes and the key geographies for co-investment are also factors. If North Asia is likely to generate a lot of co-underwriting opportunities, it might be easier to work out of Hong Kong. If direct investments in mature infrastructure feature strongly, an Australia base makes sense. And then some LPs, like British Columbia Investment Management, seek meaningful Asian exposure, including co-investment, without venturing far from home. They believe a cohesive investment culture shouldn't be risked for the sake of convenience.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.