Australia customer reviews specialist gets $26m Series A

Okendo, an Australia-founded customer review platform for e-commerce brands, has received USD 26m in Series A funding led by US venture capital firm Base10 Partners.

Craft Ventures and Index Ventures also participated. Index led a USD 5.3m seed round nearly 12 months ago, with the proceeds earmarked for business expansion in the US.

Okendo launched in 2018 on the Shopify app store, leveraging the emergence of direct-to-consumer (D2C) brands and demand for customer-centric marketing tools. While owning the customer relationship presented opportunities to turn unique datasets into differentiated user experiences, many D2C brands were trying to make sense of data scattered across multiple platforms.

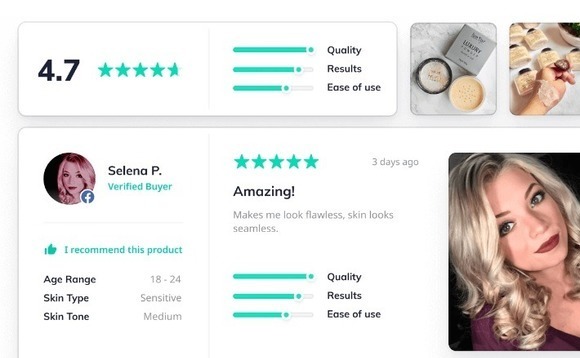

The start-up claims to help merchants attract more shoppers, drive sales, and increase customer lifetime value by collecting better user-generated content like ratings and reviews, creating plug-in review displays, and enabling seamless multi-channel marketing and content management.

Okendo has accumulated more than 5,000 clients and works specifically with Shopify merchants. It claims this focus facilitates an intelligent approach to review collection that utilises customer and order data to personalise interactions, the development of content displays that offer customisation without compromising page load speed, and integration with other e-commerce enablement tools.

Matthew Goodman, the company's co-founder and CEO, noted that 90% of shoppers read reviews before buying, which means reviews are essential to the growth of modern commerce brands. A statement cites recent testing that found on average, shoppers interacting with Okendo had a 2.5x higher conversion rate and a 15% higher average order value.

"We see a significant opportunity to expand our customer-centric platform to help merchants deepen their customer relationships and engage more intentionally with customers to drive more efficient, scalable growth," Goodman added.

Okendo employs 80 staff across Australia and the US. The Series A will be used to scale go-to-market activities and accelerate product development, while headcount is expected to pass 130 this year.

"In this era of Shopify enabling major innovation in the retail megatrend, owning and understanding your customers is a huge unlock for any e-commerce brand looking to grow quickly," said T.J. Nahigian, a managing partner at Base10.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.